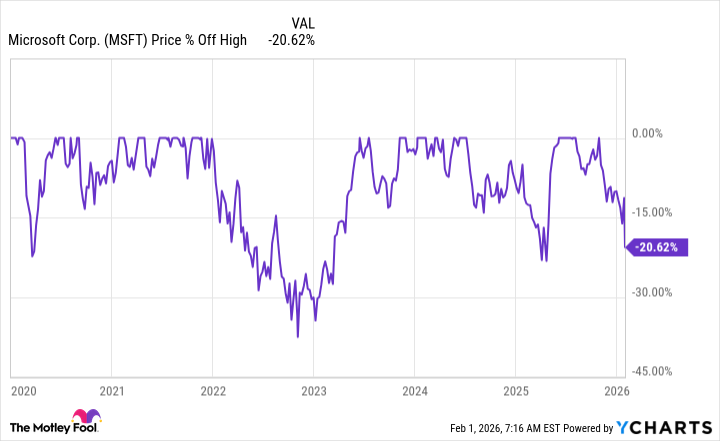

Right. Microsoft. It’s been…a week. The stock had a bit of a wobble after earnings, didn’t it? A ten percent sell-off. Honestly, it felt a bit dramatic. Like a friend who bursts into tears over a slightly overcooked soufflé. It’s down about twenty percent from its peak, which, in investment terms, feels…significant. Most people seem to be bracing for the worst, but I’ve actually been buying. Yes, buying. I know, I know, it feels counterintuitive. But hear me out.

Units of MSFT purchased: 15. Hours spent staring at charts, questioning life choices: 7. Number of times I’ve told myself “this time it’s different”: Numerous.

Why the Market Seems to Have Lost Its Marbles (and My Thoughts on It)

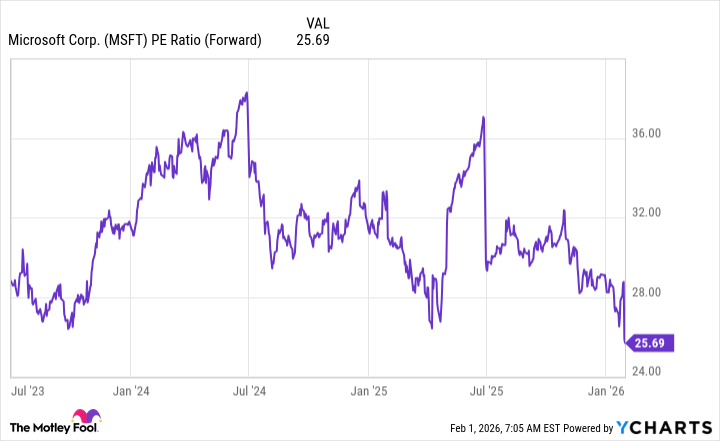

Valuing a stock is, let’s be honest, more art than science. When a company is growing at a reasonable pace, the usual P/E ratios feel… inadequate. It’s like trying to measure the ocean with a teaspoon. I prefer looking at forward earnings. It’s still imperfect – forecasting is, after all, a form of optimistic delusion – but it feels more relevant for a company like Microsoft. And right now? It’s trading at its cheapest level in three years. Which, for a company that isn’t exactly on the brink of collapse, feels…odd.

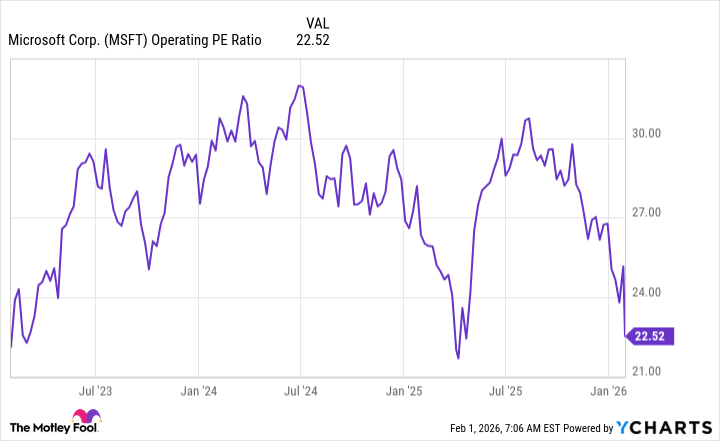

Historically, whenever Microsoft has traded at these levels, the stock has bounced back. Rather quickly, actually. Which is encouraging. Though, of course, past performance isn’t a guarantee of future results. The universe has a frustrating habit of ignoring what we want to happen. I also looked at price-to-operating profits. Earnings per share are a bit skewed by the OpenAI investment, which is…a lot of money. Even using that metric, it’s still looking pretty good.

At its peak, Microsoft was trading at around 35 times forward earnings, or 30 times operating profits. That suggests a potential upside of nearly 50 percent if things return to normal. Which, let’s face it, is a big “if.” But still, it’s a comforting thought. Like having a backup plan for your backup plan.

The Sell-Off: A Mystery (and My Attempt to Solve It)

The really puzzling thing is why the stock sold off in the first place. There has to be a reason, right? A perfectly logical explanation for a ten percent drop? I’ve been digging through the earnings reports, and honestly, I can’t find it. It’s like searching for a missing sock in a black hole.

Revenue was up 17 percent year-over-year to $81.3 billion. Management had guided for $79.5 to $80.6 billion, so they actually beat expectations. Which, you’d think, would be a good thing.

Two out of three segments outperformed guidance. The one that didn’t was “more personal computing,” which is always a bit unpredictable. It’s also the smallest segment, so most investors aren’t losing sleep over it. The important thing is Azure, Microsoft’s cloud platform. It delivered incredible results, growing revenue by 39 percent year-over-year. This is key, because Azure is a leading indicator of AI spending. As long as Azure is doing well, it suggests that the AI build-out is still on track. Which is…reassuring.

Honestly, I can’t see any major red flags. So, I’m cautiously optimistic. Since 2020, Microsoft’s stock has sold off by more than 20 percent four times. Each time, it proved to be an excellent buying opportunity. So, I’m going to follow that pattern. And hope for the best.

Number of times I’ve checked the stock price today: Too many to count. Number of grey hairs acquired: Significant. Will become disciplined long-term investor: Probably not. But I’m buying more MSFT anyway.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-04 21:33