Nebius Group, they say, will grow. Triple digits, even. A beautiful thing, growth. It makes the accountants happy, for a little while. It’s enough to make a person believe in something. So it goes.

But Nebius isn’t making money now. And won’t be, for a while. Losses widening, they say. A common story. It’s like building a rocket ship out of hope and spare parts. Impressive, certainly. But does it get you to Mars? Probably not. Investors like a return, eventually. It’s a funny thing, wanting something for nothing.

There’s a company called DigitalOcean. Less glamorous, perhaps. Not a rocket ship. More like a sensible sedan. But it is making money. Right now. A quaint concept, I know.

What Does DigitalOcean Do?

Most folks haven’t heard of them. But if you play video games, or plan a trip, or just generally exist on the internet, chances are you’ve benefited from their services. They provide the plumbing. The bits and bytes that keep things running. 640,000 paying customers. A decent crowd.

Google and Microsoft could do the same thing, you say? Sure. They could. But they have other things on their minds. Bigger fish to fry. DigitalOcean focuses on the small fry. The little guys. The ones who need a simple solution at a reasonable price. It’s a niche, really. But a profitable one.

They’ve figured out how to scale things up, too. A small business can dip its toe into the artificial intelligence waters without mortgaging the farm. A $50 monthly test drive. A bargain, if you ask me. So it goes.

Most clients spend a few hundred to a few thousand a month. They’re happy. And the number of clients spending over a million a year is up 72%. That’s a lot of happy clients. And a lot of money. Their net dollar retention rate is 99%. Meaning, once they get a customer, they tend to keep them. A miracle, really.

The Bull Case, Such as It Is

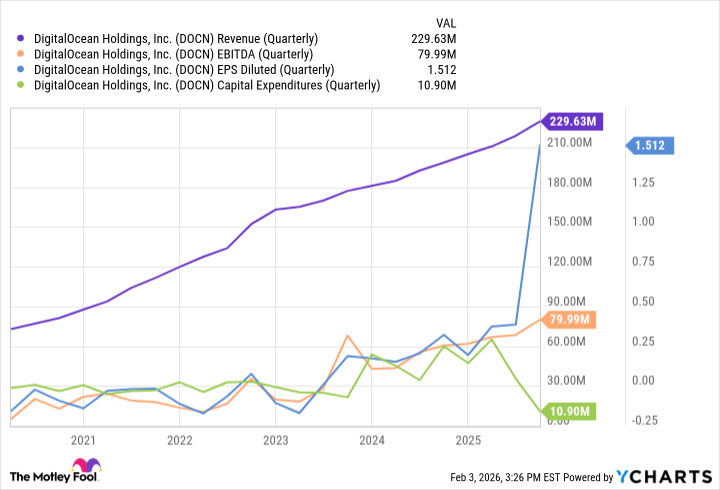

DigitalOcean won’t grow as fast as Nebius. That’s just a fact. Nebius is starting from zero. Easy to show growth when you’re starting from zero. DigitalOcean has been around since 2012, building things slowly, steadily. They’re on pace to report nearly $900 million in revenue for 2025. Respectable.

Earnings per share are up. They spent a lot of money securing their future in the AI data center market. EBITDA margins are around 40%. Not bad. They won’t be growing at this pace forever, of course. Nothing does. So it goes.

Analysts expect this growth to continue through 2027. The AI data center industry is expected to grow at 35.5% a year through 2034. A lot of growth. DigitalOcean could easily ride that wave. Or be swallowed by it. Who knows?

More Reward Than Risk, Perhaps

The stock is trading around analysts’ target price. Not a lot of upside. And there’s always the risk of an AI bubble bursting. Bubbles always burst, eventually. Just something to keep in mind. So it goes.

But the stock is reasonably priced. About 25 times this year’s expected earnings. They’ve beaten earnings estimates for ten consecutive quarters. And analysts may be underestimating their potential. A long shot, perhaps. But worth considering. It’s a small comfort, in a world full of uncertainties.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2026-02-06 22:32