As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of XRP. The past month has been a rollercoaster ride for this cryptocurrency, with its modest growth of 2.2% in the last 30 days. The golden cross earlier this month had me optimistic about potential bullish momentum, but the lack of whale accumulation is a cause for concern.

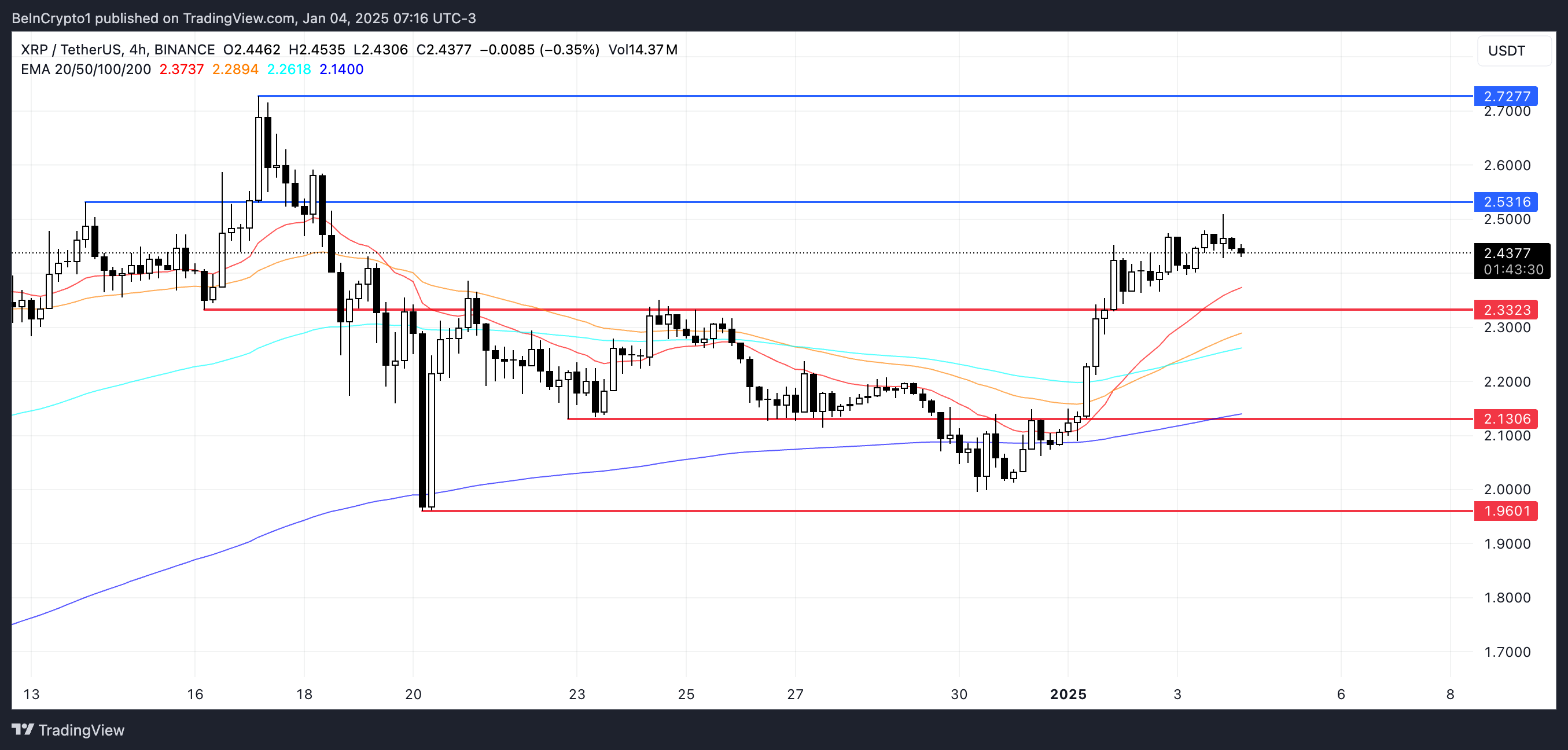

Tracking whale activity is crucial, and their recent decline suggests bearish sentiment among major investors. This shift could weigh on XRP price in the short term, especially if it fails to break above its $2.53 resistance or succumb to bearish pressures near its $2.33 support.

However, I find solace in the fact that the Chaikin Money Flow (CMF) remains positive, signaling ongoing buying pressure. The CMF’s recent peak reflects growing investor confidence and suggests that XRP is attracting interest from market participants. But as a wise man once said, “Markets can stay irrational longer than you can stay solvent,” so I’ll keep a close eye on the situation.

In terms of price prediction, if the support at $2.33 fails to hold, we could see a potential 19.6% correction. On the flip side, if the uptrend regains traction and XRP breaks above the $2.53 resistance, it could target $2.72 next.

And now for a little humor: Remember folks, in crypto, just when you think you’ve got it all figured out, it changes its mind! So keep your eyes peeled and your portfolio light on its feet. Happy trading!

Over the course of the past month, XRP’s price has been relatively stable, rising only about 2.2% in the last 30 days. Although a golden cross occurred earlier this month, which typically points to increasing bullish sentiment, large-scale investors (whales) seem to be holding back on accumulation, which could limit further price increases.

The Chaikin Money Flow (CMF) of XRP continues to show a positive trend, indicating persistent buying activity, but it has somewhat decreased from its highest point recently. This implies that the direction of XRP might be determined by whether it manages to surpass the $2.53 resistance or experiences downward pressure close to its $2.33 support level.

