The chronicles of Netflix (NFLX +0.87%) reveal a familiar pattern – the ascent to seeming invincibility, followed by the inevitable reckoning. From its zenith on June 30, 2025, a decline has taken hold, a shedding of thirty percent in the latter half of that year. One ventured a prediction – that this entity would outperform the broad market, the S&P 500 (^GSPC 0.33%), from 2026 through 2030. Yet, the currents have shifted. Year to date, Netflix has conceded twelve and three-tenths percent, while the index has gained a modest one and three-tenths. A disquieting divergence.

The matter is not merely one of numbers, but of the very spirit of valuation. Netflix concluded 2025 with a balance sheet of apparent strength – a mere $4.4 billion in net long-term debt. Operating income reached $13.3 billion, and net income, $11 billion, on revenues of $45.2 billion. Margins, at 29.4% and 24.3% respectively, suggest a machine for generating capital. A seemingly unassailable fortress. Yet, such figures, while impressive in isolation, are shadows cast by the expectations they must fulfill.

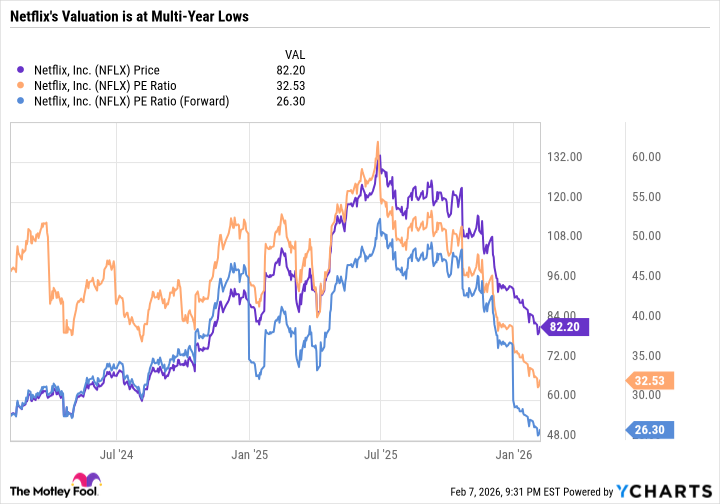

The company, once trading at a multiple of sixty times trailing earnings, even exceeding fifty times forward estimates, now finds itself at a price-to-earnings ratio of 32.5, and a forward multiple of 26.3. A substantial contraction. The market, it seems, has begun to weigh the cost of ambition. In mere seven months, Netflix has descended from the realm of extravagant pricing to a premium only slightly exceeding the S&P 500’s forward P/E of 23.6. A sobering correction.

The precipitating factor is not merely valuation, however. It is the introduction of uncertainty, a destabilizing element that unsettles even the most rational of investors. On December 5th, the announcement of the acquisition of Warner Bros. Discovery for $27.75 per share – a transaction involving $82.7 billion in enterprise value, burdened by $10.7 billion in net debt – sent ripples through the market. A merging of empires, built on foundations of differing strengths and weaknesses. The subsequent amendment, shifting the deal to an all-cash transaction on January 20, 2026, only deepened the imbalance, necessitating further indebtedness.

Warner Bros. Discovery, laden with debt, will inevitably weigh upon Netflix’s once-pristine balance sheet. The acquisition, while promising a bolstering of intellectual property and content creation capabilities, introduces a degree of leverage that was previously absent. The prospect of HBO and HBO Max being integrated into a bundled offering is enticing, yet it does not negate the fundamental shift in the company’s financial structure. This is not merely a growth story; it is a tale of risk and potential recompense.

Those who recoil from such added risk are justified in their caution. Others, those who believe in the synergy of the combined entities and the potential for debt reduction, may find this a moment of opportunity. To acquire shares at a relatively diminished valuation is, in itself, a privilege. Yet, one must remain vigilant. The true measure of this acquisition will not be revealed for some time. Until clarity emerges – until the post-acquisition business model is fully articulated and the monetization of Warner Bros. assets is demonstrably underway – the stock may remain under pressure.

Netflix, at present, presents a compelling, if cautious, buy. It is a company standing at a crossroads, burdened by ambition, yet possessing the underlying strength to navigate the challenges ahead. But let us not mistake a temporary dip in price for a fundamental shift in the market’s assessment. The true test lies not in the numbers, but in the execution. The path forward is shrouded in uncertainty, and only time will reveal whether this acquisition will prove to be a stroke of genius, or a cautionary tale.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-11 11:52