The streaming giant, Netflix – a name once synonymous with limitless expansion – finds itself in a rather peculiar predicament. Shares, you see, have embarked on a journey southward, a descent that’s brought them uncomfortably close to their recent nadir. The market, it seems, isn’t exactly throwing confetti over their ambition to acquire Warner Bros. Discovery. A seventy-two billion dollar dalliance with debt? It’s enough to make even a seasoned speculator reach for the smelling salts.

Last summer, Netflix appeared invincible, a titan striding across the digital landscape. The stock, a proud vessel, sailed at over $134. But tides, as any sailor knows, can turn. Now, it’s down a good thirty percent from that peak. A golden opportunity, perhaps? Or merely a trap for the unwary, baited with promises of growth?

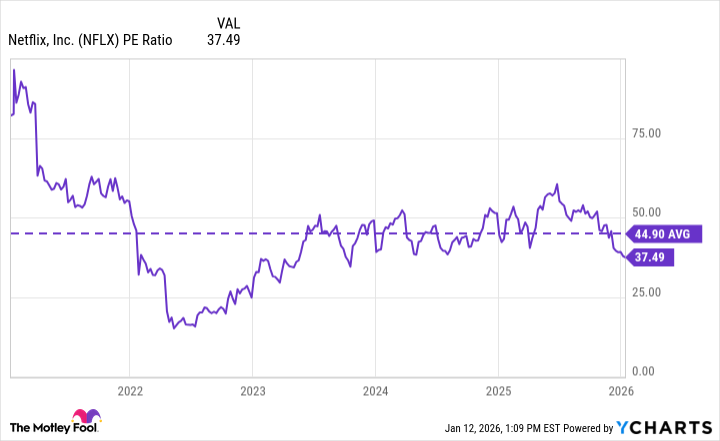

Valuation: A Matter of Perspective

Currently, Netflix trades at 37 times its earnings. A princely sum, wouldn’t you agree? Considerably higher than the S&P 500’s modest 26. But, and this is a crucial ‘but’, it’s a relative bargain compared to its own inflated past. It reminds one of a gentleman who, after squandering his fortune, boasts of his threadbare coat being a designer item. A clever ruse, perhaps, but a ruse nonetheless.

Back in 2022, during the market’s little tantrum, the stock dipped to more reasonable levels. A shrewd investor could have tripled their investment since then. But history, alas, rarely repeats itself exactly. Today, it’s trading at levels not seen since last April, when some minor tariff disputes rattled the nerves of the financial elite. One must always remember, a market spooked by tariffs is a market ripe for… opportunities.

The Warner Bros. Conundrum

For years, Netflix has been the undisputed king of the streaming jungle, a master of its domain. Warner Bros. Discovery, on the other hand, has been… less fortunate. A collection of assets, certainly, but one that seems to require constant resuscitation. It’s like acquiring a magnificent, yet perpetually ailing, racehorse. A beautiful beast, to be sure, but one that may cost you more in veterinary bills than winnings.

Adding such a complicated entity to the Netflix portfolio is, let’s say, ambitious. It introduces a delightful degree of uncertainty, a touch of chaos that may appeal to the adventurous investor. But for those of a more cautious disposition, it’s a signal to proceed with extreme caution. After all, a smooth sea never made a skilled sailor, but it does avoid shipwrecks.

Given the question marks, a demand for a steeper discount seems perfectly reasonable. A prudent investor always insists on a margin of safety, a cushion against unforeseen circumstances. It’s like insuring your hat against a sudden gust of wind – a small price to pay for peace of mind.

A Golden Opportunity or Fool’s Gold?

Netflix’s growth, while respectable, rarely ventures into truly stratospheric territory. Below 20%, you see. A perfectly adequate rate of expansion, but hardly justifies a multiple of 40 times earnings. Throw in the complexities of the Warner Bros. acquisition, the potential for margin erosion, and even 30 times earnings begins to seem… optimistic.

The stock has certainly come down from its lofty heights, but it remains a rather expensive indulgence. There’s ample room for further decline, given its inflated valuation. For now, I’d advise observing from a safe distance. There are plenty of other, less extravagant, growth stocks vying for attention. One should always remember, a penny saved is a penny earned, and a wise investor knows when to walk away from a tempting, yet overpriced, proposition.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2026-01-15 23:02