As a seasoned financial analyst with extensive experience in Wall Street, I believe Morgan Stanley’s decision to allow its brokers to actively recommend Bitcoin ETFs to clients represents a pivotal moment for the industry. This shift comes in response to the surging demand for these investment products and the recent SEC approval of 11 spot Bitcoin ETFs, which have collectively amassed an impressive $12.3 billion in assets under management.

Morgan Stanley, a prominent financial institution based on Wall Street, intends to grant its 15,000 brokers the authority to propose Bitcoin exchange-traded funds (ETFs) to their clients, as per a report in CoinDesk, which cites AdvisorHub. This move signifies a substantial change from Morgan Stanley’s earlier stance, permitting brokers to process Bitcoin ETF transactions solely when clients initiated the request.

In reaction to increasing interest in Bitcoin spot Exchange-Traded Funds (ETFs), Morgan Stanley executives anticipate these investments will draw more resources. These ETFs offer a simpler and less risky way for investors to enter the Bitcoin market compared to holding the digital currency directly.

I’ve observed an executive from Morgan Stanley expressing the carefulness of their approach in expanding their cryptocurrency offerings. They emphasized, “We’ll tread carefully with this…” and further explained, “We’re committed to ensuring that everyone has access to it. Our goal is to do so in a controlled manner.” This statement underscores their commitment to integrating more cryptocurrencies into their services while prioritizing informed decision-making for both their financial advisors and clients.

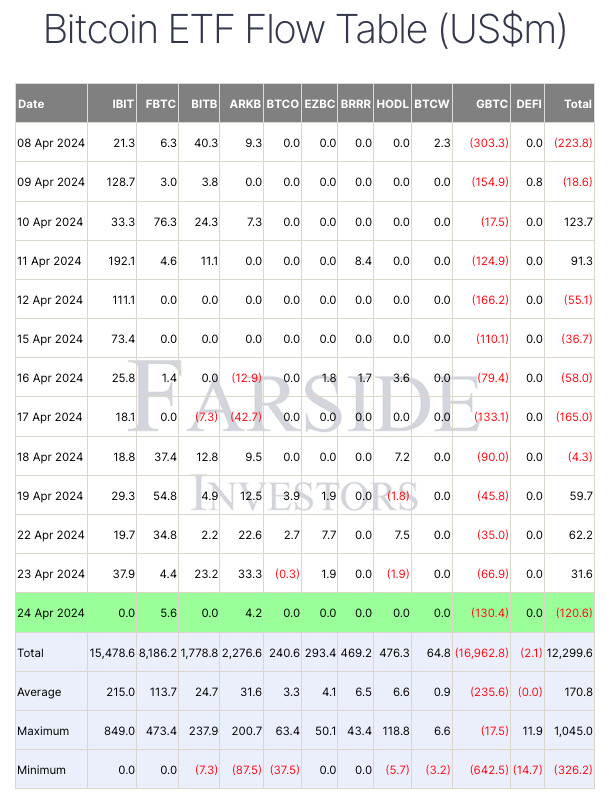

The SEC’s approval of 11 Bitcoin spot ETFs in January, including for firms like BlackRock, Fidelity, and Invesco, brought a wave of investments that boosted Bitcoin’s market standing. This influx of funds initially generated excitement, but more recent data shows it may be slowing down. For example, the BlackRock iShares Bitcoin Trust (IBIT) experienced no new investments on a specific day since the launch of these ETFs in the US on January 11, despite having previously attracted consistent investments and amassing over $15.5 billion within 71 days.

So far, in the United States, the Bitcoin ETF market has accumulated an impressive $12.3 billion worth of Bitcoin. This demonstrates the increasing enthusiasm and trust among investors in considering cryptocurrency as a worthwhile investment option.

As an observer, I can suggest that Morgan Stanley’s decision to allow its brokers to make direct recommendations for cryptocurrency investments may reinvigorate the influx of funds into this asset class. Furthermore, this move could deepen the integration of cryptocurrencies within mainstream investment portfolios.

Read More

2024-04-25 14:21