Nike (NKE 1.10%) and Starbucks (SBUX +0.65%), those ubiquitous emblems of contemporary desire, find themselves, rather inconveniently, at a crossroads. For years, they’ve been engines of growth, purveyors of aspiration, and, let’s admit, quite profitable exercises in branding. But the recent climate, a confluence of inflationary pressures and shifting consumer whims, has introduced a certain… discord into their carefully orchestrated symphonies of commerce. Both have undergone executive reshuffles, a predictable maneuver when the music falters, and now, each attempts a delicate pirouette, a turnaround strategy poised, or perhaps not, for success.

Last year, the market offered a rather unenthusiastic appraisal of their efforts. Nike, a 16% descent; Starbucks, a slightly less precipitous, but still discernible, 8% dip. The question, then, is not merely which stock will recover, but which possesses the more robust constitution, the more artful choreography to navigate the gathering economic shadows?

The Current Disposition of Affairs

Starbucks, in a move that smacked of calculated ambition, recruited Brian Niccol from the reliably popular Chipotle in September 2024. A coup, naturally, and the market responded with a predictable surge of optimism. Niccol’s mandate: simplification, velocity, an elevation of the customer experience. A noble pursuit, certainly, though one wonders if a truly transcendent coffee experience can be engineered, or if it remains, stubbornly, a matter of subjective fancy.

A month later, Nike unveiled Elliott Hill as its new helmsman. A decidedly internal appointment, a promotion from within the ranks. A pragmatic choice, perhaps, lacking the dramatic flair of Niccol’s arrival, but suggesting a deep understanding of the company’s intricate anatomy. Hill’s focus: mending fences with wholesale partners, reinvesting in the brand’s aura. A restoration, rather than a revolution.

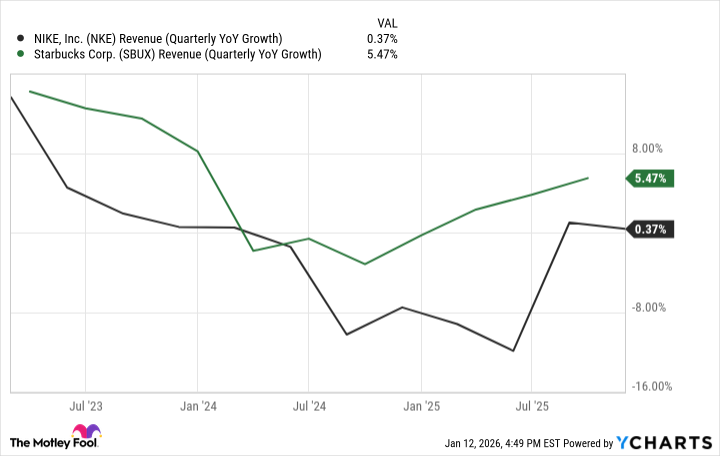

Both executives have now navigated a full year, and initial tremors of progress are, indeed, detectable. Growth rates, while not yet soaring, are exhibiting a tentative upward trajectory. A fragile bloom, easily withered by a sudden frost.

The Weight of Price: A Delicate Balance

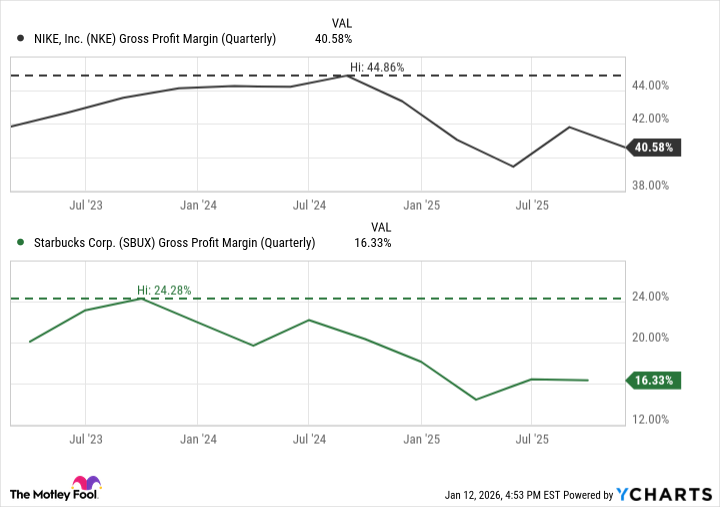

Gross profit margin, that quietly revealing metric, offers a glimpse into the pressures exerted by rising costs and shifting pricing power. A declining margin signals a precarious position: either an aggressive slashing of prices in a desperate bid for market share, or a reluctance to pass on rising costs to consumers, a gamble predicated on maintaining volume. A rather unenviable dilemma, wouldn’t you agree?

Nike, burdened by tariffs, has experienced a manageable erosion of its margin – a four-percentage-point decline. Starbucks, however, has suffered a considerably more substantial hit, nearly double that amount. A curious disparity, suggesting a greater vulnerability to the whims of the market, a more delicate constitution when confronted with economic headwinds.

Starbucks, in a rather dramatic gesture, has divested a 60% stake in its China business, acknowledging the intensifying competition in that crucial market. And, as if to underscore the point, Luckin Coffee, a formidable rival, has recently launched an assault on Starbucks’ home turf. A rather pointed reminder that even the most iconic brands are not immune to the forces of disruption.

Nike, however, is not entirely immune to challenges. Its sluggish revenue growth, despite efforts to mend relations with key partners, is a source of concern. A rather puzzling anomaly, suggesting a deeper, more insidious problem lurking beneath the surface.

A Prognosis, Carefully Considered

Both companies face obstacles that are, shall we say, less than trivial. Both offer premium-priced products, a proposition that may prove increasingly difficult to sustain in an economic climate characterized by uncertainty and frugality. A rather delicate balancing act, wouldn’t you agree?

However, I’d tentatively favor Nike. Its brand remains a potent force, resonating with consumers, particularly the coveted demographic of young people. Piper Sandler’s latest teen survey confirms Nike’s continued dominance in the clothing and footwear categories, a rather commanding lead. A rather compelling endorsement, wouldn’t you say?

Starbucks’ decision to relinquish a majority stake in its China business suggests a vulnerability to pricing pressures, a fragility that could complicate its turnaround efforts. A rather ominous sign, wouldn’t you agree?

Both stocks carry a degree of risk, of course. But, at this juncture, I’d place my wager on Nike. A rather conservative choice, perhaps, but one guided by a careful consideration of the available evidence. A delicate bloom, yes, but one with a rather tenacious root system.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2026-01-15 15:24