As a seasoned crypto investor with a keen eye for global economic trends and a knack for navigating turbulent geopolitical waters, I find myself at a crossroads amidst the escalating tensions in the Middle East. The potential oil supply disruptions looming on the horizon have me more than just a little concerned.

With tensions escalating in the Middle East, there’s increasing anxiety about the possible economic fallout, particularly the possibility of a significant interruption to the worldwide oil supply, according to Peter S. Goodman in an article for The New York Times (NYT). Israel is readying its reaction to last week’s missile attacks from Iran, and the specter of a broader conflict has stoked worries about a surge in oil prices. Such an event could lead to a steep rise in gasoline, fuel, and other oil-derived product costs, with potentially severe implications for global economies, particularly those reliant on imported oil, as suggested by the NYT report.

According to the New York Times, an Israeli attack on Iran’s oil facilities might provoke counterattacks against significant refineries in Saudi Arabia and the United Arab Emirates. Additionally, there’s a possibility that Iran may cut off oil tankers from passing through the Strait of Hormuz, a key waterway responsible for transporting about one-third of the world’s oil. Although these scenarios seem improbable, the current rise in tensions has broadened the spectrum of potential events.

The NYT article highlights that the economic effects may go beyond just oil costs. In recent times, central banks in the U.S. and Europe have been lowering interest rates to combat inflation, a strategy intended to stimulate investment, employment, and overall economic expansion. However, an oil supply disruption could undo this progress, leading to renewed inflation, decreased investments, and slowed growth. This predicament would be especially challenging for energy-reliant nations, with impoverished African countries, currently battling debt crises, possibly experiencing the harshest repercussions.

Additionally, it’s worth noting that China and Europe are equally susceptible to sudden increases in oil prices. China buys over 90% of Iran’s oil exports and heavily depends on imported energy sources. On the other hand, Europe is still grappling with the aftermath of reduced Russian oil supplies due to the Ukraine conflict. A substantial rise in oil prices could potentially trigger stagflation in Europe, a condition characterized by rising inflation rates coupled with economic stagnation.

According to a New York Times article, an increase in oil prices may have far-reaching political effects on Russia. This rise in oil prices might give Russia additional financial resources, which they could use to prolong their military activities in Ukraine. Moreover, some of this extra money might be used to aid their ally Iran, potentially making it harder for Israel to take military action without risking higher oil prices. If Israel’s actions result in increased oil prices, they may unintentionally strengthen both Iran and Russia, adding complexity to the international situation.

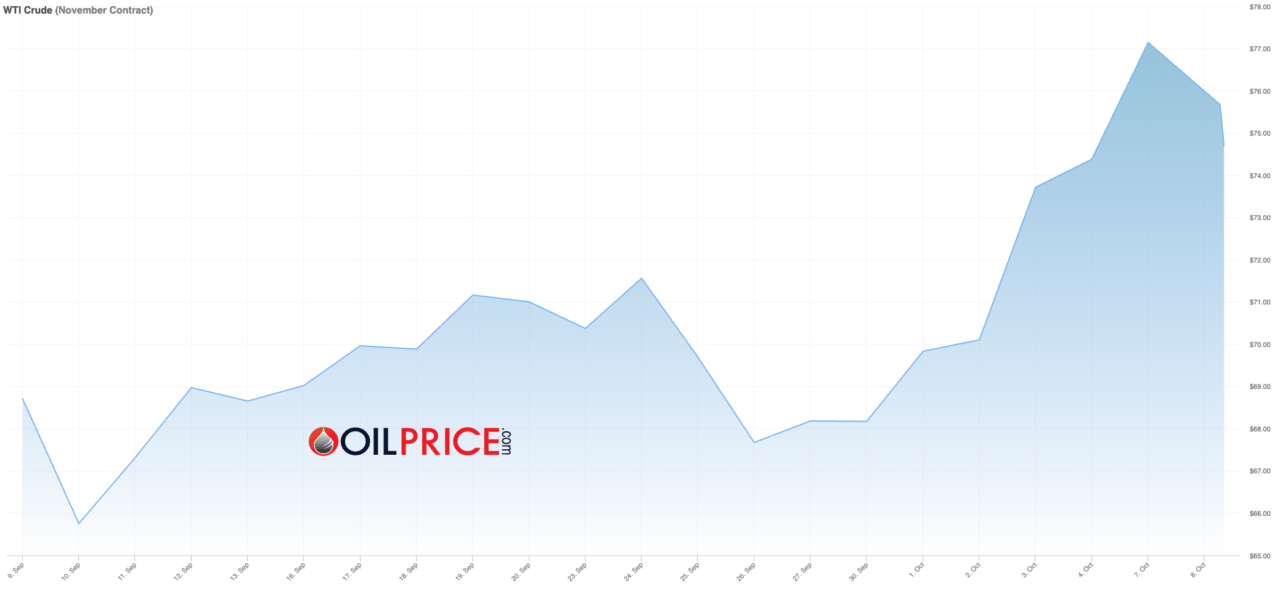

On Tuesday, as reported by CNBC, the price of crude oil futures dropped around 2%, as the upward trend driven by geopolitics took a pause while investors waited for Israel’s reaction towards Iran.

The CNBC report continues by explaining that investor confidence decreased when Chinese officials did not introduce new stimulus plans during a Tuesday press conference, as was expected. Prior to the escalation of conflict in the Middle East, markets had been affected by pessimistic outlooks, primarily because of reduced demand in China, the world’s biggest consumer of crude oil. Worries about oil production possibly outpacing consumption in 2025 had driven oil prices down to their lowest levels since December 2021 earlier this September.

Phil Flynn, an analyst at Price Futures Group, pointed out that oil prices took a slight step back following yesterday’s increase, partially because China did not announce any fresh economic stimulus measures.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-10-08 16:56