The winds of change whisper through the halls of finance, carrying tales of a peculiar firm named Strategy. With Q2 profits and unrealized gains enough to make a gold-digger blush, it’s now in the running for the S&P 500-a prize worth $16 billion in stock sales. But will the old guard let it in? 🤔

Meanwhile, Nasdaq, the gatekeeper of tradition, has thrown its weight around like a bull in a china shop, scrutinizing digital asset treasury firms. Strategy’s stock took a tumble, as if mocked by the very institutions it hopes to charm. Tradition, it seems, is a stubborn beast. 🐂

Strategy On the S&P 500?

Strategy, once a punchline in boardrooms, has been basking in legal victories and a $450 million BTC splurge. It’s riding high, like a cowboy who just won the rodeo. But the S&P 500 is no rodeo-it’s a velvet-rope club, and the bouncer is picky. 🤵

Bloomberg, that sage of the financial world, claims Strategy’s Q2 2025 report is a blockbuster: $10 billion in revenue and $14 billion in gains. Numbers like these could buy a small island-or at least silence a few skeptics. Still, the S&P Committee isn’t just a calculator; it’s a jury of gatekeepers with a penchant for drama. 🎭

Could they greenlight it? Well, they’ve already let Coinbase and Block Inc. in, so maybe they’re feeling generous. Melissa Roberts of Stephens says Strategy is the “big kahuna” of Web3, and even a stubborn committee can’t ignore a whale. 🐋

“They want to build an industry group, not just a list,” Roberts said, as if explaining why a bear might hibernate. “If you’re the biggest fish in the pond, you get noticed-even if the pond smells like crypto.”

If Strategy slides into the S&P 500, passive funds will dump $16 billion on its shares. That’s not just a windfall-it’s a hurricane. And unlike their BTC buys, this won’t dilute shareholders like a leaky sieve. A win for Strategy, a punch in the gut for traditionalists. 🥊

A Bad Sign from Nasdaq

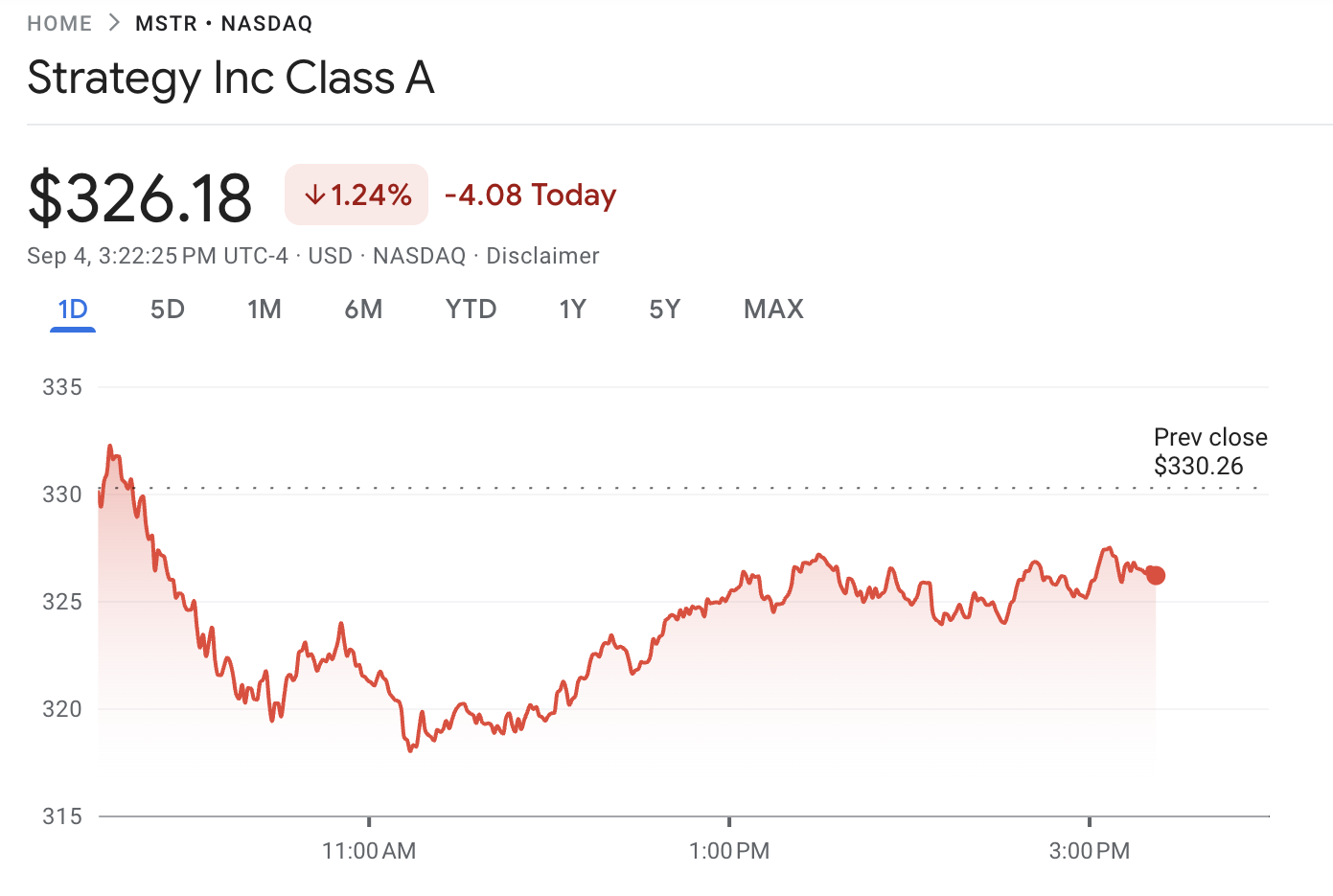

But let’s not get carried away. Nasdaq is currently sniffing around DAT firms like a bloodhound on a leash, hunting for “economic malfeasance.” The market yawned, then sneezed-stocks dropped, but Strategy coughed up a lung and mostly recovered. Here’s the chart for your viewing pleasure:

Nasdaq and S&P aren’t buddies, but this is a bad omen. Still, Strategy’s story is one of grit. Michael Saylor, once laughed at for his “DAT agenda,” is now a modern-day Midas. If he keeps this up, the S&P 500 might have to let him in-or risk looking like a bunch of stuck-up possums. 🦝

Will it happen? Not tomorrow. But if Strategy keeps charging like a bull in a china shop, the old guard might just crack. After all, progress doesn’t wait for permission. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

- Gold Rate Forecast

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-04 23:54