they’re the golden tickets of the AI era, and Nvidia and AMD are the only ones printing them. But supply? Non-existent. Demand? A pack of hyenas at a buffet. So, while the big names hoard chips like Scrooge McDuck in a microchip vault, companies like Nebius are doing the thankless job of making GPUs accessible. It’s the equivalent of being the friend who brings wine to a wine-tasting party-no one claps, but everyone benefits.

Enter Nebius Group (NBIS), the Russian startup that’s somehow outmaneuvered Oracle in the GPU arms race. Let’s be real: if I told you a company named “Nebius” was about to disrupt the tech world, you’d assume it was a typo. But here we are. Last week, they announced a $17.4 billion, five-year deal with Microsoft. For context, Nebius was previously aiming for $1.1 billion in annual recurring revenue by December. The math here is so absurd it makes me question my own life choices. Like, did I just spend $50 on a cup of coffee? Why am I comparing my bank account to corporate contracts?

Microsoft’s move is as strategic as it is desperate. GPUs are harder to find than a decent barista who knows what a double-shot espresso is. By partnering with Nebius, Microsoft avoids the nightmare of expanding its own data centers-which, let’s be honest, sounds like a logistical version of hell. Meanwhile, Nebius gets to whisper, “We’re good enough for Microsoft,” to the rest of the industry. It’s the tech equivalent of getting a standing ovation at a karaoke bar: validation, but also a little cringey.

Why This Deal Matters (And Why You Should Care)

AI isn’t a fad-it’s the new electricity. Enterprises are deploying AI faster than you can say “quantum computing,” and the infrastructure layer? That’s where the real money is. Nebius isn’t just selling GPUs; it’s selling the illusion of control in a world where everything feels like it’s on fire. And right now, people will pay for that illusion. I know I did when I bought that “cryptocurrency will save us all” mug in 2021. (Still using it, by the way. It’s a reminder.)

Is Nebius Stock a Buy? Let’s Do the Math (Badly)

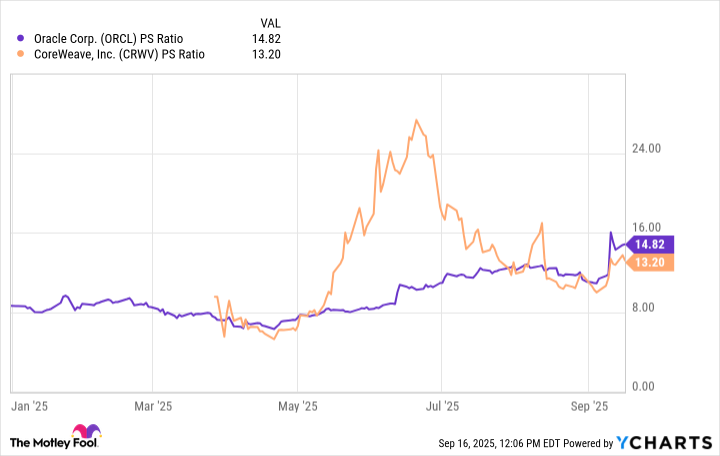

Since the Microsoft deal, Nebius shares have jumped 39%. That’s a lot. But here’s the kicker: if we spread that $17.4 billion over five years, Nebius suddenly looks like a bargain at a forward P/S ratio of 4.6. Compared to Oracle’s bloated valuations? It’s like comparing a five-course meal to a McDonald’s Happy Meal. But hold on-this assumes Nebius doesn’t wake up one day and decide, “You know what? I’d rather build yachts for oligarchs.” Customer attrition is a thing, folks. Even Microsoft could get bored if Nebius starts acting like it owns the place.

And let’s not forget the elephant in the room: Oracle and CoreWeave have their own multi-billion-dollar deals with OpenAI. But here’s the catch-OpenAI doesn’t have the cash to fund those contracts. It’s like dating someone who promises a Tesla but shows up in a rental car. Nebius, meanwhile, has a real, tangible contract with a company that doesn’t need to fake-check its balance sheet. That’s not just validation; it’s a middle finger to the chaos.

So, is Nebius a buy? If you’re the kind of investor who believes in love at first contract and isn’t easily spooked by the possibility of geopolitical drama (looking at you, Russia-Ukraine situation), then yes. But if you’re the type who panics when your Wi-Fi cuts out, maybe hold off. The AI infrastructure race is a sprint, not a marathon-and Nebius is currently in the lead. Just don’t expect me to bet your life savings on it. I’ve already done that with a NFT of a digital banana. 🤞

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-20 03:51