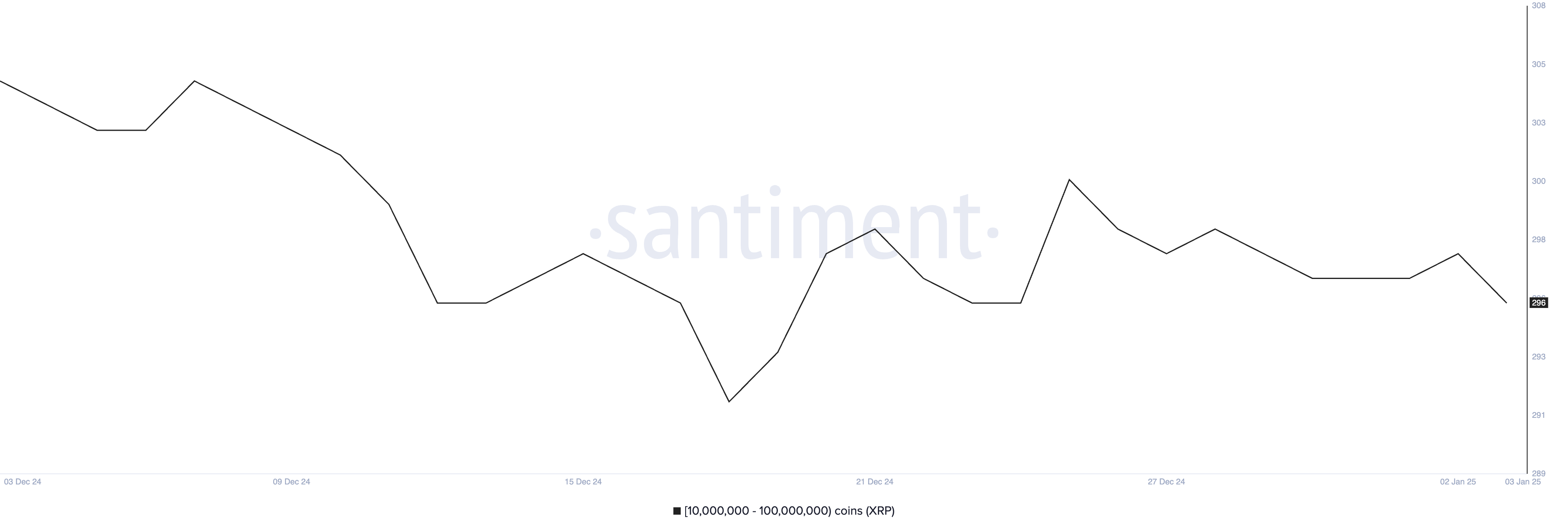

XRP Whales Pause Accumulation

The count of significant XRP investors holding between 10 and 100 million XRP has dropped to an all-time low of 296 since December 24. Following a peak of 301 on December 25, the number of these substantial holders has been gradually decreasing.

This notable change indicates a reduction in the number of active whales, since they peaked at 305 on December 7, which corresponds to when the value of XRP surpassed $2.50.

Monitoring whale behavior is essential as these substantial investors can substantially impact the market trends. When they amass a particular coin, it usually signifies optimism and could boost prices. Conversely, a decrease in their holdings might suggest selling pressure or decreased enthusiasm, which could potentially lower prices.

Lately, the decrease in whale population indicates that significant investors are pessimistic, which might negatively impact the cost of XRP temporarily. If the behavior of these large investors doesn’t improve or starts showing signs of buying more (accumulation), it could be challenging for XRP to regain its upward trend.

XRP CMF Reached Its Highest Level in a Month

The XRP Chaikin Money Flow (CMF) stands at 0.28 and has remained positive since January 1st, when it was close to 0. The CMF has been on an upward trajectory in the new year, indicating a rise in capital inflows as buying pressure surpasses selling pressure, suggesting optimism among investors.

The increasing favorable sentiment towards XRP indicates a rise in investor trust and implies that this digital asset is gaining attention from market players.

As a researcher, I’m examining the Cumulative Moving Average (CMF) of XRP, which is an indicator that quantifies the flow of money into and out of this asset by considering price and volume fluctuations. A CMF value greater than zero indicates a net buying pressure, while a value less than zero points to a net selling pressure. Just now, the CMF for XRP reached a high of 0.33 and has since dipped slightly to 0.28. However, it’s essential to note that it continues to show positive territory.

Based on my years of trading experience, I have observed that when a momentum slightly cools down in a market, it doesn’t necessarily mean the overall trend is about to reverse. Instead, it might signal a period of price stability or moderate gains in the short term. This phenomenon has been consistent across various markets and asset classes, including equities, forex, and commodities. However, if the Chaikin Money Flow (CMF) continues to decline, it could be a warning sign that the market may experience some turbulence in the near future. Therefore, I would advise staying cautious and keeping a close eye on the CMF indicator while remaining patient for potential opportunities.

XRP Price Prediction: A Potential 19.6% Correction

At present, the value of XRP is moving within a narrow band, with the upper limit at approximately $2.53 and the lower limit around $2.33. A technical pattern called a ‘golden cross’ that emerged on January 1 has propelled a recent upward price trend, suggesting robust bullish energy.

On the other hand, signs such as decreased whale hoarding and a minor decrease in the Cumulative Market Value indicate that the existing upward trend might be weakening.

If the $2.33 resistance isn’t strong enough, there might be an influx of sellers causing XRP’s price to decrease, potentially reaching $2.13. Dropping below this point could lead to additional declines towards $1.96, indicating a possible 19.6% fall in value.

If the upward trend gains momentum again and XRP’s price manages to surpass the resistance at $2.53, it might aim for $2.72 next, potentially providing a 10.6% increase in value.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2025-01-04 21:37