As a seasoned crypto investor with over a decade of experience under my belt, I can confidently say that November was a month to remember for privacy coins! The nullification of Tornado Cash sanctions sparked a resurgence of interest in this sector, and it was evident in the impressive gains recorded by the top five privacy coins. Monero, being the largest player in the game, didn’t disappoint with a 21% increase.

As an analyst, I observed a substantial increase in the price of Monero (XMR) during November. This growth appears to be connected to a robust month for privacy coins, as the lifting of sanctions on Tornado Cash may have sparked renewed interest in these types of cryptocurrencies.

The revived focus on this field led to increases in the leading privacy-focused cryptocurrencies, where Monero saw a surge of 21% and continued to lead as the most valuable privacy coin based on market capitalization.

November Was a Great Month For Privacy Coins

In November, privacy coins experienced significant growth due to the rescinding of sanctions against Tornado Cash, leading to renewed excitement within the sector.

All the leading privacy tokens experienced substantial increases, with DASH experiencing a notable jump of 167%, making it the front-runner. This rise underscores the growing investor trust in privacy-centric investments in response to recent regulatory adjustments.

Monero stands out as the leading privacy coin with a significant edge over others, and its value rose by approximately 21% in the past month. Its market capitalization surpasses the total worth of the top four other privacy coins on the market, solidifying its position as the dominant player in this sector.

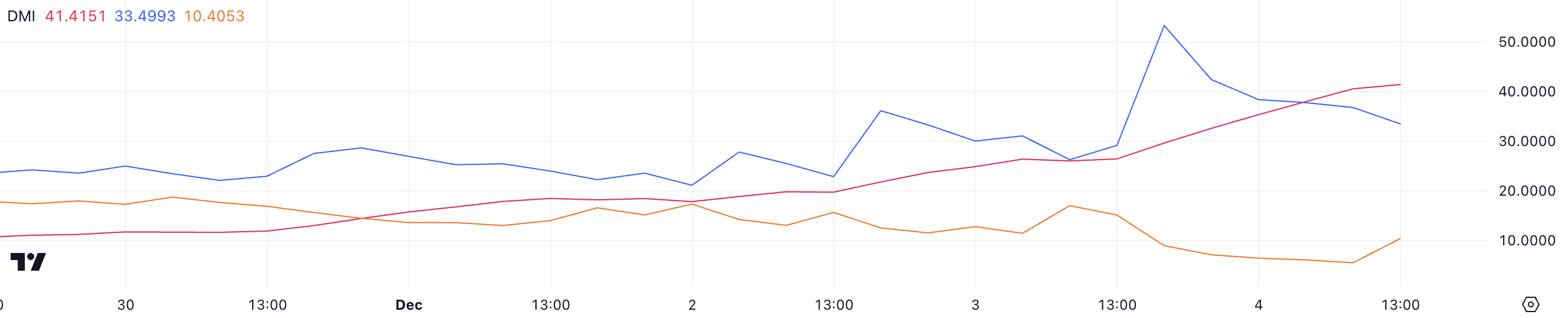

Monero DMI Shows The Current Uptrend Is Strong

The Monero DMI chart demonstrates a robust upward trajectory, with its ADX value surging to 41.4, significantly higher than yesterday’s 30 and placing Monero among the top performers in the altcoin market.

This substantial upward spike suggests that the force behind XMR’s ongoing trend has grown much stronger, mirroring a surge in market dynamism.

The Average Directional Index (ADX) is a tool that gauges the strength of market trends; values exceeding 25 signify a robust trend, while those below 25 imply a weak or volatile market. In terms of Monero (XMR), the DMI diagram demonstrates that the buying group holds a substantial edge over sellers, with D+ at 33.4 and D- at 10.

As an analyst, I’m noticing a shift in the market dynamics. The dip in D+ and the surge in D- indicates an increase in sellers’ activity, which might be a sign of growing selling pressure. If this trend persists, it could potentially dampen XMR’s bullish trend.

XMR Price Prediction: Can Monero Price Keep The Bullish Momentum?

Monero’s Exponential Moving Averages (EMA) continue to show a positive trend, as the shorter-term averages hover above the longer-term ones, and the price consistently stays above the short-term lines. This configuration implies that the present upward trend is being sustained, potentially indicating that it may persist further.

Should this upward trend continue, the Monero price might attempt to break through the $217 barrier and possibly climb as high as $220 or even $225 – values last witnessed in May 2022.

On the other hand, the DMI chart suggests a potential change in direction, which might lead the Monero (XMR) price to retest its closest robust support at approximately $166.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2024-12-05 00:37