Ah, the dance of finance! Crypto ETF options, those capricious creatures, now stir the hearts of traders and the pens of regulators alike. Bitcoin and Ether, those digital sirens, beckon with promises of wealth and whimsy.

Nasdaq, ever the eager suitor, has beseeched the SEC to loosen the reins on Bitcoin ETF options. “Let us play with larger stakes!” they cry, as if the market were a grand ball and they, the most ardent of dancers. Data, that cold and impartial observer, reveals a steady waltz of volume and open interest in these BTC-tied investments. Yet, like a chaperone at a Victorian soiree, strict caps curb the ardor of traders, leaving Nasdaq to lament the stifled romance of the crypto-linked options markets.

The Grand Plea for Higher Limits on Bitcoin and Ether ETFs Options

In a filing as elegant as a Turgenev novel, dated January 21, Nasdaq proposes to amend its options position and exercise limit rules. The current cap of 25,000 contracts, they argue, is but a quaint relic of a bygone era. “It discourages liquidity providers and large institutions,” they sigh, “leaving the dance floor sparsely populated.” Fewer dancers, of course, mean less grace, less fluidity, and a market as awkward as a novice at a quadrille.

Nasdaq, ever the visionary, desires these limits removed, so that crypto ETF options may mingle freely with their more established ETF counterparts. BlackRock, Fidelity, Grayscale, Bitwise, ARK twenty-one Shares, and VanEck-all stand to benefit from this grand emancipation. The firm insists that the current restrictions are as out of place as a frock coat at a summer picnic, no longer reflecting the depth and vibrancy of the market since the spot ETF launches.

With a flourish, Nasdaq requests the waiver of the standard 30-day waiting period, as if time itself were an unnecessary formality. The SEC, ever the cautious arbiter, retains the power to suspend the change for up to 60 days, should it deem further contemplation necessary. A final decision, we are told, is expected by late February-a date that hangs in the air like the anticipation of a first kiss.

IBIT Options: The Darling of U.S. Assets by Open Interest

BlackRock’s iShares Bitcoin ETF, that darling of the financial world, has seen its options grow in popularity like a debutante at her first ball. Data from SosoValue reveals that IBIT options now rank eleventh among U.S. assets by total open interest, with over 5.3 million contracts still in play. Yet, they trail behind the more seasoned gold and silver ETF options, a reminder that even the most dazzling newcomers must earn their place in the hierarchy of finance.

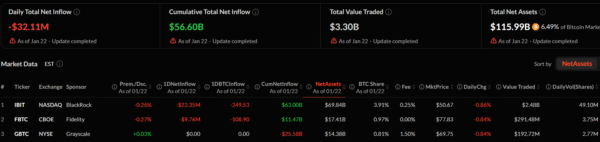

Spot Bitcoin ETFs, however, have experienced a less glamorous turn, with outflows reaching $32.11 million in recent sessions. BlackRock and Fidelity, those titans of the industry, led the redemptions with $22.35 million and $9.76 million respectively. A momentary lapse in confidence, perhaps, or merely a strategic retreat before the next advance.

Image Source: SosoValue

Risk management, that ever-present specter, looms over the proposal. Options, those versatile instruments, allow investors to hedge against the whims of the market while maintaining their long positions. Broader access to Bitcoin ETF options, Nasdaq argues, could temper the panic that often accompanies periods of stress, like a steady hand guiding a skittish horse.

Uniform Limits: The Key to Ether ETF Options Trading?

Ether ETF options, those volatile companions, have also captured the attention of traders, particularly following the approval of spot Ether ETFs. Traders, ever seeking to manage the risks tied to protocol upgrades and ecosystem changes, find themselves drawn to these instruments like moths to a flame. Yet, Ether-linked options, with their higher volatility, demand larger positions to navigate the tempestuous seas of the market.

Nasdaq, in a move as bold as it is pragmatic, proposes uniform position limits across major crypto ETFs. This, they argue, would simplify compliance and attract a broader array of participants. Bitcoin, trading near $88,893 with modest daily gains, and Ether, sitting around $2,921 after a weekly drop, ensure that demand for options remains as strong as ever.

Image from Nasdaq.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-23 15:41