Nike, or rather, the swoosh, remains a globally recognised emblem. One imagines even the most remote tribes could identify it, though whether they’d desire the accompanying footwear is another matter. The company, however, has demonstrated a regrettable talent for disappointing investors, a phenomenon not entirely unconnected to its own internal machinations.

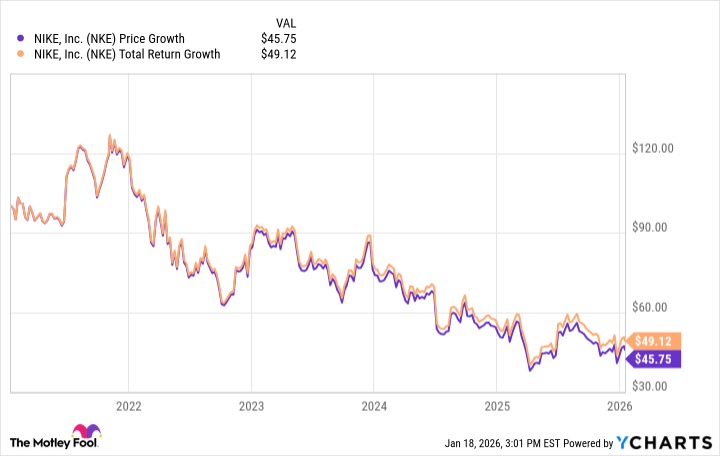

An investment of a mere hundred dollars in Nike stock five years ago would, today, yield a paltry forty-five dollars and seventy-five cents. Including dividends, a gesture of almost paternalistic generosity, one might scrape together forty-nine dollars and twelve cents. A return that scarcely covers the inflation, let alone the inconvenience.

The recent struggles are, of course, attributable to a misguided ambition to bypass established retail channels. A decision, one suspects, born of hubris and a fundamental misunderstanding of consumer behaviour. To underestimate the influence of institutions like Foot Locker, Dick’s Sporting Goods, and even Macy’s, is akin to a general dismissing his supply lines. These are not merely shops, but conduits to a public that, it seems, prefers the convenience of browsing whilst simultaneously acquiring other necessities.

Compounding this strategic error is a lamentable lack of innovation. One observes a distinct dearth of genuinely novel designs, a condition exacerbated by the emergence of competitors like On and Hoka. These newcomers, unburdened by legacy and a bloated bureaucracy, have managed to capture the attention – and wallets – of a discerning clientele. It’s a rather predictable outcome, really.

Nike has, belatedly, begun to retrace its steps, attempting to refocus on its core competency: athletic performance. A commendable effort, though one suspects the damage is already done. The stock remains stubbornly resistant to improvement, a fitting metaphor for a company attempting to rediscover its footing after a period of self-inflicted wounds. One can only hope, for the sake of its shareholders, that this course correction proves more than cosmetic.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-21 01:13