This week, Nasdaq moved significantly closer to unveiling the initial Litecoin-centric Exchange-Traded Fund (ETF) in 2025, as they filed a 19b-4 form with the United States Securities and Exchange Commission (SEC).

The Canary Litecoin ETF plan seeks to leverage the achievements of Bitcoin and Ethereum ETFs that were approved recently, possibly introducing a new asset-tied product to the expanding selection of crypto investment options.

1) Prior to Nasdaq’s filing, Canary Capital made adjustments to their S-1 submission, which the SEC has reportedly provided detailed feedback on, suggesting that regulators are actively considering the proposal. Meanwhile, Bitwise has submitted a request for an XRP ETF, and it seems likely this will be approved in early 2025.

Analysts’ View on Litecoin ETFs

Analysts believe that the way regulators are reviewing Litecoin’s ETF is similar to how they handled Bitcoin and Ethereum ETFs in the past, which eventually resulted in their approval. The fact that Litecoin is considered a commodity instead of a security might make it easier for approval and set it apart from other cryptocurrencies that continue to face regulatory challenges.

Under the new Trump administration, there’s a transition happening at the SEC, with Paul Atkins, a commissioner who has been supportive of digital assets, expected to take over as chair. This move comes after Gary Gensler, who was known for stricter regulation of crypto markets, completed his term. Some analysts believe that this change in leadership could potentially speed up and favor the approval process for Litecoin’s ETF proposal.

Market Response to Approval News

As a crypto investor, I’ve noticed an increase in both retail and institutional attention towards Litecoin, with anticipation of an upcoming approval. Over the past 24 hours, the coin’s price has skyrocketed by a substantial 18%, as per market data. Notably, large investors, often referred to as “whales,” are reportedly boosting their portfolios with sizeable Litecoin holdings. Currently, Litecoin’s market cap hovers around $8.8 billion, and several analysts speculate that achieving formal ETF status could significantly enhance its appeal among traditional investors, potentially increasing its prominence even further.

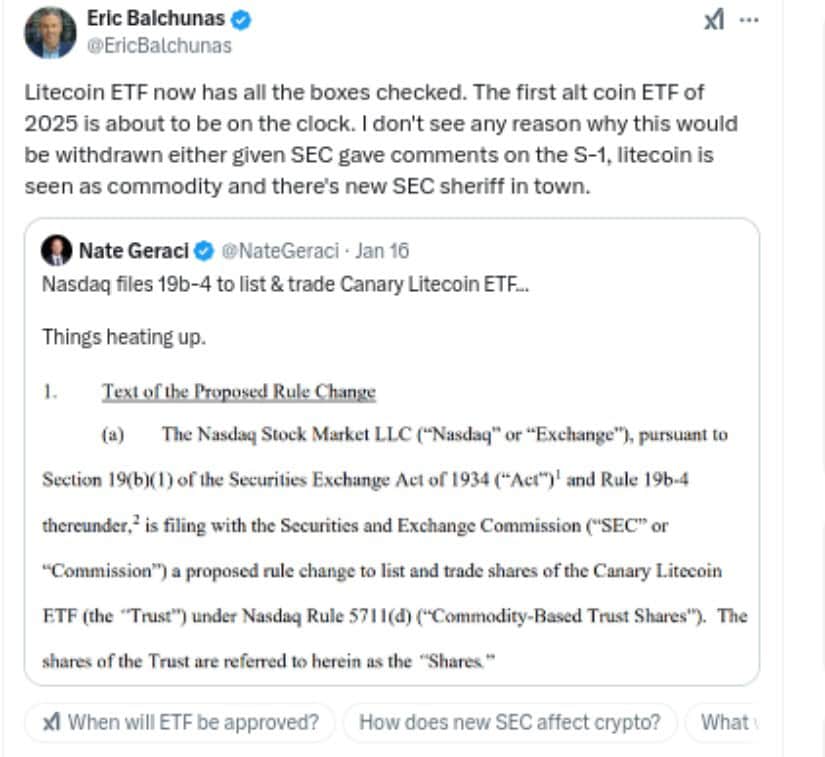

According to Eric Balchunas, a senior analyst at Bloomberg, the criteria for a Litecoin ETF have been met. This means that the first ETF based on an alternative coin could potentially be launched in 2025. Given that the Securities and Exchange Commission (SEC) has provided feedback on the S-1 filing, Litecoin is considered a commodity, and there’s a new SEC leader, it seems unlikely that this ETF would be withdrawn.

Should the SEC give its final nod, it’s planned that Coinbase Custody Trust Company LLC will manage custodial duties, while U.S. Bancorp Fund Services, LLC will take care of administrative tasks. This setup illustrates the infrastructure established for the suggested fund’s support.

Litecoin: The Digital Silver to Bitcoin’s Gold

Originating from Charlie Lee in 2011, Litecoin (LTC) is frequently compared to Bitcoin’s “gold” as its “silver.” Being one of the first cryptocurrencies, Litecoin was developed with the intention of supplementing Bitcoin, resolving some of its limitations while preserving its fundamental values of decentralization and security. It provides quicker transaction rates and lower costs, making it perfect for smaller, routine transactions.

Litecoin functions on a modified adaptation of Bitcoin’s original code, employing the Scrypt encryption method rather than Bitcoin’s SHA-256. This choice made mining simpler for typical users during its initial phase, fostering decentralization. Additionally, Litecoin completes a block in about 2.5 minutes, whereas Bitcoin takes 10 minutes, resulting in faster confirmations.

Throughout its existence, Litecoin has introduced numerous advancements, like Segregated Witness (SegWit) and the Lightning Network, that boost both scalability and compatibility. More recently, it has incorporated MimbleWimble extension blocks, which offer privacy functions, attracting users who prioritize confidential transactions.

Despite having a smaller market share compared to Bitcoin or Ethereum, Litecoin is a dependable and commonly used cryptocurrency that consistently ranks among the top by market capitalization. Its long history and solid development make it a crucial component in the crypto world, making it an attractive choice for those looking for a swift and affordable digital currency.

As a crypto investor, I’m keeping a close eye on Litecoin’s potential for securing an ETF listing in the U.S., which many market analysts believe is imminent. This anticipation has sparked increased interest and speculation about Litecoin price movements. If it does get listed, Litecoin could potentially ride the wave of the Trump Pump, a term used to describe the crypto bull runs that often follow positive news or actions related to cryptocurrencies by prominent figures like President Trump.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-01-18 12:56