Ah, the illustrious Mt. Gox, once the crown jewel of the cryptocurrency kingdom, has made yet another daring pirouette, transferring a staggering $1 billion in Bitcoin (BTC).

As if choreographed by fate itself, this transfer waltzes in precisely as the sordid affair of creditor payouts looms ever closer, with a deadline that seems to mock its audience—October 2025.

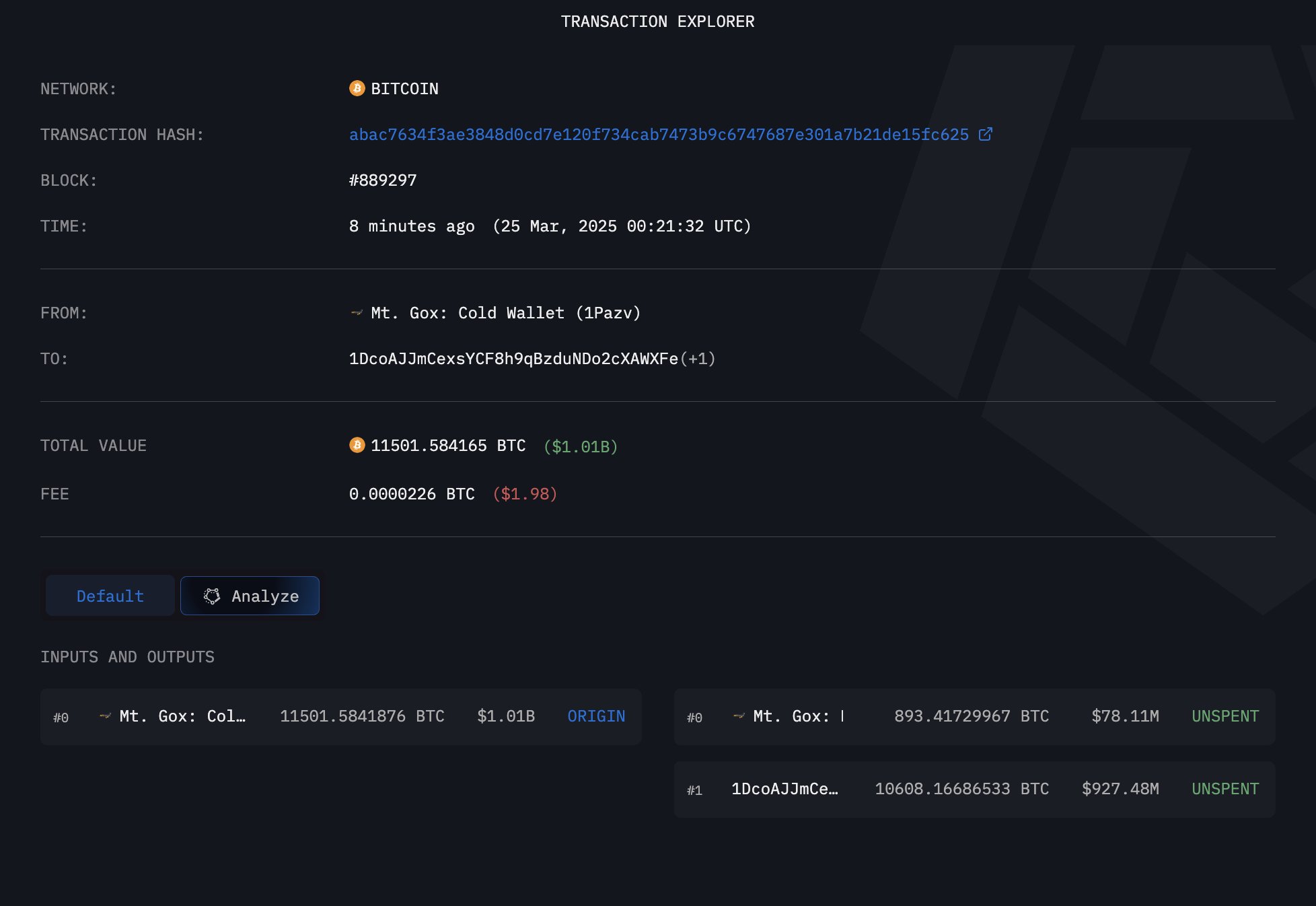

Mt. Gox Performs the Grand Bitcoin Transfer: 11,501 Coins at Stake!

According to the discerning eyes at Arkham Intelligence, our dear Mt. Gox whimsically dumped 11,501 Bitcoins into the abyss of two wallets. A change wallet (address: 1DcoA) received a delightful 10,608 BTC, worth a dizzying $929 million, while its hot wallet (address: 1Jbez) clutched 893 BTC with a cheeky value of $78 million.

But wait, there’s more! Just earlier in the month, the exchange waltzed away with 12,000 BTC worth $1 billion—an encore to its earlier 11,834 BTC performance worth a paltry $910 million. Talk about a showstopper!

In this latest act, a sprightly 332 BTC, worth over a swanky $25 million, took the stage at the Bitstamp exchange, prompting whispers of potential liquidation. Thus, SpotOnChain playfully suggested that the 893 BTC perched in the hot wallet might soon be looking for new dance partners too.

At the conclusion of this extravagant transfer, Mt. Gox still cradles a treasure trove of 35,583 BTC, valued at over $3 billion. One could say it’s preparing for a grand repayment spectacle to those unfortunate creditors, forever haunted by the specter of its infamous hack over a decade ago.

A curious urgency envelops the air as the repayment deadline draws near. Last October, the trustee, taking a page from a procrastinator’s handbook, generously extended the cutoff for creditor repayments by an entire year. The new date, one to mark with a golden pen—October 31, 2025.

“Many rehabilitation creditors still have not received their Repayments because they have not completed the necessary procedures for receiving Repayments. Additionally, a considerable number of rehabilitation creditors have not received their Repayments due to various reasons, such as issues arising during the Repayments process,” read the notice, like a poor imitating a rich man’s problems.

In a rather anticlimactic twist, the transfer scarcely fluttered Bitcoin’s silk edges. According to the wise scribes at BeInCrypto, the price merely dipped a trifling 0.19% within the past day—a touch more eventful than a sloth on a Sunday. At last glance, it traded at a princely sum of 86,756.

One mustn’t ignore that this splendid coin has been making a slow and steady recovery from its recent woes. BeInCrypto’s astute analysis suggests Bitcoin tiptoes toward a breakout from a descending wedge pattern. Should this rumor hold, it could set the stage for an encore performance, potentially soaring to $95,000, perhaps even securing bids from clowns in love with yachts.

And then, bless his heart, Arthur Hayes, the ex-CEO of BitMEX, chimed in with unrestrained optimism for Bitcoin’s future.

“The price is more likely to hit $110k than $76.5k next. If we hit $110k, then it’s yachtzee time and we ain’t looking back until $250k,” he grinned on X, his digital alter ego as buoyant as a helium balloon at a children’s party.

His reasoning, of course, rests upon the lofty hope that the US Federal Reserve might shift from the dreary confines of quantitative tightening (QT) to a joyous romp through quantitative easing (QE), thereby enriching liquidity like a fat cat at an all-you-can-eat buffet. According to Hayes, pesky tariffs and their inflationary antics won’t cast a long shadow over the economy, allowing Bitcoin to gallop forth into the sunset.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

2025-03-25 10:42