Barr’s resignation is sparking discussions about a potentially more welcoming approach towards cryptocurrencies under the incoming Trump administration.

The criticized “anti-crypto regulator,” Barr, announced his resignation which will be effective from February 28th. However, he will continue to serve on the Board of Governors. The advisers of President-elect Donald Trump have expressed their intent to reduce Barr’s position, a move that could potentially create legal complications and draw the Fed into a prolonged conflict over its autonomy.

At a critical juncture for the cryptocurrency sector, Barr’s resignation occurs amidst ambiguous signs from the central bank. The Federal Reserve Chair, Jerome Powell, has consistently stated that the Fed won’t invest in bitcoin and has no intention of finding a legal means to do so. This skepticism towards cryptocurrencies is also reflected in the Fed’s caution about banks engaging with digital assets. Some policymakers argue that such engagements could pose risks, such as volatility, lack of transparency, and the possibility of illicit activities. However, industry leaders remain hopeful that a change in leadership at the country’s primary bank regulators may lead to more lenient policies.

Strategic Bitcoin Reserve

Trump’s plans involve suggesting the establishment of a national strategic Bitcoin stockpile, an idea that has sparked mixed reactions in financial communities. On one hand, supporters believe that officially recognizing Bitcoin within the U.S.’s monetary system would strengthen the country’s dominance in digital currencies. On the other hand, detractors argue that Bitcoin’s inherent volatility makes it an unsuitable choice as a stable reserve asset.

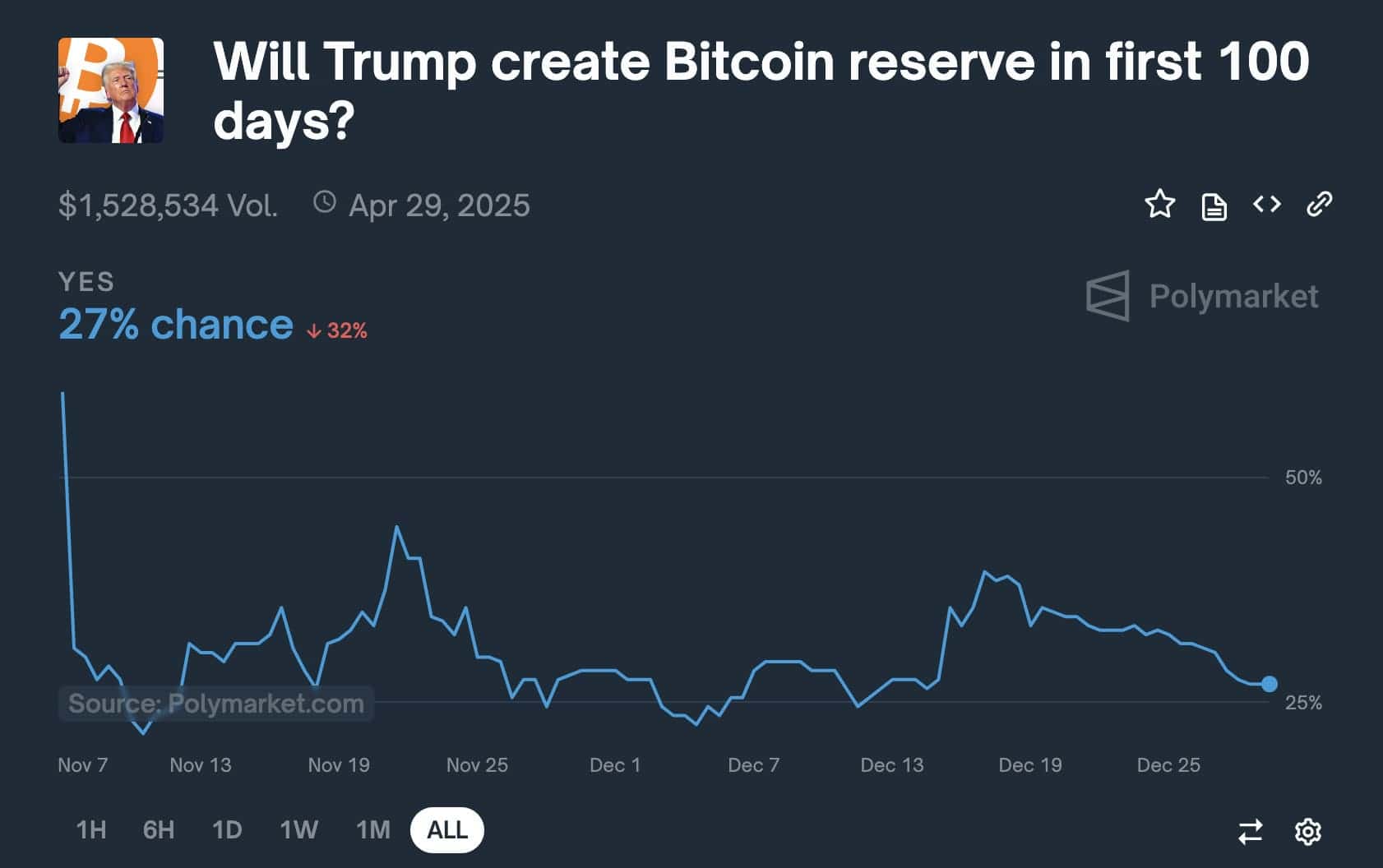

Betting markets suggest a Bitcoin Reserve remains a strong possibility under Trump

Observers in the industry have proposed the idea that executive orders could be issued on Trump’s first day in office, with the intention of preventing cryptocurrency companies from being cut off from traditional banking services. These actions would line up with Trump’s promise to halt the practice some crypto supporters refer to as “debanking,” which they claim occurred under previous administrations.

In the meantime, Barr’s resignation paves the way for Trump to choose a new Vice Chair for Supervision at the Fed. It is suggested that current Fed Governors who are more receptive to fintech and digital currencies could be potential candidates for this position. However, it should be noted that the agency’s autonomy might restrict the immediate impact of any presidential orders aiming to ease crypto regulations. Nonetheless, those in the crypto industry view Barr’s departure as another indication of diminishing power among officials viewed as unfavorable towards digital assets.

After Barr’s resignation, it appears that the Federal Reserve won’t initiate significant rulemaking until a new leader is appointed. This has sparked speculation that stricter capital rules for large banks, some of which have digital asset divisions, might be postponed or discarded. The share prices of major U.S. lenders increased following the news of Barr’s resignation, suggesting that less stringent, or at least more bank-friendly, policies could be implemented under a new leadership.

Market experts believe that while the incoming administration might issue orders favorable to cryptocurrencies, significant policy transformations would still necessitate collaboration with legislators, regulators, and the entire financial community. The Trump team’s intention to appoint a “cryptocurrency leader” suggests that the upcoming years could witness swift changes in federal supervision of bitcoin and digital assets.

For the sector, Barr’s resignation from his regulatory position is a significant turning point. Cryptocurrency supporters view this as an opportunity for easier banking access and potentially a shift away from the restrictive measures characteristic of the Biden administration. However, doubts linger about whether any White House initiative to create a substantial bitcoin reserve would be accepted by Congress or the courts. With the Fed board maintaining a Democratic-inclined majority until at least 2026, implementing extensive reforms swiftly might prove difficult.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

2025-01-07 22:06