As a seasoned crypto investor with over a decade of experience navigating market ebbs and flows, I find myself intrigued by this recent development. The three consecutive days of outflows from Bitcoin ETFs, especially the record-breaking outflow on December 19, certainly raises eyebrows. However, it’s not uncommon to see profit-taking during a bull run, and given Bitcoin’s stellar performance this year, it seems plausible that some investors are cashing in their gains.

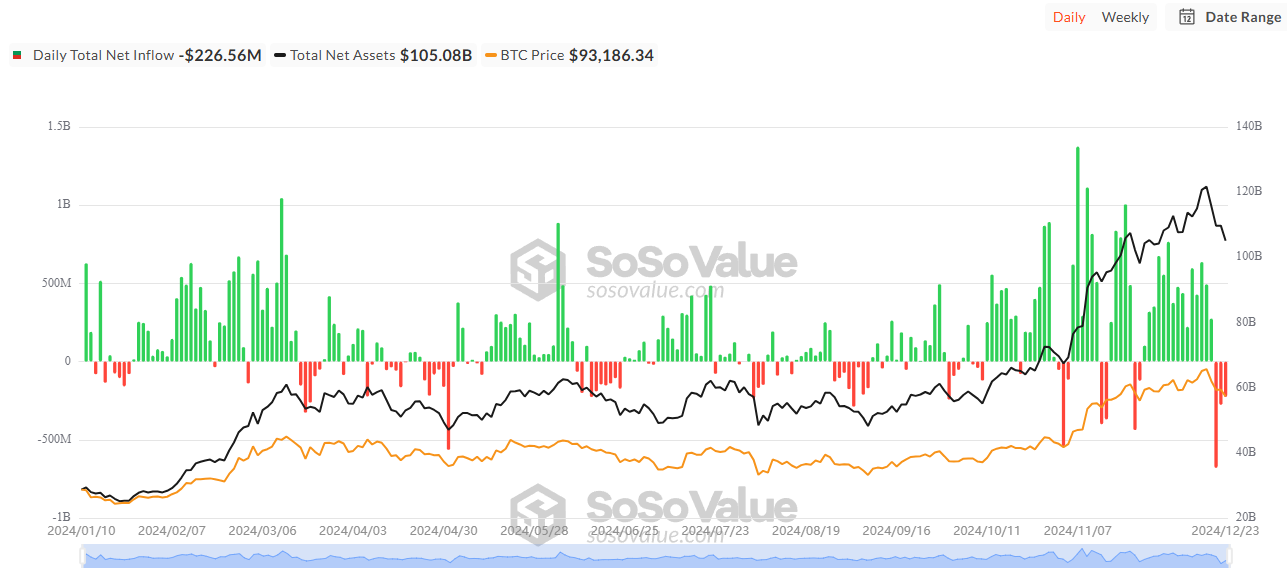

In the U.S., Bitcoin Exchange Traded Funds (ETFs) have experienced daily outflows for three consecutive days before Christmas. Additionally, these ETFs recorded their highest single-day outflow yet, momentarily slowing Bitcoin’s price surge.

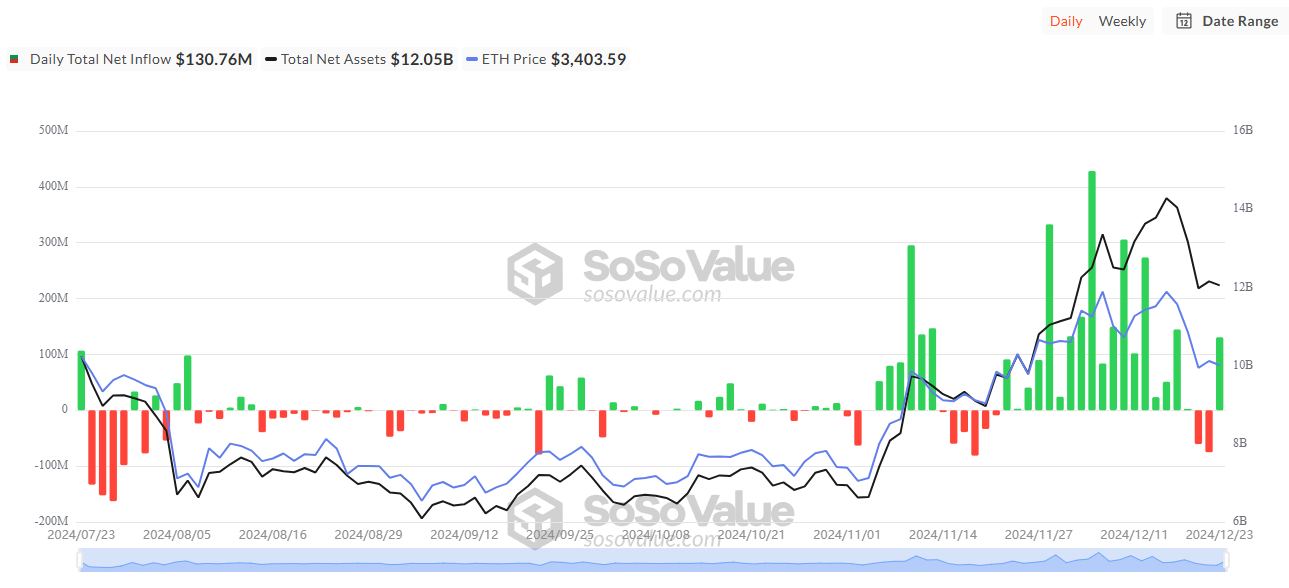

However, Ethereum ETFs in the US showed positive signs with a net inflow.

