Now, most folks think of computing power as something that makes toasters smarter or allows cats to post selfies.1 But there’s a growing realization – a sort of dawning horror, really – that this “artificial intelligence” everyone’s jabbering about requires vast amounts of electricity and silicon. And that, my friends, is where Nebius Group (NBIS 0.55%) comes in. They don’t actually create the intelligence – that’s left to the wizards…er, software engineers – but they provide the enchanted workshops where it’s brewed.

Nebius, you see, isn’t in the business of selling dreams or magical potions. They build and operate data centers, crammed full of glowing, humming GPUs.2 Think of them as the logistical backbone of the AI revolution. They provide the ‘cloud’ – a rather optimistic name, considering it’s mostly just warehouses full of hot air and spinning disks – where these digital brains can think, learn, and occasionally demand more RAM. Major hyperscalers, those entities that control the flow of information (and, increasingly, our lives), are signing long-term contracts with Nebius, and the resulting revenue spike is… noticeable. It’s the sort of growth that makes accountants weep with joy and regulators start twitching.

The stock has, predictably, jumped. A rather impressive 120% in the last year. But, and this is a crucial ‘but’, the market hasn’t quite grasped the sheer scale of the opportunity. Nebius isn’t just riding the wave; it’s building the surfboard, the lifeguard tower, and possibly even training the dolphins. Let’s delve into why this company could, potentially, multiply your net worth – assuming, of course, you have a net worth to begin with.3

Nebius is Growing at a Terrific Pace

The demand for data center power in the U.S. is expected to leap from a modest 25 gigawatts in 2024 to a frankly alarming 106 gigawatts by 2035. That’s enough energy to power a small country, or at least keep a very large number of AI models from having existential crises. Nebius offers investors a chance to capitalize on this, especially given the current shortage of data center capacity. They’re essentially building the digital real estate that everyone needs, and the supply isn’t keeping up with the demand. It’s basic economics, really, but somehow everyone gets surprised every time it happens.

In 2024, Nebius operated a mere two data center sites. Last year, that number jumped to seven. And they’re aiming for sixteen by the end of 2026, scattered across the U.S. and Europe. Their active data center power capacity stood at 170 megawatts in 2025, comfortably exceeding their initial target. But here’s the truly astonishing part: they have over 3 gigawatts of contracted data center capacity. That’s power they’ve secured from utility companies, essentially reserving the electricity needed to build and equip new facilities. Think of it as claiming the best fishing spots before anyone else realizes there are fish.

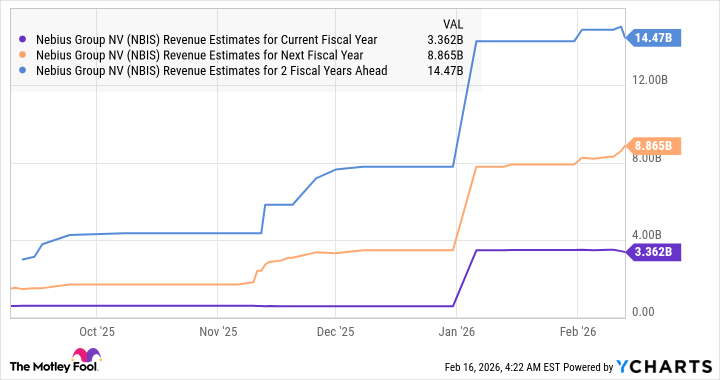

This contracted capacity is almost twenty times their active capacity. As Nebius converts this into connected power – actually getting the GPUs humming – their revenue growth will accelerate. It’s a bit like winding up a very large, very powerful spring. The company’s 2025 revenue landed at $530 million, almost six times the previous year. Analysts expect a significant surge over the next three years, and frankly, it’s hard to argue with them.

Why the Stock Can Become a Multibagger

Increasing your net worth tenfold is, admittedly, a rather ambitious goal. And buying Nebius stock with the sole hope of becoming fabulously wealthy isn’t a particularly smart strategy. Any cracks in their growth story could send the stock plummeting faster than a poorly-cast spell. However, including it as part of a diversified portfolio – spreading your risk, you see – could be a sensible move, given the vast sums being poured into AI data centers. It’s a bit like betting on the inevitable; eventually, someone will need more computing power.

Analysts predict Nebius’ revenue will jump 27 times over the next three years. If they achieve $14.5 billion in revenue by 2028 and trade at a modest 8.4 times sales (in line with the average for U.S. tech companies), their market cap could hit $122 billion – almost five times its current value. That’s a substantial return, even for the most jaded investor. And, given Nebius’ outstanding growth, they could very well command a higher multiple, potentially unlocking even more upside.

1 Cats and their obsession with the internet is a topic for another article entirely.

2 GPUs, or Graphics Processing Units, are the workhorses of the AI revolution. They’re essentially tiny, incredibly powerful brains designed to crunch numbers at an alarming rate.

3 A net worth, for those unfamiliar with the term, is the value of everything you own minus everything you owe. It’s a surprisingly complicated concept.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- The Best Single-Player Games Released in 2025

2026-02-18 07:22