As a researcher with a focus on emerging economies and their adoption of financial technologies, I have closely followed Cambodia’s journey towards embracing digital assets. The recent decision by the National Bank of Cambodia to allow commercial banks and payment institutions to use certain stablecoins is indeed a positive step forward for the country’s nascent blockchain space. However, the continued ban on Bitcoin suggests that the nation’s approach to cryptocurrencies remains cautious.

Currently, financial establishments in Cambodia, such as commercial banks and digital payment providers, are authorized to utilize specific “Class 1” assets, including stablecoins that are heavily supported by traditional currency reserves. Nevertheless, it’s important to note that the use of Bitcoin remains prohibited within the country.

This advancement could foster expansion for the emerging blockchain sector within our country, yet a significant transformation would necessitate broader pro-cryptocurrency regulations.

Cambodia Friendly to Stablecoins?

Based on local updates, it appears that this latest action could be a beneficial stride towards overseeing stablecoins within Cambodia. However, the government’s stance towards cryptocurrencies seems cautious, as pointed out by Hong Vanak, an economist at the Royal Academy of Cambodia.

“Cryptocurrencies don’t seem to offer significant advantages to national economies because they are digital, decentralized, and difficult to manage, tax, or track ownership. However, enabling crypto services could generate substantial income from transaction fees for banks and financial institutions through user transactions, as per Vanak’s assertion.

As a researcher, I’ve observed that the regulatory landscape for cryptocurrencies in Cambodia tightened significantly during the year 2024. To illustrate, just this month, the nation took action to prohibit 16 prominent international digital asset exchanges from operating within its borders.

Initially, the national bank wasn’t as hostile as it appears now; it introduced a Central Bank Digital Currency (CBDC) and facilitated cross-border payment transfers before. However, increased worries about money laundering have led to stricter scrutiny of digital assets by regulators. Now, its acceptance of stablecoins brings positive news for the crypto sector in Cambodia.

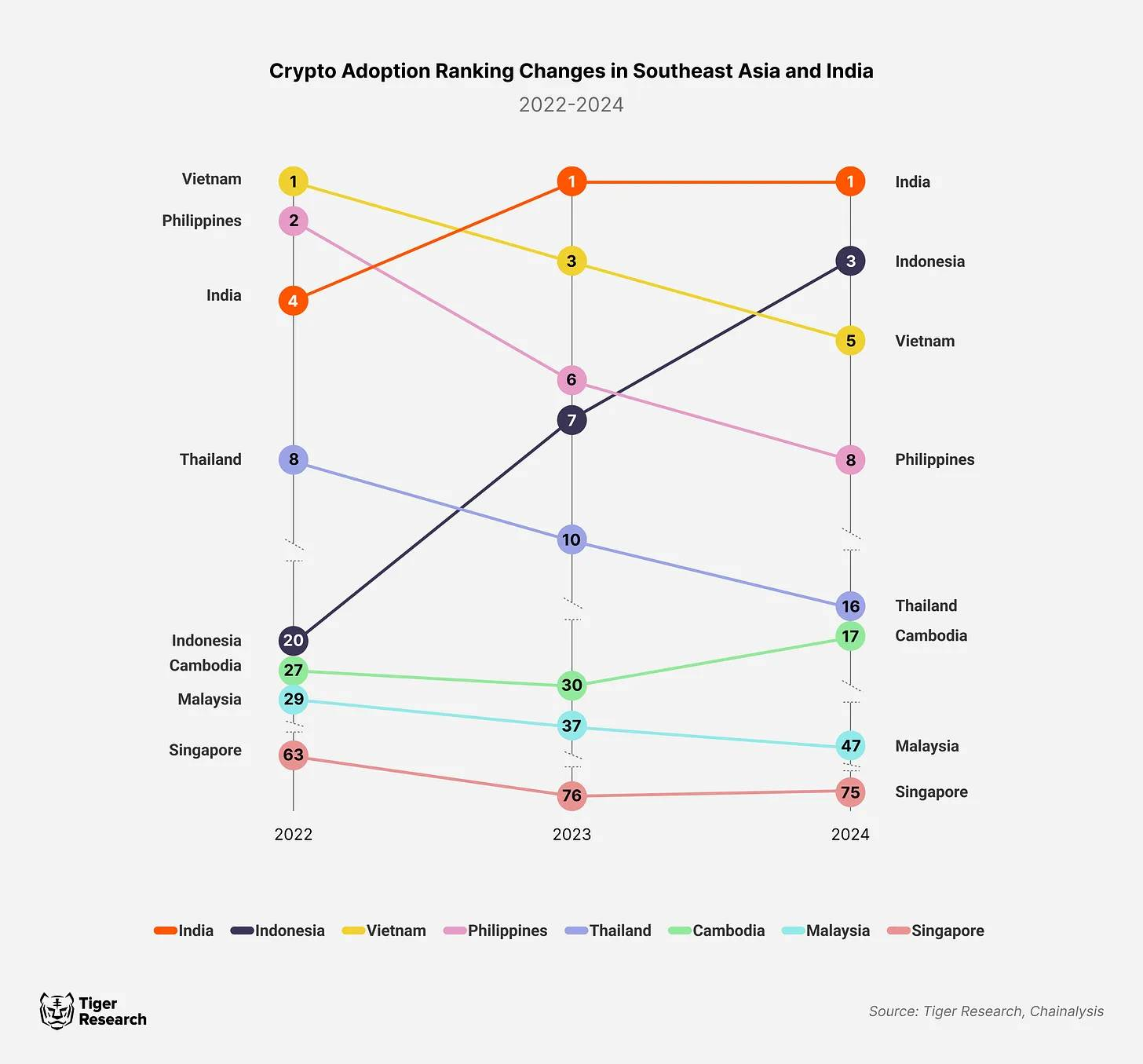

Over the past two years, crypto adoption has grown in the country. However, much of this is associated with organized crime, creating a negative stigma.

Earlier this year, a clandestine trading operation worth approximately $11 billion was discovered in Cambodia by researchers, with connections reaching as far as the President’s immediate relatives. As a result, Tether took action to freeze the majority of these assets.

The underground marketplace in question has also been implicated in the washing of funds tied to the notorious North Korean Lazarus Group, adding fuel to the controversy. More recently, Cambodian authorities have collaborated with companies such as Binance to establish constructive regulations. (Paraphrased)

While it’s positive that Cambodia is endorsing stablecoins, it might require some time before the wider cryptocurrency industry experiences similar progression.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-27 21:38