As a seasoned crypto investor with over a decade of experience under my belt, I find Morgan Stanley’s interest in offering crypto trading services through E-Trade to be a promising development for the industry. Having witnessed numerous regulatory hurdles and skepticism from traditional financial institutions, it is heartening to see a major player like Morgan Stanley stepping into the crypto arena.

The firm’s bullish stance on Bitcoin and its proactive approach towards crypto ETFs this year have been commendable. If they manage to offer direct crypto trading services, it would not only expand their service offerings but also provide a gateway for mainstream investors to explore digital assets more efficiently.

However, I must emphasize that this is still in the exploratory stage, and there are many unknowns at play. As an investor who’s been through multiple market cycles, I can attest that the crypto market can be quite volatile. It would be prudent for both Morgan Stanley and its potential clients to approach this new venture with caution and a well-diversified investment strategy.

Lastly, I find it amusing to imagine the reaction of some traditional finance purists when they learn about Morgan Stanley venturing into crypto trading. They might just need a moment to process the fact that their beloved ‘Bitcoin is just digital money’ has finally found a home in the hallowed halls of Wall Street!

As a researcher, I’m finding intriguing developments in the world of finance: E-Trade, a division of Morgan Stanley specializing in online brokerage, is contemplating entering the crypto trading market. At this point, it remains uncertain when these changes will materialize or how extensive they might be.

The company is contemplating a daring decision, largely influenced by Donald Trump’s recent victory in the elections and expectations of favorable cryptocurrency regulations during his term.

Morgan Stanley Wants a Share of the Lucrative Crypto Trading Market

Reports indicate that Morgan Stanley is keen on venturing into the cryptocurrency trading service market, considering the widespread acceptance of digital assets in various industries.

For some time now, the company has maintained an optimistic stance towards Bitcoin. However, its strategies this year have primarily involved indirect involvement with it. Should they proceed with the E-Trade proposal, it would signify a major step forward in their operations.

This year, Morgan Stanley has aggressively advocated for crypto Exchange-Traded Funds (ETFs), mobilizing a force of approximately 15,000 brokers to support their cause. As a result, wealth advisors at the firm have been able to incorporate Bitcoin ETFs into their offerings, and by October, they had committed close to $300 million in investments towards these funds.

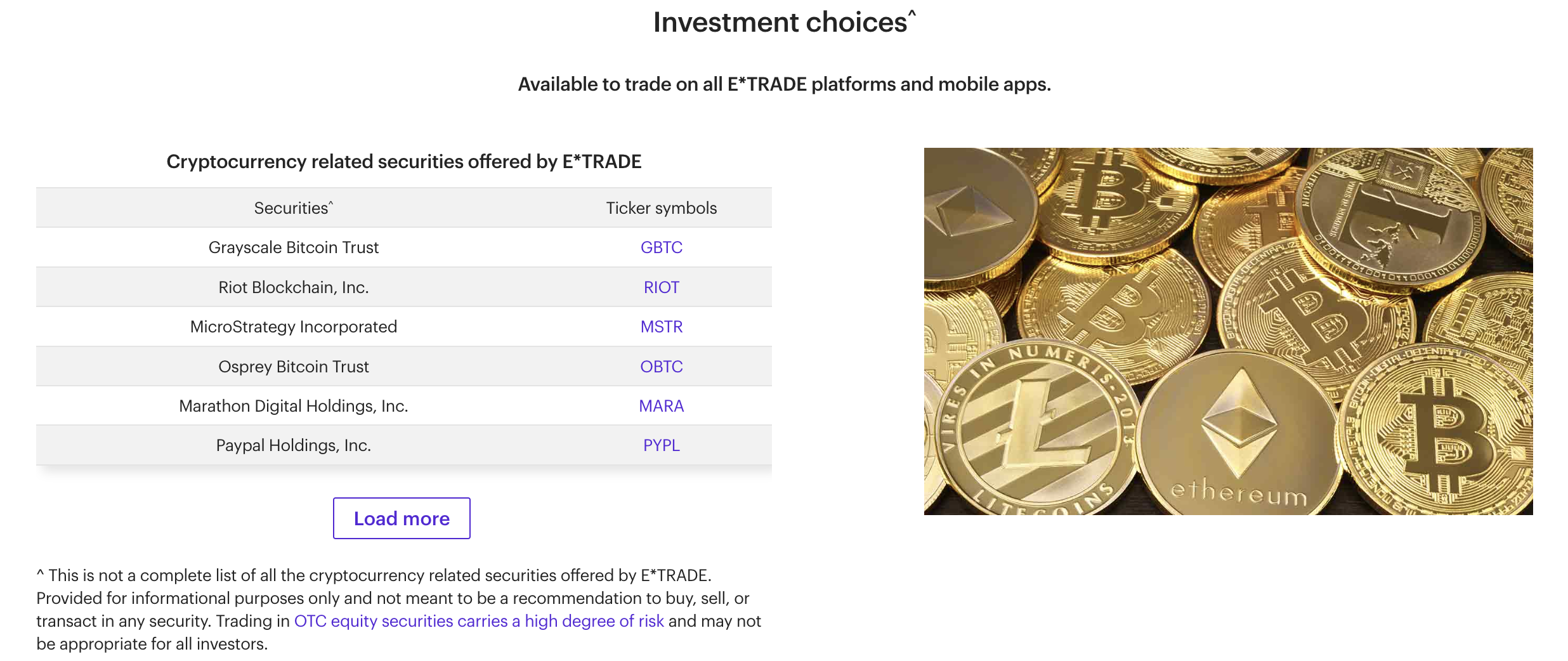

Currently, this plan remains at an early developmental phase, focusing on exploration rather than implementation. Notably, E-Trade’s investment selection suggests indirect involvement in cryptocurrency without direct ownership, as they market this kind of access. If approved, Morgan Stanley’s existing connection to crypto services would undergo a significant transformation.

It seems clear that the reason for this policy change originates from anticipation of favorable cryptocurrency regulations. Donald Trump’s election win sparked a bull market in the crypto industry, and E-Trade believes this momentum will continue with more positive developments under Trump’s administration. Trump has promised significant changes to crypto regulation, and E-Trade may stand to gain from these shifts.

Even though Morgan Stanley has plans to proceed with this idea, it’s important to note that these are initial steps. The company is merely examining the potential for direct cryptocurrency services, and it may require some time before they can solidify and execute the details.

Yet, with Trump’s presidency set to start within a few weeks, it could serve as a significant motivation for the initiation process.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-01-02 20:26