Investing, in its purest form, is a dialogue between patience and profit. Yet too often, the clamor for growth drowns the quiet virtue of compounding income. Enter MPLX, a midstream energy entity that has, with unassuming persistence, outpaced the S&P 500 by nearly double over five years. Its 7.6% dividend yield is not a flourish of generosity, but a testament to its mastery of a system that rewards the steadfast over the speculative.

The Alchemy of Midstream

The energy sector, a tripartite beast-upstream, midstream, downstream-has long been the domain of titans. MPLX, however, occupies the shadowed corridor between extraction and consumption. It is the unseen hand that stores, processes, and transports the lifeblood of modernity: oil, gas, and their byproducts. To call it “midstream” is to invoke a metaphor of rivers and canals, of quiet infrastructure that sustains the industrial machine while evading the spotlight.

Marathon Petroleum, its progenitor, birthed this entity not for glory, but for utility. With pipelines like veins and processing plants as sentinels, MPLX claims dominion over 10% of U.S. natural gas. It is a kingdom of valves and tanks, where the true wealth lies not in headlines but in the unbroken flow of distributable cash.

The Tax-Evading Oligarch

MPLX is no mere corporation; it is a master limited partnership, a structure that dodges the corporate tax beast by passing profits directly to shareholders. This is not a triumph of morality, but of arithmetic. By sidestepping the taxman, it channels more of its marrow into dividends-a balm for income-starved investors, though one laced with the bureaucratic thorn of Schedule K-1 filings.

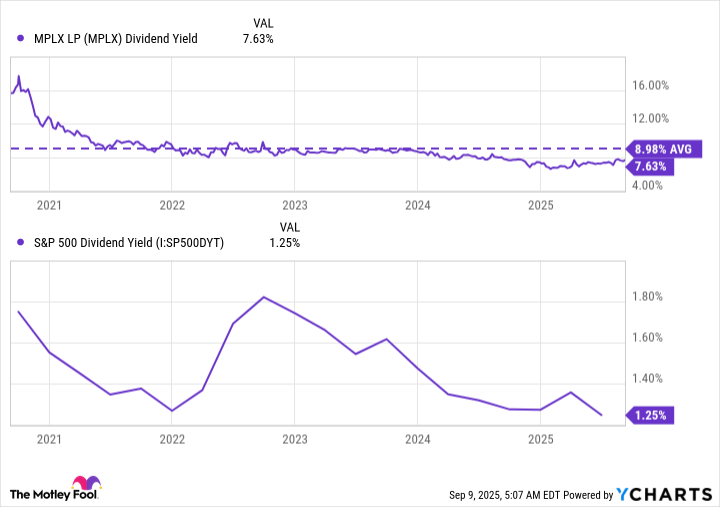

Its dividend yield, now 7.6%, has wandered below its five-year 9% average. Yet it remains a towering obelisk compared to the S&P 500’s paltry offerings. The yield is not a promise, but a performance-a dance with distributable cash flow (DCF), which has crept upward at 6.9% annually since 2021. A modest crescendo, but one that whispers of endurance.

The Arithmetic of Survival

MPLX’s revenue, $3 billion in Q2, may seem a mere ripple in the energy ocean. Yet its adjusted EBITDA, up 5% year-over-year, tells a subtler story. The company’s lifeblood is not in explosive growth but in the steadfastness of long-term contracts-pacts that bind it to a steady, if unglamorous, cash flow. For value investors, this is not a drawback, but a virtue: predictability in a world of chaos.

Its DCF, $1.42 billion in Q2, grew a mere 1% year-over-year. Yet from this, it managed to raise distributions from $0.85 to $0.96 per share. It is a calculus of restraint, where every dollar is measured, saved, and returned. The company is not a spender, but a steward-a role it plays with the solemnity of a monk.

The Moral Quandary of Yield

High dividends are a siren song, luring investors with the promise of passive wealth. Yet too often, they mask a yield trap-a mirage that evaporates when cash flows falter. MPLX, however, stands apart. Its yield is not a gamble, but a covenant forged in the fires of midstream discipline. It is a company that grows not through the reckless acquisition of dreams, but through the patient absorption of assets-like its $2.375 billion purchase of Northwind Midstream, a move that triples its capacity by 2026.

This is the paradox of MPLX: it is neither a growth stock nor a speculative play. It is a relic of an older ethos, where value was measured in the weight of dividends and the durability of infrastructure. For those who bristle at the chaos of modern markets, it is a refuge-a fortress of cash flow in a world of vaporware.

If you are prepared to navigate the labyrinth of K-1 forms and embrace the quiet labor of midstream, MPLX offers a path not to wealth, but to dignity. It is a reminder that in investing, as in life, the most enduring victories are often the least celebrated. 🌟

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-12 17:11