As a seasoned financial analyst with over two decades of experience in traditional and digital asset markets, I’ve witnessed countless market cycles and observed that MicroStrategy Inc.’s recent stock decline is not an anomaly but rather a reflection of its inherent link to Bitcoin‘s price movements.

I remember vividly the dot-com bubble burst in 2000 when tech stocks plummeted due to overvaluation, similar to the current concerns over MicroStrategy’s leverage and potential financial strain. In my experience, high leverage can amplify gains during bull markets but also magnifies losses during downturns, as we are seeing with MSTR right now.

Sino G.’s analysis resonates with me, as it underscores the importance of understanding a company’s business model and its sensitivity to market conditions. Investors who believed that MSTR could decouple from Bitcoin’s downturns were engaging in wishful thinking, which I’ve seen time and again in overly optimistic markets.

I would advise investors to approach MSTR with caution, as the stock’s volatility can lead to significant gains during Bitcoin’s bull runs but equally substantial losses in bearish or sideways markets. It’s crucial to consider the factors that contribute to the decline, such as profit-taking, Fed policy, and concerns over leverage, before making investment decisions.

On a lighter note, I often find it amusing when investors think they can outsmart the market, only to be humbled by its unpredictable nature. In my experience, the best approach is always to understand the underlying dynamics of a company and the broader market, and to make informed decisions accordingly. After all, as the saying goes, “The stock market is designed to transfer money from the active to the patient.

