Newmont, the gold and copper miner, has recently enjoyed a surge in its share price – a doubling in the last year, if reports are to be believed. This outpaces even the enthusiasm surrounding artificial intelligence, a sector currently favored by those who believe technology can solve all problems. Before one succumbs to the temptation of believing this stock will secure a comfortable future, a sober assessment is required. The market, after all, is rarely charitable to those who mistake hope for analysis.

The Business of Extraction

Mining is, at its core, a laborious and expensive undertaking. It requires not merely the discovery of valuable minerals, but the securing of permits, the construction of infrastructure, and the eventual reclamation of land – a process often overlooked in the rush for profit. These are not costs that can be wished away; they are the bedrock upon which the entire enterprise rests. A lengthy time commitment is also a factor, a truth frequently obscured by quarterly earnings reports.

The products of this industry – gold and copper – are commodities, subject to the whims of supply and demand. Gold, in particular, holds a peculiar place in the collective imagination – a store of value, a symbol of permanence, and yet, ultimately, a metal dug from the earth and susceptible to the same fluctuations as any other. Copper, while less romantic, is no less vital, underpinning much of modern industry.

The current rise in gold prices, driven by geopolitical anxieties and economic uncertainties, has naturally benefited Newmont. This is not a revelation, but a simple observation. The company’s fortunes are inextricably linked to the price of the metal it extracts. To assume this correlation will continue indefinitely, however, is to ignore the lessons of history.

Leverage and its Discontents

Mining operations are inherently leveraged. A significant portion of the cost is fixed, regardless of the prevailing metal prices. The ‘all-in sustaining cost’ (AISC) – a measure of the total expense of production – becomes a critical benchmark. As long as the price of gold exceeds this cost, the company profits. Below it, losses accrue. This is not a complex equation, but one often lost in the noise of market commentary.

The effect of rising gold prices can be substantial. A modest increase in price can yield a disproportionate increase in profit, and vice versa. However, this leverage cuts both ways. A decline in price can quickly erode earnings, despite the initial gains. To illustrate, consider an AISC of $1,000 per ounce. At $1,500, the profit is $500. At $2,000, the profit doubles to $1,000. But a fall back to $1,500 halves the profit, despite only a 25% decline in the price of gold. This is a simple arithmetic, and yet, frequently ignored.

Newmont’s recent earnings reflect this dynamic. A doubling of profits in the last quarter is undoubtedly encouraging. But this prosperity is contingent upon sustained high gold prices. To assume this will continue is to indulge in wishful thinking. History suggests that gold, like all commodities, is subject to cycles of boom and bust.

Diversification, Not Salvation

The true value of Newmont, in a portfolio, lies not in its potential for exponential growth, but in its role as a diversification tool. Gold, and those who mine it, are often seen as safe havens in times of uncertainty. This is not necessarily a rational assessment, but a psychological one. Investing after a substantial price increase is rarely prudent, but adding Newmont to a well-balanced portfolio may offer some degree of protection.

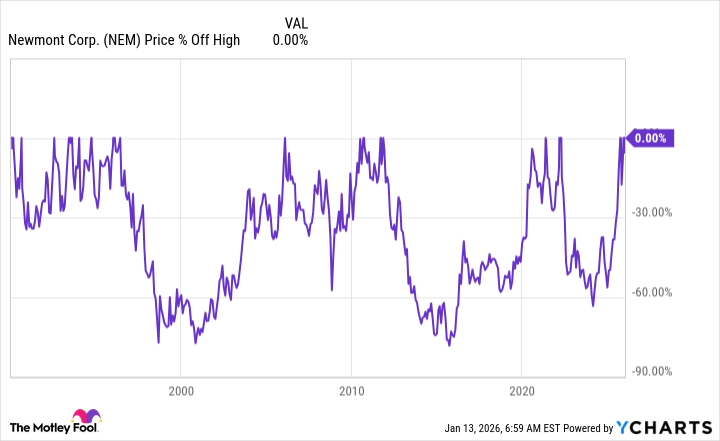

However, to believe this stock will ‘set you up for life’ is a dangerous delusion. The chart above illustrates the inherent volatility. Significant rallies are inevitably followed by equally significant drawdowns. Unless one anticipates a continued, and perhaps unsustainable, rise in gold prices, Newmont should remain on a ‘watch list’ – a potential addition, but not a guaranteed path to financial security. A period of correction would present a more sensible opportunity.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-16 14:42