As a seasoned analyst with over two decades of experience in the financial markets, I find MicroStrategy’s latest funding strategy to be nothing short of groundbreaking. This bold move to raise $2 billion through perpetual preferred stock offerings is a testament to their audacious ambition and innovative spirit in the ever-evolving world of Bitcoin.

MicroStrategy has consistently proven itself as a pioneer in the digital asset space, and this latest move solidifies its position as a trailblazer. By offering investors regular dividends without a maturity date, they are providing a unique tool for raising capital while also allowing investors to gain exposure to Bitcoin’s inherent volatility.

However, it is crucial to acknowledge the potential risks associated with this strategy. Issuing new shares to raise capital can dilute the ownership of existing shareholders, which can reduce earnings per share. This is a challenge that MicroStrategy must navigate carefully to ensure the success of its Bitcoin acquisition strategy.

In the grand scheme of things, I find it fascinating how a company once known primarily for business intelligence software has now become synonymous with Bitcoin. Who would have thought that Satoshi’s creation would one day propel a software firm to such heights?

Lastly, I can’t help but chuckle at the irony of a company raising capital through debt and equity to buy an asset known for its lack of collateral and perceived as a riskier investment. It’s like borrowing money to buy lottery tickets—the potential rewards are enormous, but so are the risks! Nonetheless, MicroStrategy seems to be playing this game with finesse and courage, making it a company worth watching closely in the years to come.

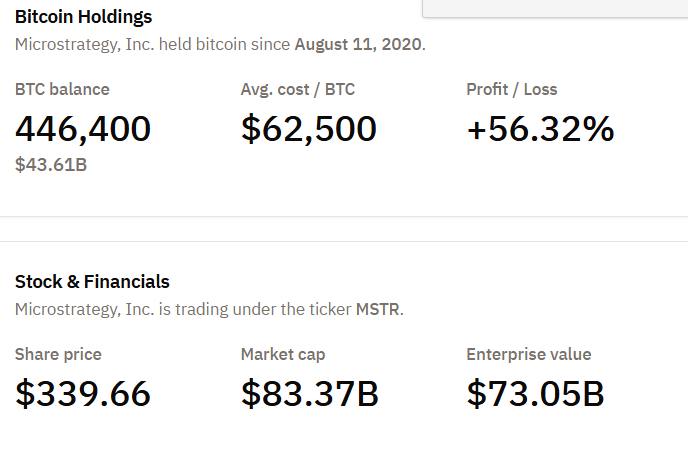

In simpler terms, MicroStrategy, known as the world’s biggest Bitcoin-holding corporation, has announced its intention to gather $2 billion by selling perpetual preferred stocks.

This plan is designed to grow our Bitcoins holdings and fortify our financial position, which aligns with our aggressive expansion plans.

MicroStrategy Pushes New Limits With Bitcoin Funding Strategy

On January 3rd, MicroStrategy made it clear that the recent financing they’re pursuing is distinct from their earlier intentions to acquire $21 billion through equity and a similar sum via debt securities.

The ever-popular preferred stocks might be financed in several ways, such as swapping Class A common stock, distributing cash payments (dividends), or purchasing back shares. This investment opportunity offers continuous dividend payouts without a specified maturity date, making it an exceptional resource for securing capital funds.

According to Dylan LeClair, Director of Bitcoin Strategy at Metaplanet, this action showcases its innovative side. He highlighted that this offering gives investors an opportunity to experience Bitcoin’s built-in volatility, all while offering MicroStrategy a budget-friendly method for fundraising.

According to LeClair’s calculation, if the yearly dividend rate increases to 6%, the company would distribute approximately $120 million each year from the $2 billion they raised – a relatively small amount compared to the over $15 billion in equity capital they acquired in 2024.

As an analyst, I’d rephrase this statement as follows: “For me, volatility is the core aspect of Bitcoin (BTC), and BTC Yield serves as our main performance metric. The unique, open-ended flexibility that MicroStrategy (MSTR) can offer to the fixed income market through its products is particularly intriguing.

In the upcoming first quarter of 2025, the company plans to introduce the product, assuming positive market trends and other requirements are met. Yet, it’s important to note that MicroStrategy has not definitively decided to move forward with this plan.

MicroStrategy’s ongoing investments in Bitcoin have noticeably bolstered its competitive standing. The value of the company’s shares has skyrocketed, earning it a place on the prestigious Nasdaq 100 index. Furthermore, the organization’s forward-thinking strategy for financing – borrowing both debt and equity to buy Bitcoin – has garnered it acclaim as a trailblazer in the realm of “Bitcoin asset management” companies.

On the other hand, employing this approach presents certain difficulties. By selling more shares to generate funds, the ownership of current shareholders gets diminished, leading to a decrease in earnings per share. The Kobeissi Letter pointed out this issue in a comprehensive examination, cautioning that if MicroStrategy fails to obtain further financing, it could potentially threaten their Bitcoin acquisition plan.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-01-04 16:12