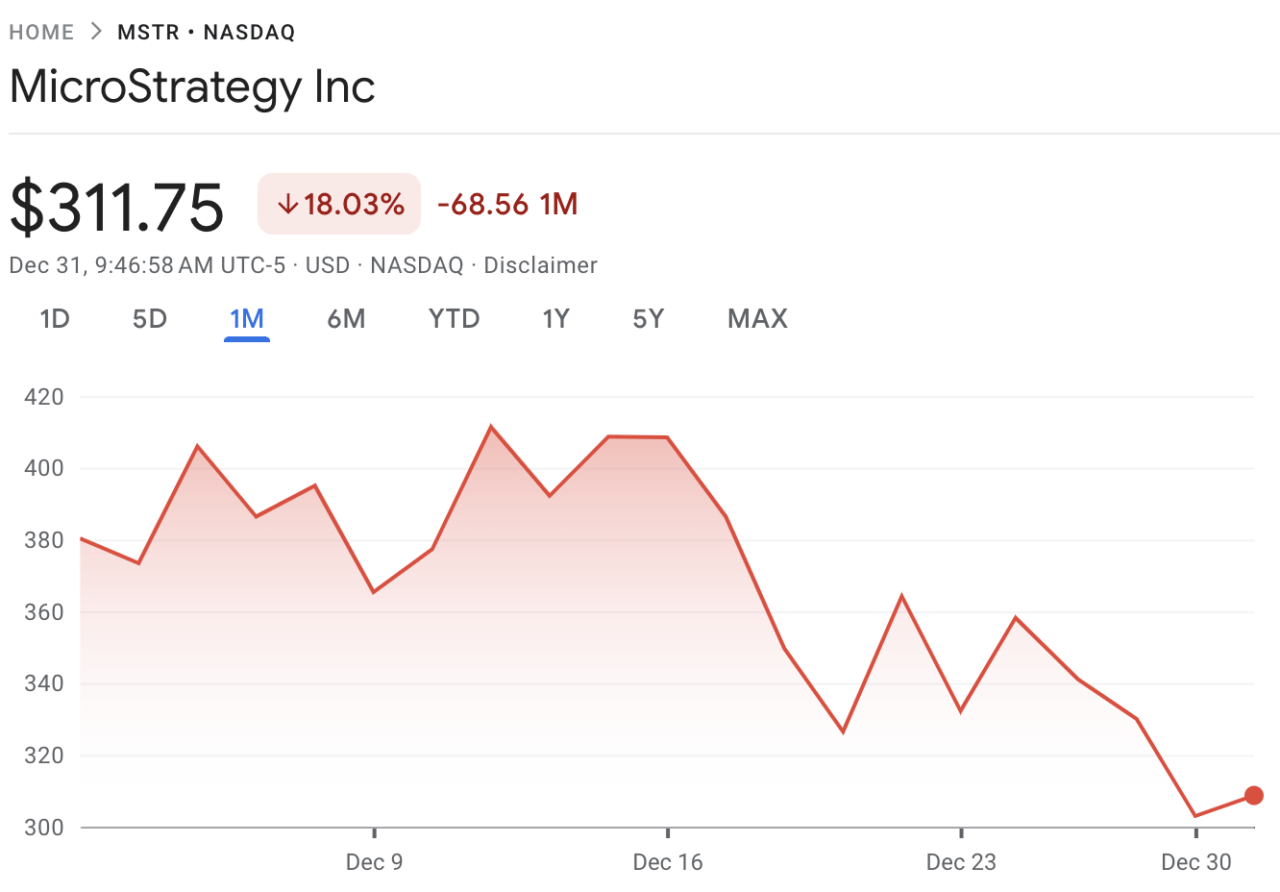

In a significant decline, shares of MicroStrategy Inc., the company renowned for its bold Bitcoin investment approach (traded under Nasdaq: MSTR), dropped by over 20% in December. The stock price fell from $487.47 at the start of the month to $309.42 by Dec. 31, 2024.

As a crypto investor, I’ve found myself questioning the underlying causes of this recent steep drop in prices, given that even Bitcoin, the market leader, took a substantial hit during the same timeframe.

On Monday, Sino G., Co-Founder and COO at 21st Capital, discussed on platform X why MicroStrategy’s (MSTR) stock has dropped recently. He pointed out that the movement of MicroStrategy’s stock price closely mirrors Bitcoin’s price changes. He brought attention to how sensitive MicroStrategy’s adjusted Net Asset Value (mNAV) is to Bitcoin opinions, noting that the stock usually does well during Bitcoin price increases but struggles in sideways or downward markets. Sino explained that mNAV decreases when Bitcoin prices are flat or falling, which means MSTR is very responsive to shifts in Bitcoin sentiment.

As someone who has spent years closely following the cryptocurrency market, I have noticed a common mistake among some investors: overly optimistic expectations about companies like MicroStrategy (MSTR) being able to separate themselves from Bitcoin’s fluctuations. This belief, in my opinion, is more of a hopeful fantasy rather than a realistic assessment of the situation.

You see, MSTR’s business model is deeply intertwined with Bitcoin’s price movements. Therefore, it’s crucial to understand that its volatility can be both a blessing and a curse. During bullish markets, this volatility amplifies gains; however, in bearish or sideways markets, the same volatility magnifies losses.

I have seen countless investors get caught off guard by Bitcoin’s unpredictable nature, and I believe it is essential to approach investments with a clear-eyed perspective rather than relying on wishful thinking.

Michael Saylor compared MicroStrategy to a device that transforms traditional currency into Bitcoin. Essentially, he said that MicroStrategy’s strategy works by using shares sold at a higher price to buy more Bitcoin. This means that those who own only Bitcoin can potentially profit from the premium paid over time, as MicroStrategy’s actions indirectly boost Bitcoin’s value. However, Saylor warned against impulsive investments in MicroStrategy due to fear of missing out (FOMO), advising investors to thoughtfully assess the stock’s vulnerability to Bitcoin market trends and sentiments before making any decisions.

Here are the key drivers for the decline in MicroStartegy’s stock:

- Profit-Taking and Bitcoin Sentiment: After Bitcoin’s record-breaking rally earlier in December, many investors engaged in profit-taking, leading to a pullback in both Bitcoin’s price and Bitcoin-related equities like MSTR. Sino’s analysis underscores that the contraction in mNAV during these periods directly impacts MSTR’s stock price.

- Federal Reserve’s Hawkish Stance: The Fed’s December meeting resulted in a statement and supporting material indicating a more hawkish stance on future rate cuts over inflation concerns, which dampened investor appetite for risk assets. This development contributed to selling pressure on cryptocurrencies and tech stocks, further weighing on MSTR.

- Concerns Over Leverage: Some analysts and investors have raised concerns about MicroStrategy’s heavy reliance on leverage to fund its Bitcoin purchases. While this strategy amplifies gains during bull markets, it also increases the company’s risk exposure during market downturns. The potential for financial strain has fueled bearish sentiment around the stock.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-31 19:27