As a long-term crypto investor with some experience under my belt, I find Katie Stockton’s analysis on Bitcoin and the broader market trends insightful and thought-provoking. Her perspective on Bitcoin’s recent volatility and its correlation with other risk assets like the NASDAQ is particularly interesting. I agree with her assessment that Bitcoin serves as an indicator for other risk assets, and its price movement often influences the overall market sentiment.

On July 8, Katie Stockton, the founder and managing partner at Fairlead Strategies, made an appearance on CNBC’s “Squawk Box” to discuss Bitcoin‘s recent price fluctuations and broader market tendencies. During her talk with co-host Joe Kernen, Stockton offered a thorough examination of the current cryptocurrency market landscape and the crucial technical signals that investors ought to monitor.

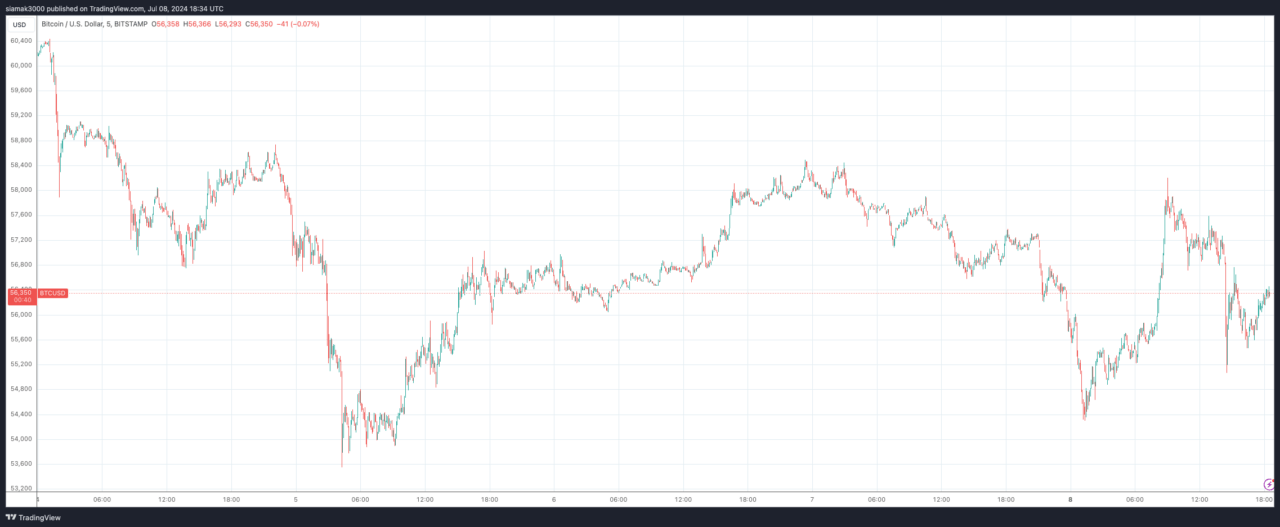

As a crypto investor, I’ve noticed with concern that Bitcoin has taken a dip recently, slipping below the $55,000 mark for the first time since February.

Stockton pointed out that the decline in price was instigated by Mt. Gox’s revelation of initiating repayments, almost a decade since their bankruptcy filing. He underlined Bitcoin’s tendency to influence other risk assets, with its recent strong link to the NASDAQ 100 becoming evident.

As a crypto investor following Katie Stockton’s analysis, I’ve noticed that although the NASDAQ is thriving, Bitcoin has shattered some crucial support milestones. Specifically, Stockton highlighted $60,000 as a significant support level for Bitcoin, and its departure signals potential corrective price movements. Based on her assessment, the subsequent support level for Bitcoin lies around $51,500, suggesting further declines while still adhering to an overall upward trend.

I strongly advocate for holding a modest portion of my investment portfolio in Bitcoin, disregarding temporary price fluctuations. To me, Bitcoin represents a long-term opportunity with substantial growth potential, similar to having a call option. If Bitcoin were to dip down to the $40,000 price level, it might signal underlying technical concerns that could pose a threat to its overall upward trend.

As a researcher studying broader market trends, I’ve noticed that the S&P 500 and NASDAQ are significantly influenced by a handful of mega-cap tech stocks, such as Apple, Meta, and Tesla. These companies have recently experienced short-term breakouts, fueling the markets’ upward trend. However, this narrow market leadership raises some concerns, suggesting that only a few stocks are driving the market’s performance and leaving many others behind.

Katie Stockton raised doubts about using negative divergences as a reliable indicator for bearish market trends. According to her, while these divergences may suggest a less vibrant market, they do not automatically mean the end of an upward trend. Instead, she anticipated that the second half of the year would bring increased market volatility. However, she believed that the uptrend would persist through this period, but would experience more corrections along the way.

As an analyst, I’ve noticed investors expressing their frustration with the market’s narrow leadership, dominated by large-cap technology stocks. However, I want to emphasize that there are still abundant investment opportunities beyond this sector. In fact, I’ve identified commodity-related stocks as particularly intriguing, with energy and materials being standout categories. The technical setups in these areas appear quite promising.

Katie Stockton noted that crude oil seems to be breaking out of a prolonged triangle pattern, implying a possible resurgence in energy stock performance. Additionally, she highlighted copper’s potential for downward exhaustion, which could signal an opportune moment to invest in related industries. Stockton underscored the significance of aligning with these trends, even if market leadership is limited.

Stockton and Kernen looked back at previous market trends, with Kernen mentioning notable milestones in the NASDAQ’s history. Stockton highlighted significant targets identified by flag patterns in both the S&P 500 and NASDAQ indices, suggesting potential for continued growth. Stockton emphasized the market’s resilience in climbing higher despite past price fluctuations.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

- All 6 ‘Final Destination’ Movies in Order

2024-07-08 21:50