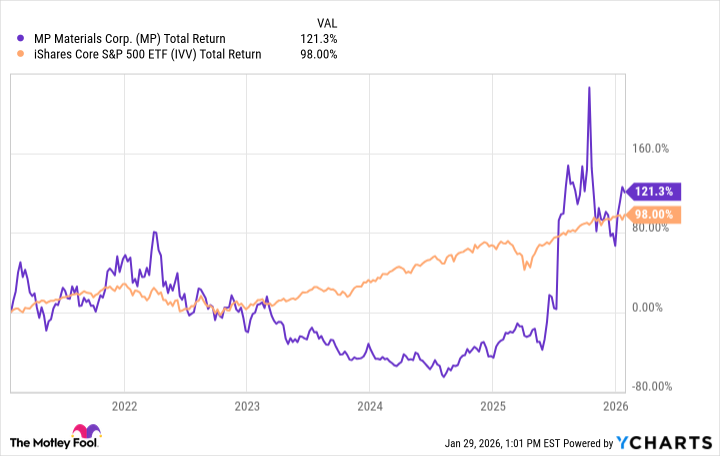

So, as of January 29th, 2026, MP Materials is, against all odds, beating the S&P 500. A little less than 11% gain for them, a meager 1% for the index. It feels…wrong. Like a particularly polite dog winning a fight. Last year, the difference was even more jarring. The S&P crawled up 18%, while MP Materials practically launched itself forward with a 224% gain. My brother-in-law, bless his heart, invested heavily. He’s now insufferable, constantly explaining rare-earth elements to anyone within earshot. It’s exhausting.

Over five years, an investment in MP would have outperformed the S&P 500. Charts, naturally, are involved. I’m not a visual person. I find them…judgmental. Like they’re silently accusing me of not understanding basic finance. Which, let’s be honest, is often true.

What’s driving this, this unlikely success? Well, the U.S. has a bit of a rare-earth problem. We’re embarrassingly reliant on China for processing and, crucially, for the magnets that make everything from electric car motors to defense systems function. It’s a geopolitical tightrope walk, and frankly, I find it stressful just thinking about it. Our government, predictably, is in a bind. They need these magnets, but relations with China are…complicated. It’s like trying to borrow a cup of sugar from someone you’re actively feuding with.

This is where MP Materials comes in. They control the Mountain Pass mine in California, which is apparently brimming with rare-earth elements. They’re trying to become fully integrated – digging up the ore, processing it, and actually making the magnets. It’s ambitious. I admire ambition, especially when it involves things I don’t understand. It’s like watching someone attempt to build a ship in their backyard. You know it’s probably not going to work, but you can’t look away.

Last year, things really started to heat up. A $400 million deal with the Department of Defense, followed by a $500 million agreement with Apple to provide recycled magnets for their devices. Apple! That’s…significant. It’s like getting a personal endorsement from a very stylish, very wealthy aunt. It shifted MP from a simple mining operation to something…more. Their magnetics revenue was practically nonexistent in 2024, but last quarter it was around $21.9 million. Progress, I suppose.

The problem, as I see it, is scaling. They’re building a magnet factory in Fort Worth, but it’s not exactly operational yet. They’re newcomers to this whole magnet-making business, and it’s unlikely they’ll eliminate our dependence on China anytime soon. It’s a long game, and I’m not sure if they have the stamina. I once tried to knit a scarf. It took three months, and it looked like a cat had attacked it. Scaling is hard.

Can MP Beat the Market in 2026?

It’s possible. They have backing from the government and Apple. That’s a pretty good start. But they need to prove they can actually churn out magnets at scale. The Fort Worth facility is almost ready, and they’re planning a second, even bigger factory. If they can get both of those running smoothly, revenue could really take off. It’s a big ‘if,’ though.

The demand for high-performance magnets is clear, and there’s strong national support for rebuilding domestic supply chains. That makes MP Materials a potentially solid long-term holding. I’m not saying it’s a sure thing. Nothing ever is. But it’s certainly more interesting than my brother-in-law’s endless lectures on neodymium. And frankly, that’s enough for me.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-02-01 00:12