It’s a curious thing, the stock market. A sort of collective, slightly panicked imagining of what things might be worth. And right now, that imagining seems to have taken a rather dim view of Netflix. The company recently reported some perfectly respectable numbers – a record number of subscribers, a growing advertising business – and the stock price promptly did a rather dramatic impression of a falling soufflé. A 36% drop, you say? That’s enough to make even the most seasoned investor reach for the antacids.

Now, one might assume this means Netflix is in some sort of trouble. But let’s put that in perspective. Since going public in 2002, the stock has increased by approximately 78,000%. Yes, you read that correctly. 78,000%. If you’d invested a mere pittance back then, you could now be funding a small island nation. A temporary wobble, therefore, feels…well, a bit like getting upset because your yacht has a minor barnacle problem.

Netflix Isn’t Resting on its Laurels (or its Subscribers)

The streaming world, as you may have gathered, is rather crowded these days. Amazon Prime, Disney+, and a host of others are all vying for our attention (and our monthly subscription fees). Netflix, with over 325 million subscribers, still towers over the competition, a sort of digital Colossus. But maintaining that position requires more than just a good library of shows. It requires innovation, a willingness to experiment, and a healthy dose of cunning.

Which brings us to advertising. In 2022, Netflix introduced a cheaper subscription tier supplemented by ads. A surprisingly sensible move, really. It’s like offering a slightly smaller portion of your favorite meal at a reduced price. People are, generally speaking, quite fond of value. The ad revenue, it turns out, is doubling year on year. Last year, it reached $1.5 billion. Which, in the grand scheme of things, isn’t astronomical, but it’s growing at a rate that suggests it could become rather significant rather quickly.

And they’re leaning into live sports, too. Boxing, football…it’s a smart move. People will tolerate a lot of mediocre television, but they’re fiercely protective of their sporting events. It’s like a primal instinct. Which, incidentally, is also why cat videos are so popular.

Then there’s the proposed acquisition of Warner Bros. Discovery. A truly ambitious undertaking. Imagine, if you will, the combined power of Netflix and the owners of Harry Potter, Lord of the Rings, The Sopranos, Friends, and Game of Thrones. It’s a bit like assembling the Avengers of entertainment. The problem, of course, is that regulators are understandably concerned about the potential for market dominance. It’s a valid point. Too much power in one company’s hands is rarely a good thing. Whether the deal will go through remains to be seen. It’s a bit like waiting for a particularly stubborn kettle to boil.

A Look at the Numbers (and Why They Matter)

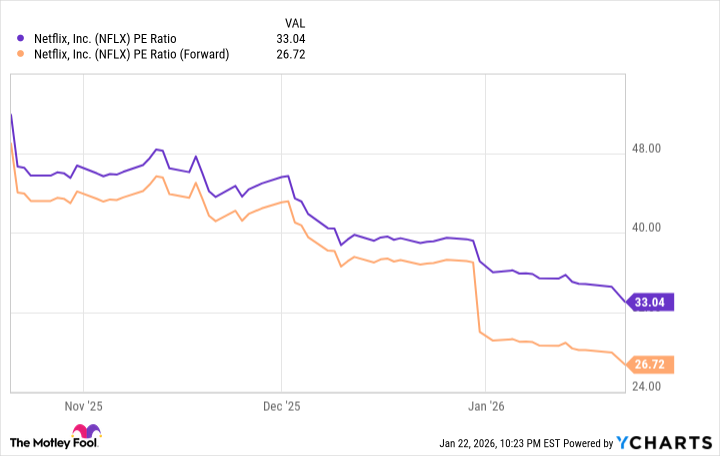

Let’s talk valuation, shall we? The company generated earnings of $2.53 per share last year, putting the price-to-earnings ratio at 33. That’s roughly in line with the Nasdaq-100. So, not outrageously expensive. But here’s where it gets interesting. Analysts predict earnings could grow to $3.12 per share next year, bringing the forward P/E ratio down to 26.6. That’s a significant difference. It suggests the stock is currently undervalued. Which, for a value investor like myself, is rather pleasing.

To put it another way, the stock would need to climb by 24% just to maintain its current P/E ratio. That’s not a bad potential return, especially considering the long-term growth prospects. There will, of course, be volatility along the way, particularly as the Warner Bros. deal hangs in the balance. But even if the deal falls through, Netflix remains a fundamentally strong company with a bright future.

Management expects the advertising business to double again this year, and they continue to invest heavily in content. As a result, I believe the recent 36% decline in Netflix stock represents a compelling buying opportunity. It’s not a guaranteed win, of course. Investing always involves risk. But sometimes, a temporary wobble is just that – a wobble. And sometimes, the best opportunities are found when everyone else is panicking.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-01-26 01:23