Should you consider revising or redistributing your investment portfolio? It might be beneficial to find alternative investments for the money that has been gradually accumulating without being actively used.

No worries, I believe I can assist you. Let me share with you a more detailed examination of five stocks that I’ve been closely watching for some time now. These stocks have risen to become some of my top recommendations. I think they could also be great fits for many other investors out there.

1. PepsiCo

Since the end of 2023, when inflation became particularly harsh due to lingering economic factors, the stocks of PepsiCo (PEP) have significantly lagged behind those of its competitor Coca-Cola.

While Coca-Cola primarily outsources its costly bottling processes to external bottling partners, PepsiCo manages the majority of its production facilities on its own. However, these in-house manufacturing operations have lately become pricier to maintain.

It’s equally misleading to deny that Coca-Cola possesses some degree of pricing advantage over PepsiCo. This is especially true when we consider the contrast between their respective businesses, with Coca-Cola’s beverage segment appearing to have more potential for price manipulation than PepsiCo’s Frito-Lay snack chip division.

Despite the challenging environment affecting PepsiCo’s profits, it was not the imminent danger that the stock’s 30% decline from its 2023 peak implies. On the contrary, this drop in price has actually benefited investors significantly. It has boosted the forward-looking dividend yield to a promising 4.2%. This high yield is built on a dividend that has been consistently increased for an impressive 53 years in a row.

2. AppLovin

Have you ever come across the company called AppLovin (APP)? If not, that’s understandable as it isn’t very well-known. However, it’s quite possible that you or someone within your household has encountered its services somehow.

AppLovin isn’t just about promoting apps for developers; it elevates digital marketing to an artistic and scientific level. Whether it’s streaming television, mobile applications, or other platforms, AppLovin enables marketers to design, execute, and evaluate advertising campaigns effectively.

I can’t help but be thrilled about this tech company I’m invested in! The sheer enthusiasm of our customer base is evident, and the projected revenue growth of over 21% this year speaks volumes. It’s not just a flash in the pan; experts predict this impressive growth pace will continue well into 2027. To top it off, we’re not just profitable, but profitability is on the rise! In fact, we’re expecting our per-share profits to triple from last year’s $4.53 to a staggering $14.00 per share by 2027. I can hardly wait to see what the future holds for this amazing tech company!

For the sake of clarity, there has been a bit of controversy. Back in March, a firm specializing in short-selling, Muddy Waters, raised doubts about the effectiveness of AppLovin’s advertising technology as claimed. This revelation led to a significant drop in share prices.

It’s quite telling, however, that the stock has since more than reclaimed that lost ground.

3. Snap

Back in 2017, when I saw Snap Inc. (SNAP) hitting the public market, I must admit I shared the hesitation of many investors. After all, Twitter and Meta Platforms’ Facebook were already deeply rooted, expanding continuously. The idea of another social media platform, especially one that wasn’t yet profitable, seemed like an unnecessary addition to the scene. As an investor, the thought of sinking money into a loss-making venture didn’t sound appealing at all.

In the meantime, something quite amusing has occurred – Snapchat is thriving! The platform has been steadily advancing in terms of revenue, profitability, and user base. Its first-quarter daily user count of 460 million marks another high point in a consistent growth trend. Moreover, its sales growth and progress towards sustainable profitability are equally remarkable, backed by the company’s determination to experiment, learn from both successes and failures, and adapt accordingly.

Could it be that Facebook and X are becoming progressively intolerable due to their perceived toxicity, leading more individuals to seek refuge on the Snapchat platform? This theory, although often overlooked, suggests that people are growing weary of the escalating negativity on these platforms.

4. MercadoLibre

It’s quite possible that you aren’t familiar with MercadoLibre (MELI), but it shouldn’t stop you. In fact, it presents a terrific chance for growth.

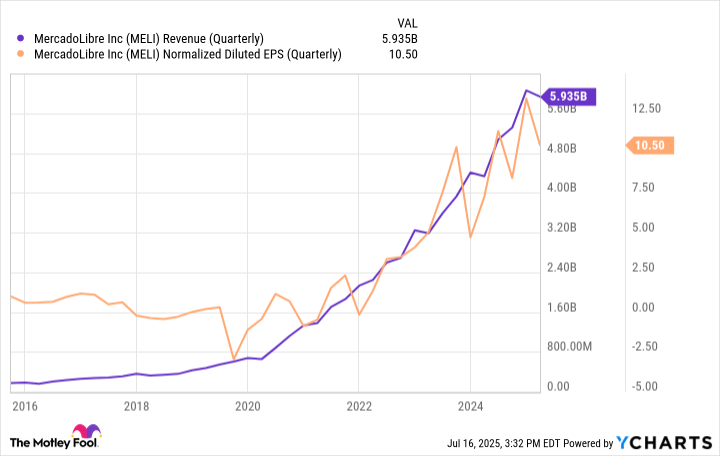

MercadoLibre is commonly known as the “Amazon of Latin America” due to its extensive e-commerce platform catering to the entire region. It offers a comprehensive solution for various South American businesses, encompassing payment processing, delivery logistics, and technological tools for traditional retailers. In the past year alone, its technology enabled transactions worth $51.5 billion in goods and services, while also acting as an intermediary for approximately $200 billion in digital payments. These figures represent significant growth compared to the previous year.

This still only scratches the surface of its opportunity.

In numerous aspects, the telecom sector in Latin America resembles North America about a quarter-century ago, during Amazon’s early expansion phase. According to research firm Canalys, smartphone shipments to Latin America surpassed 137 million devices last year, mirroring the region’s current accelerated expansion of both wired and wireless broadband networks.

Just as a surge in online shopping was observed in North America, an increasing number of people in Latin America are showing keen interest in internet shopping. According to predictions by Payments and Commerce Market Intelligence, the e-commerce market in Latin America is projected to nearly double in size from 2023 to 2027. Given its strategic position, MercadoLibre stands a strong chance of dominating a significant portion of this expanding market.

5. Alibaba

Last but not least, I’m adding Alibaba (BABA) to my list of favorite stocks to buy right now.

Alibaba serves as the parent company to two dominant Chinese e-commerce platforms, Taobao and Tmall. Together, these platforms account for roughly half of China’s online shopping market. While Alibaba’s sites AliExpress and Alibaba.com may not have the same extensive reach, they are still notable in their respective markets catering to customers beyond China.

The organization extends beyond just online shopping. It runs a digital entertainment division, offers logistics services, and manages a cloud computing sector that has created an advanced AI-driven chat application known as Qwen. This versatile tool can be utilized and profitably exploited in multiple settings.

Observing the ongoing tariff dispute, which is merely a piece of the broader trade conflict between the globe’s economic titans, I find myself questioning its significance. It seems that it might not carry as much weight as one might initially assume.

In a general sense, China and Alibaba mostly function independently from their major trading partners, not necessarily relying on close ties to achieve growth. To support this contention, after Alibaba reported a 6% increase in its first-quarter revenue, China announced that retail spending grew by 4.8% in June, following May’s growth of 6.4%. Furthermore, China’s industrial output remained consistent during the same period.

It’s not implied that China doesn’t desire improved trade ties with the U.S., but rather, it’s important to note that even amidst trade disputes, both the nation and this particular company are capable of prospering independently.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 11:42