One observes, with a certain weariness, the relentless obsession with the S&P 500. Everyone insists it is the market, naturally. And when one attempts to suggest a broader view, the conversation inevitably devolves into a tiresome debate about large versus small capitalizations. Mid-caps, poor dears, are usually left quite out in the cold.

It seems rather illogical, doesn’t it? These companies, not yet the lumbering behemoths of the large-cap world, yet demonstrably more established than the perpetually precarious small-caps, possess a certain… potential. A dash of growth, a soupçon of stability. One might even call it a happy medium, if one were feeling particularly vulgar.

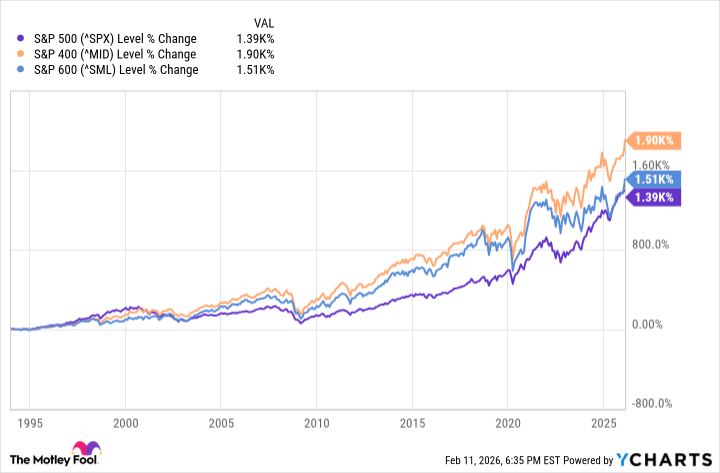

And, as it happens, the data supports this rather sensible notion. Over the past thirty-odd years – a blink of an eye in the grand scheme, but long enough to be mildly interesting – the S&P 400 MidCap index has, quite decisively, outperformed both its larger and smaller brethren. A fact which, one suspects, is largely ignored by those who prefer a simpler narrative.

Therefore, one is compelled to suggest that mid-caps warrant a place in any reasonably constructed portfolio. They offer a welcome opportunity to enhance returns and, crucially, to introduce a degree of diversification. Something, one might add, that is sorely lacking in many of the portfolios one encounters.

The Vanguard Mid-Cap ETF: A Modestly Intelligent Choice

My current preference, if pressed, falls upon the Vanguard Mid-Cap ETF. Not, naturally, because one is particularly enamoured of Vanguard – though their cost efficiency is, admittedly, rather commendable – but because of its construction. It strikes me as… less arbitrary than some of its competitors.

This ETF tracks the CRSP U.S. Mid Cap Index, which is a point of some significance. It defines mid-cap stocks differently than the methodology employed for the S&P 400. The CRSP index measures performance based on a company’s position within the 70%-85% market capitalization range of the investable universe. A rather inclusive approach, wouldn’t you agree? It simply includes all companies that fall within that range, without unnecessary complications.

The S&P 400, by contrast, is subject to the whims of a committee. Some companies, perfectly capable of meeting the market cap requirements, are inexplicably excluded. It also targets a fixed number of components – 400, naturally – which seems rather… contrived. And, most irritatingly, it applies a profitability screen. As if one could reliably predict future performance based on the previous quarter’s earnings. The height of folly, really.

The result? The portfolios of these ostensibly similar mid-cap ETFs can differ quite substantially. I, for one, prefer the Vanguard Mid-Cap ETF’s more comprehensive coverage. A wider net, you see, is more likely to catch something worthwhile.

A Sectoral Composition Worth Considering

Most investors are, of course, aware that the S&P 500 is heavily weighted towards technology – and, specifically, the so-called “Magnificent Seven.” The mid-cap market, however, presents a rather different picture. It’s more broadly diversified across multiple sectors and, crucially, more exposed to cyclically sensitive areas of the economy.

The Vanguard Mid-Cap ETF’s top holdings include Industrials (19.7%), Consumer Discretionary (15.5%), Financials (13.8%), Technology (13.3%), and Utilities (8.9%). A considerably more balanced mix than one finds in the S&P 500, where technology accounts for nearly 35% of the index.

Furthermore, mid-caps are more closely tied to the health of the U.S. economy and interest rates. Technology, of course, is also affected by these factors, but it’s also susceptible to the whims of fashion and the hype surrounding the latest technological marvel. The recent artificial intelligence boom, for example, has driven up tech stock prices on hope as much as on results. A rather precarious foundation, wouldn’t you agree?

Industrials, Financials, and Consumer Discretionary, on the other hand, are more directly linked to manufacturing, consumer spending, and interest rates. A different set of influences, which actually strengthens the case for mid-caps as a diversifier.

And, as a final, rather pleasing observation, mid-caps are generally less expensive than large-caps. The Vanguard Mid-Cap ETF’s price/earnings ratio is currently around 23, compared to 28 for the Vanguard S&P 500 ETF. A modest advantage, perhaps, but one appreciates a bargain when one encounters it.

A Touch of Sensibility for Your Portfolio

Mid-caps have demonstrably outperformed large-caps over the long term, but that’s not the whole story. They offer a different risk/return profile, a different sectoral composition, and a different level of value. That’s what one should be looking for when constructing a balanced portfolio: assets that behave differently, perform differently, and look different. Assets that reduce overall risk when paired together.

The Vanguard Mid-Cap ETF fulfills that role admirably for equity investors. Given the current market conditions, it might be exactly what they need. A touch of sensibility, a dash of diversification, and a rather pleasing opportunity to outperform. One can but hope.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-02-17 22:53