Many years later, as the last of the hummingbirds abandoned the jacaranda trees, old Mateo would recall the feverish promises of flight, whispered on the humid air of Georgia. He remembered the scent of damp earth clinging to the concrete of the Archer Aviation facility, a scent that tasted of both ambition and the inevitable dust of forgotten dreams. It was said that the machines themselves dreamed of escaping gravity, of joining the migrating birds, but their dreams, like so many human endeavors, were tethered to the cold logic of profit and loss. The year was not yet fully formed, but the echoes of unfulfilled projections already resonated within the steel skeletons of the hangars.

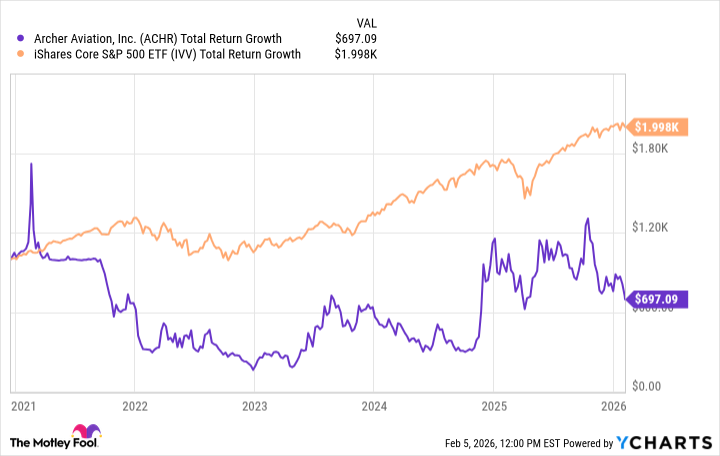

Archer Aviation, they called it. A name that suggested a swiftness, a grace, that seemed to mock the laborious process of bringing a novel aircraft into being. They spoke of Midnight, a vessel intended to liberate the city dweller from the tyranny of traffic, to carry them aloft on currents of electricity. A beautiful vision, certainly, but one that had already begun to fray at the edges, like a handwoven tapestry exposed to the relentless sun. Seven years they had labored, building not just a machine, but a legend, a story told in balance sheets and regulatory filings. And yet, the stock, that fickle barometer of hope, had offered a meager return to those who had dared to believe, a 35% decline from the initial offering price of $10. The S&P 500, that stoic giant, had doubled its value in the same span, a silent rebuke to the more audacious venture.

The shares now hover around $6.50, valuing the company at a substantial $4.25 billion. A curious valuation, given that the sky remains stubbornly devoid of Midnight’s promised fleet. The question, then, is not merely whether to buy, but whether to participate in a collective act of faith, a gamble on a future that may never arrive. The optimists speak of backing from titans – United Airlines, Stellantis, Boeing – partnerships forged in the fires of mutual self-interest. They cite a $6 billion backlog, a mountain of pre-orders that shimmer like a mirage. And they whisper of $1.6 billion in cash, a comforting weight in a world of uncertainty.

The Illusion of Progress

Archer claims to be navigating the labyrinthine corridors of the FAA certification process, inching closer to the elusive Type Certification that would allow them to carry passengers. There is talk of White House initiatives, of a concerted effort to accelerate the adoption of eVTOL technology. The CEO, Adam Goldstein, even dared to suggest that flights could begin this summer, a pronouncement that hung in the air like the scent of ozone before a storm. They were also designated the official air taxi provider for the LA 2028 Olympic Games, a symbolic victory that felt strangely detached from the practical realities of engineering and economics.

But one must remember that promises, like the jacaranda blossoms, are fleeting. In February of 2021, Archer boldly predicted FAA certification in 2024 and free cash flow breakeven in 2025. Those dates have passed, swallowed by the relentless march of time. The truth is, eVTOLs remain a realm of unknowns, a landscape shrouded in speculation. No one can say with certainty how much revenue each aircraft will generate, how much it will cost to build and operate, or whether the public will embrace this new mode of transportation. The price of flight, after all, is not merely measured in dollars and cents, but in the willingness to relinquish the familiar comfort of the ground.

Success, therefore, will depend not just on reaching the sky, but on scaling production while maintaining a delicate balance between cost and control. It will require a level of operational efficiency that has eluded many a more established enterprise. And it will demand a healthy dose of luck, for the forces of fate are often as powerful as any engineering feat.

To buy Archer below $10 is not to guarantee riches, but to place a bet on a dream. It is a speculative play on an industry that exists more in the realm of imagination than in the concrete world of commerce. Those with an appetite for risk may proceed, but they would do well to size their positions with the same caution that a seasoned gambler reserves for a particularly treacherous game. For in the end, the sky is a vast and unforgiving expanse, and the dreams of flight are often weighed down by the gravity of reality.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-09 20:02