The universe, as anyone who’s briefly considered it will tell you, is a profoundly illogical place. Commodity prices, particularly those involving things dug out of the earth – copper and lithium, in this instance – operate on a similar principle. Predicting where they’re heading is, let’s say, optimistic. Still, assuming current prices are the best estimate of where they’ll be in a year or so (a rather bold assumption, admittedly, but one we’ll run with), both Freeport-McMoRan (FCX +2.86%) and Albemarle (ALB 0.18%) appear to be… well, not entirely devoid of potential. Which, in the grand scheme of things, is a remarkably positive outcome. Here’s a preliminary assessment.

Freeport-McMoRan and the Curious Case of Copper

The core idea here is simple: these stocks may have more to gain than to lose. A concept, it should be noted, that applies to most things, provided you’re sufficiently vague. Freeport-McMoRan, specifically, looks interesting for three reasons. First, the company helpfully provides projections of its earnings before interest, taxes, depreciation, and amortization (EBITDA) based on various copper prices. It’s like a weather forecast for money, only slightly more reliable. Their latest update suggests $11 billion EBITDA at $4/pound of copper, escalating to $19 billion at $6/pound. Given the current price of $5.66, a rough calculation (involving numbers, which are, frankly, a bit of a nuisance) suggests around $17.6 billion. Assuming an enterprise value (EV) of $96.9 billion, that puts Freeport trading on an EV/EBITDA multiple of a mere 5.5 times in 2027 – a historically favorable valuation. It’s as if someone accidentally left a rather large discount sticker on it.

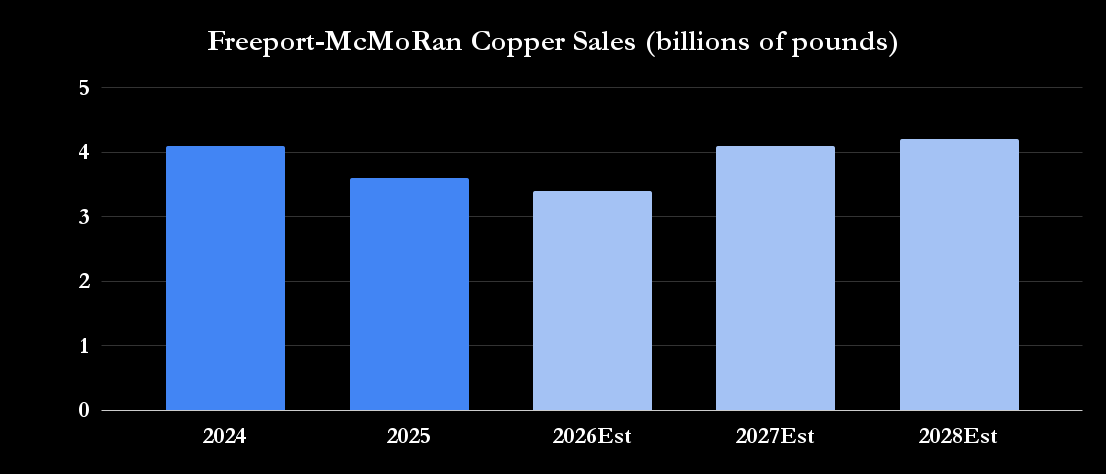

Second, Freeport is poised to increase production in Indonesia over the next few years, following a… let’s call it an “unfortunate incident” last year. (One hopes the incident didn’t involve sentient mining equipment. The paperwork would be appalling.)

Third, the company’s leaching initiative – a remarkably cost-effective method of extracting copper from existing stockpiles – continues to gain traction. Management is conservatively estimating 250-300 million pounds of copper recovery by 2026, but, crucially, hasn’t factored in the additional 400 million pounds expected in 2027, or anything beyond that, as they ramp up to 800 million pounds by 2030. This suggests a potential upside for copper sales volumes, and given the already attractive valuation, Freeport appears to be a reasonably sensible purchase for investors comfortable with the inherent unpredictability of copper. (Which, let’s be honest, is everyone, deep down.)

Albemarle and the Lithium Rollercoaster

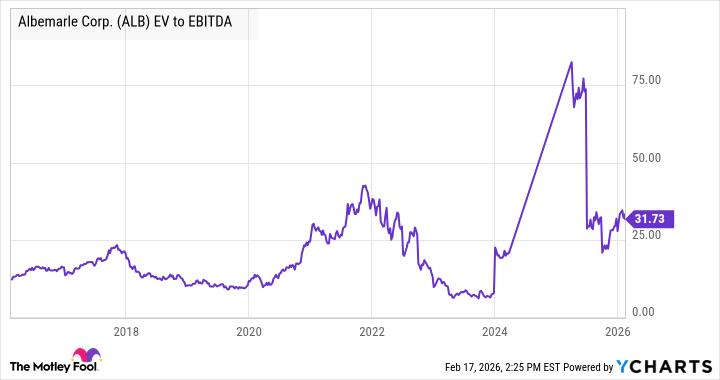

A significant drop in lithium prices, triggered by a somewhat overenthusiastic surge in electric vehicle investment followed by a period of… readjustment, led to a noticeable decline in Albemarle’s earnings starting in 2022. Consequently, the company experienced some… accounting challenges in 2024 and 2025. However, management, rather than panicking (which, admittedly, would be perfectly understandable), divested non-core businesses, implemented cost-cutting measures, and is now positioned to benefit from the recent, albeit tentative, price recovery.

Like Freeport, Albemarle’s valuation appears appealing given current lithium prices. In January, the average price of lithium carbonate equivalent (LCE) was $20 per kg. If this holds through 2026 (a big “if,” admittedly, but we’re optimists here), Albemarle could generate $2.4-2.6 billion in EBITDA. With a current EV of $23.5 billion, this translates to an EV/EBITDA ratio of 9.4 for 2026. It’s not quite giving money away, but it’s approaching the territory of “reasonable.”

Furthermore, the lithium supply glut appears to be easing, while electric vehicle investment is growing globally, and demand from battery energy storage systems (BESS) is surging. All of this points to a stock with a reasonable amount of upside potential in 2026. (Disclaimer: “Reasonable” is a relative term. The universe remains fundamentally irrational.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-22 00:12