Nano Nuclear: A Most Curious Reactor

Behold, gentle investors, a company named Nano Nuclear Energy [NNE 3.77%]. They propose a marvel of miniaturization – reactors so compact they might grace a data center, or even, so they claim, propel a vessel amongst the stars! They name these devices with a grandiosity that rivals the gods themselves – Kronos, Zeus, Loki – as if invoking divine favor upon a venture still firmly rooted in earthly speculation. A charming conceit, wouldn’t you agree?

Yet, as with all theatrical productions, the curtain has risen and fallen upon a most uneven performance. The year 2025 saw a spirited ascent, a veritable rocket launch of enthusiasm, only to be abruptly grounded by a broader sell-off amongst those who dabble in the atom’s power. The final tally? A modest decline of 3.5%, leaving Nano trailing behind both the venerable S&P 500 and the VanEck Uranium and Nuclear ETF [NLR 0.09%]. A humbling experience, to be sure.

But lo! The year 2026 dawns, and Nano Nuclear finds itself resurgent, currently boasting a gain of some 27%. Can this be the year they triumph over the market? Let us, with a judicious eye and a skeptical heart, examine the grounds for such a hope.

The Illusion of Progress and the Burden of Expectation

Nano Nuclear’s ambition, in essence, is to offer power on demand, a portable sun for those places where the grid’s reach is wanting. They aspire, moreover, to control the entire fuel chain, becoming a one-stop shop for all things nuclear. A bold vision, to be certain. But, alas, a vision still shrouded in the mists of possibility.

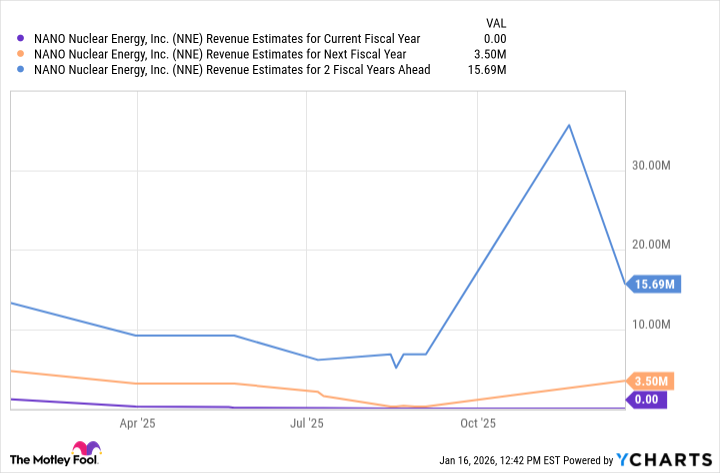

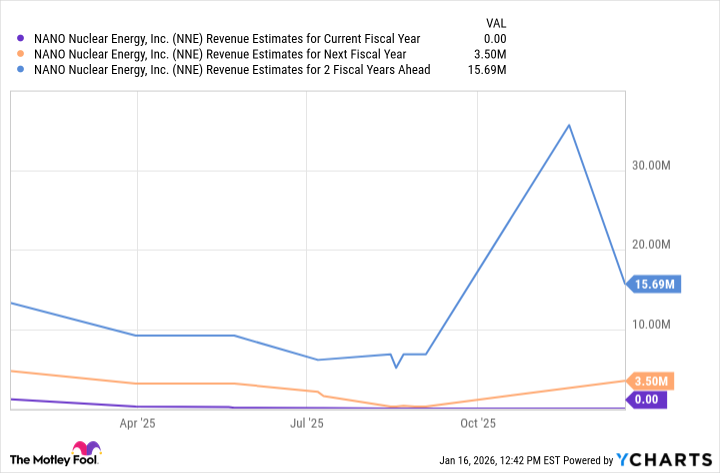

For here lies the rub: Nano Nuclear, at present, generates precisely zero revenue. Their reactor designs remain, shall we say, theoretical constructs, awaiting the approval of the Nuclear Regulatory Commission before they can grace the world with their presence. Even in the most optimistic of scenarios – and optimism, dear friends, is a costly commodity – several years must pass before Nano Nuclear can claim a meaningful contribution to the coffers.

This, naturally, explains the stock’s capricious nature. Devoid of both income and a functional reactor, Nano Nuclear is driven not by substance, but by narrative. The current tale revolves around the insatiable appetite of AI data centers. When investors embrace this fable, the company appears well-positioned. But when doubt creeps in, the relentless burn of cash becomes painfully apparent.

A recent example of this narrative-driven dance is the current upswing. While the company has announced a few minor agreements – a Memorandum of Understanding with a South Korean firm, for instance – much of the momentum seems tied to the successes of others. Meta Platforms’ power purchase agreement with Vistra, which includes Oklo and TerraPower, has cast a fleeting glow upon all those who dabble in the atom. A most convenient association, wouldn’t you say?

For now, this stock floats upon a sea of speculation, unanchored by fundamentals. While it may indeed possess the potential to power future data centers, it requires a concrete demonstration of progress – a positive signal from the NRC, perhaps – to win over a skeptic such as myself.

If, against the odds, this stock manages to outperform the market in 2026, it will be due to the continued allure of the narrative – the relentless growth of power-hungry AI. For long-term investors who believe in this tale, a small position today might, eventually, yield a handsome reward. More prudent investors, however, may prefer to spread their risk through a broader nuclear energy exchange-traded fund (ETF). After all, a wise man diversifies, while a fool risks all on a single, untested device.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- 10 Underrated Films by Wyatt Russell You Must See

- Anime That Should Definitely be Rebooted

2026-01-24 20:52