As a researcher with years of experience in the cryptocurrency market, I must say that MicroStrategy’s latest Bitcoin purchase is yet another bold move that underscores Michael Saylor’s unwavering faith in Bitcoin. Having closely followed the firm’s strategic decisions, it seems that Saylor is indeed playing a long game, with the conviction of Satoshi himself.

MicroStrategy added another 21,550 Bitcoins to its holdings today at a cost of approximately $2.1 billion. This marks the company’s second Bitcoin acquisition this month, with each Bitcoin purchased for roughly $98,783.

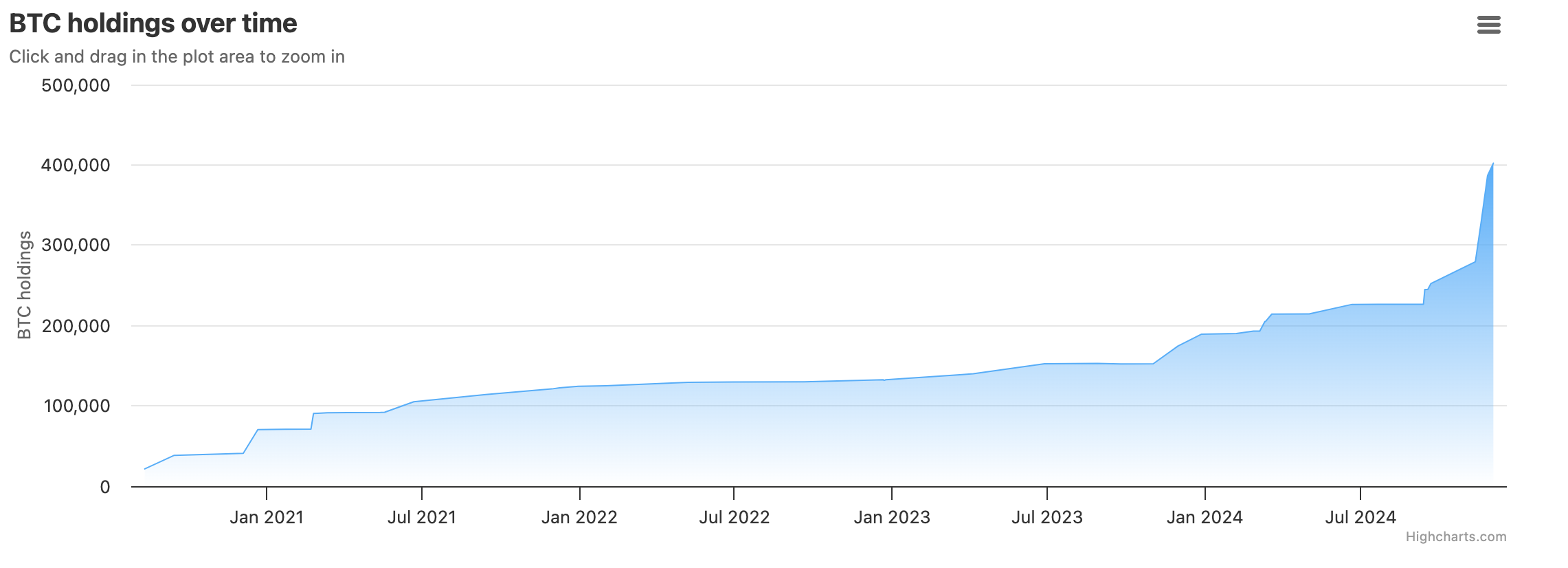

Since November, Michael Saylor’s firm has made over $15 billion worth of BTC purchases.

MicroStrategy Buys More Bitcoin

This afternoon, MicroStrategy made public their announcement of a purchase, which aligns with Saylor’s ongoing strategy, considering his recent endorsement of a “Bitcoin acquisition scheme” and expressing support for Bitcoin as a long-term financial asset two days prior.

“Satoshi gave us a game we can all win. Bitcoin is that game,” Saylor said in an interview today.

Additionally, the company made an equivalent investment back in early December, shelling out approximately $1.5 billion on Bitcoin. For quite some time now, Saylor has been a strong supporter of Bitcoin, yet his recent investments have noticeably escalated.

Consequent upon a surge in Bitcoin buying, MicroStrategy now ranks among the world’s top Bitcoin holders. This significant accumulation has noticeably influenced the company’s stock value this year. Furthermore, Bitcoin’s price escalation since the ETF approval in January can also be observed in MSTR‘s stock price, as it has skyrocketed approximately 450% so far this year.

2024 saw Bitcoin achieve its most prosperous year yet, as the price soared to an impressive $100,000. This upward trend in the market has stimulated significant Bitcoin acquisitions by prominent institutional investors, who have shown a strong appetite for this digital currency.

Example: BlackRock, the top ETF provider, stepped up its Bitcoin buying efforts following the $100,000 price mark. Notably, these issuers together hold more Bitcoin than Satoshi Nakamoto, an impressive accomplishment. MicroStrategy has been consistently investing in and promoting Bitcoin for some time, but BlackRock’s total assets under management (AUM) exceed MicroStrategy’s by over 100 times thanks to the inflow of investments into IBIT.

Although Michael Saylor believes the Bitcoin-first strategy is unquestionable, it’s been noted that the money moving within this approach is relatively small when compared to standard ETF providers. Despite these criticisms, many other publicly traded companies are imitating MicroStrategy’s lead.

In the course of my current research, I’ve noticed an interesting trend emerging: Smaller publicly traded firms like MARA and Metaplanet have been steadily augmenting their Bitcoin holdings during this bull market. This accumulation pattern hints that these companies anticipate a significantly higher value for Bitcoin, viewing the recent peak prices as opportune moments to buy in rather than sell off.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-12-09 22:42