The reports arrived, as they always do, detailing a numerical ascension. Netflix, it is stated, now possesses over 325 million paid subscriptions – a figure approaching a billion potential viewers. Ninety-six billion hours of content consumed in the latter half of the previous cycle, a 2% increase, meticulously documented. These statistics, presented with the cold precision of a municipal ledger, offer a strange comfort, a temporary reprieve from the underlying unease. The company exceeded projections, of course, registering 18% revenue growth, a 25% operating margin, and a 30% rise in operating income. Yet, the market reacted not with celebration, but with a quiet, unsettling divestment. The shares declined by approximately 5% in the subsequent trading period. One begins to suspect the numbers themselves are merely a distraction, a carefully constructed façade concealing a deeper, more intractable problem.

The Acquisition: A Procedure Without End

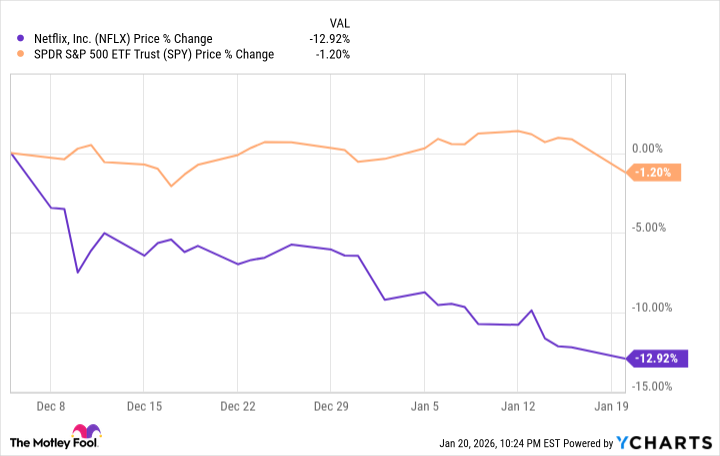

The intent to acquire Warner Bros. from Warner Bros. Discovery has been announced, then amended, then re-announced. The initial offer, a complex arrangement of cash and stock, has now been simplified to an all-cash transaction. The nominal value remains unchanged – $27.75 per share, totaling $72 billion. This adjustment, it is explained, is intended to expedite the approval process, to preempt a competing bid from Paramount Skydance. It feels less like a strategic maneuver and more like an endless bureaucratic process, a form requiring constant revision and re-submission. The shareholders of Warner Bros. Discovery are, presumably, expected to cooperate. Their compliance, however, is not guaranteed. The entire undertaking resembles a protracted legal dispute, a labyrinthine negotiation with no discernible endpoint. The market, predictably, remains unconvinced. Since the initial offer on December 5th, Netflix stock has fallen by 12.9%, a stark contrast to the S&P 500’s 1.2% decline. One wonders if the acquisition itself is the objective, or merely a symptom of a more profound organizational malaise.

To finance this endeavor, Netflix has secured $42.2 billion in bridge loans. Share buybacks have been suspended, a temporary cessation of activity intended to free up capital. The logic is impeccable, yet unsettling. It is as if the company is dismantling its own infrastructure to fund a project whose ultimate purpose remains obscure. The debt, of course, will require servicing. The interest payments will accumulate. The cycle will continue.

The Content Budget: An Expanding Void

Last year, Netflix allocated approximately $18 billion to programming – a combination of original content and licensed material. The projection for the current cycle is a 10% increase. This expenditure is presented as a necessary cost of doing business, a means of attracting and retaining subscribers. Yet, the sheer scale of the investment is alarming. It is as if the company is attempting to fill an ever-expanding void with an endless stream of content. The logic is simple: more content equals more subscribers. But what if the problem is not a lack of content, but a fundamental disconnect between the content and the audience? What if the subscribers are not seeking entertainment, but merely a distraction from the inherent meaninglessness of their existence?

Indeed, the true issue may be a misallocation of resources. The $72 billion earmarked for Warner Bros. represents four times the total content expenditure of the previous cycle. One begins to suspect that Netflix is prioritizing acquisition over creation, seeking to purchase success rather than cultivate it. Perhaps a more prudent strategy would be to invest in original content, to nurture new series and films with the potential to become the next Stranger Things or KPop Demon Hunters. But such a strategy would require patience, vision, and a willingness to accept the inherent uncertainty of the creative process. Qualities, it seems, that are in increasingly short supply.

Given the uncertainty surrounding the acquisition, the exorbitant price tag, and the inherent risks of the content strategy, it is difficult to recommend Netflix stock at this time. Only the most patient of investors, those willing to endure a prolonged period of stagnation, might consider a position. The company, it seems, is trapped in a bureaucratic nightmare, a labyrinthine system with no discernible exit. And the subscribers, unknowingly, are caught in the crosscurrents.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-01-23 10:12