So, here’s the scoop: Strategy’s (formerly known as MicroStrategy, because who doesn’t love a rebrand?) stock (MSTR) has taken a nosedive. And by nosedive, I mean it fell harder than my hopes of ever getting a good night’s sleep after binge-watching Netflix.

Now, there’s chatter in the financial gossip circles about whether the company might be forced to liquidate its Bitcoin stash. The Kobeissi Letter, which sounds like a fancy Italian restaurant, weighed in, saying that while it’s not likely, it’s also not completely off the table. So, basically, it’s like saying you might not get a second slice of cake, but you’re still eyeing it. 🍰

MSTR Takes a Dive While Bitcoin Plays Hide and Seek

In the last 24 hours, Bitcoin’s price dropped more than 3%, which sent MSTR down by 11%. According to Yahoo Finance, the stock closed at $250. That’s a whopping 55% decline from its all-time high in November 2024. Ouch! Talk about a financial hangover.

In the midst of this chaos, The Kobeissi Letter took a deep dive into the possibility of a forced liquidation of the company’s Bitcoin holdings. Spoiler alert: it’s not a fun ride.

“Forced liquidation of MSTR is not necessarily impossible. But, it is highly unlikely. It would need a “mayday” situation to occur,” the post read. So, basically, we’re not calling the fire department just yet.

The analysis went on to explain that the company’s business model is more about raising capital than selling Bitcoin. It’s like trying to fund your shopping spree by selling your old Beanie Babies—good luck with that!

By issuing 0% convertible notes and selling new shares at a premium, Strategy has managed to finance its Bitcoin acquisitions without liquidating assets—even during market downturns. Talk about financial gymnastics!

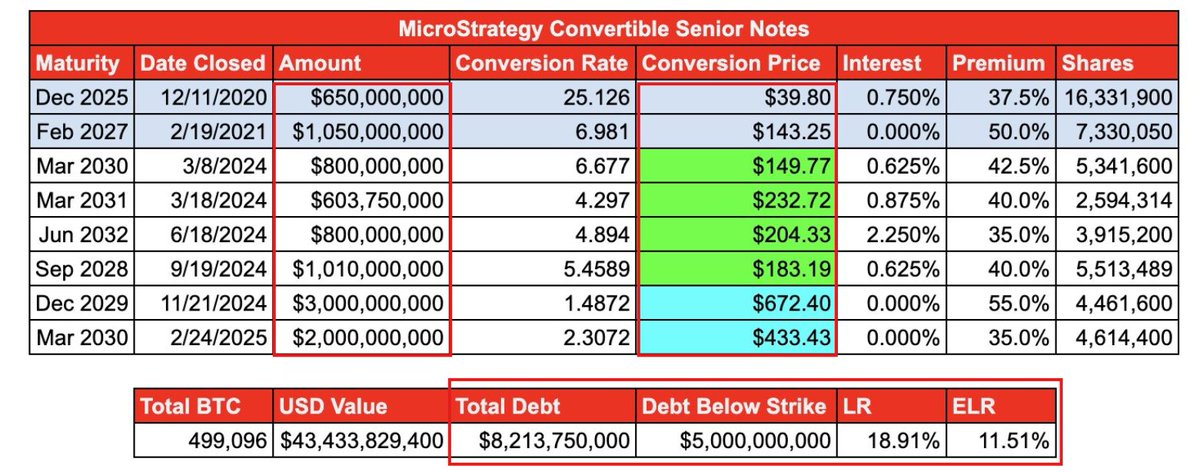

As of the latest data, Strategy holds approximately $43.4 billion in Bitcoin against $8.2 billion in debt. So, their leverage ratio is around 19%. That’s like having a credit card with a $1,000 limit and spending $190. Not too shabby, right?

Most of this debt consists of convertible notes, which sounds fancy but basically means they can convert it into shares later. The conversion prices are below the current share price, and the maturities extend to 2028 and beyond. So, they’ve got some breathing room—like a yoga retreat for their finances.

But hold your horses! The company’s ability to raise fresh capital isn’t completely immune to challenges. It’s like saying you can eat all the pizza you want, but you might regret it later.

“In a situation where their liabilities rise significantly higher than their assets, this ability could deteriorate,” the analysis examined. So, it’s like a financial game of Jenga—one wrong move and it all comes crashing down.

While this doesn’t automatically mean “forced liquidation,” it could strain the company’s financial flexibility. But don’t worry, liquidation is still a possibility, but only under a “fundamental change.”

“Effectively, for liquidation to occur, there would first need to be a stockholder vote or a corporate bankruptcy,” The Kobeissi Letter noted. So, grab your popcorn, folks!

Nonetheless, the scenario was deemed unlikely given Michael Saylor’s 46.8% voting power. That’s like having the majority of votes in a high school election—good luck getting him to change his mind!

Saylor has been a vocal supporter of Bitcoin, emphasizing its long-term growth. In fact, last week, the firm increased its holdings with a 20,356 BTC addition. That’s like adding more toppings to your pizza when you’re already full!

However, The Kobeissi Letter stressed that the real concern for Strategy lies in the future, especially when the company’s convertible bonds mature after 2027. If Bitcoin’s price falls more than 50% and stays low, Strategy might struggle to refinance or repay the debt in cash. It’s like trying to pay your rent with Monopoly money—good luck with that!

“Maintaining investor confidence will be crucial for M

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-02-26 15:23