Bitcoin ETFs Witness Net Outflows for the Third Consecutive Day

According to SoSoValue data, there was a significant withdrawal of approximately $1.2 billion from Bitcoin Exchange Traded Funds (ETFs) over the last three trading days. Interestingly, on December 19th alone, these funds witnessed their highest single-day outflow since their approval, amounting to around $680 million.

Investor Antonio Zennaro noted that the substantial outflow we’re witnessing prompts the question: Is it just a case of profit-taking, or could it be indicative of a larger structural change in capital? At this point, it seems profit-taking is the most probable explanation. However, keeping an eye on market trends and institutional activities will help us verify this assumption.

Previously, Bitcoin ETFs experienced a stretch of 15 consecutive days with an inflow of funds, which increased their total assets from $100 billion to $121 billion. Lately, there has been a three-day outflow of funds, causing the total assets to decrease back down to $105 billion.

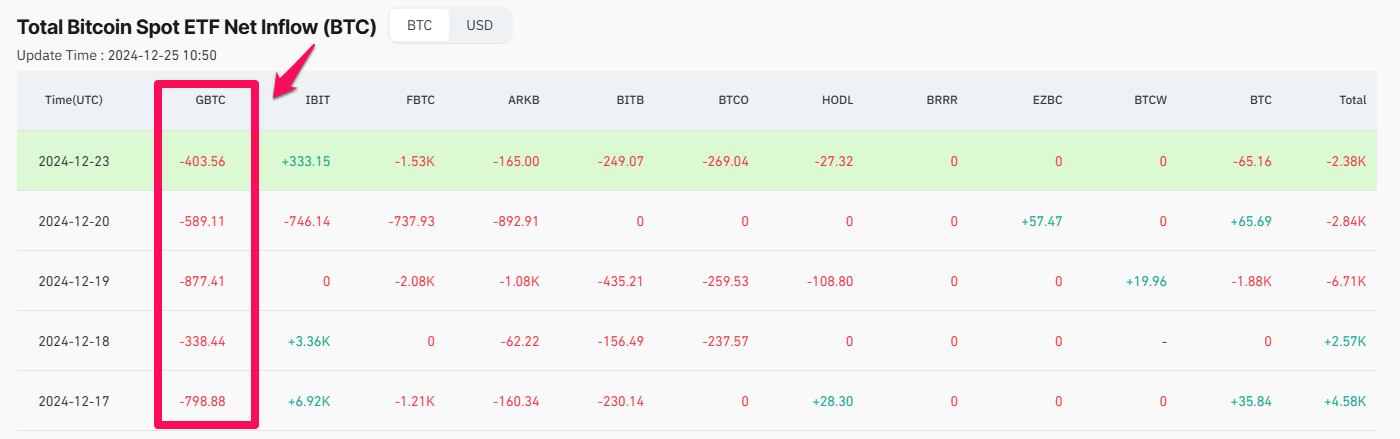

As an analyst, I’ve found some intriguing insights from the data provided by Coinglass. Over the last three trading days, Grayscale’s GBTC was a notable player in the outflows, offloading approximately 1,870 Bitcoin. This selling activity dwarfed the buying actions taken by BlackRock’s IBIT during the same period.

Even though Bitcoin saw a three-day decrease in inflow compared to outflow (netflows), investor enthusiasm for Bitcoin remains robust. Notably, Bitcoin ETFs overshadowed gold ETFs in terms of assets under management (AUM) during December, which underscores growing trust among institutional and individual investors in digital currencies.

On December 23, Bitcoin ETFs had a net outflow of approximately $226 million, while Ethereum ETFs saw a significant inflow of over $130 million. Notably, BlackRock’s Ethereum ETF now manages over 1,000,000 ETH. This suggests that investors are increasingly interested in Ethereum ETFs compared to Bitcoin ETFs during this particular trading session.

Many investors think this trend might indicate a surge of optimism for Ethereum and other alternative cryptocurrencies, given that Ethereum’s value significantly decreased from around $4,100 to almost $3,100 in December.

“BlackRock’s Ethereum ETF now holds over 1,000,000 ETH. This data, paired with the fact that ETH is still consolidating below its all-time high, is an altcoin season indicator like we’ve never seen before.” Investor Dan Gambardello commented.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-25 09:25