As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I can’t help but feel a mix of intrigue and caution regarding MicroStrategy’s performance today. The stock’s wild ride this morning, coupled with Citron Research’s recent bearish stance, has me questioning the sustainability of its meteoric rise.

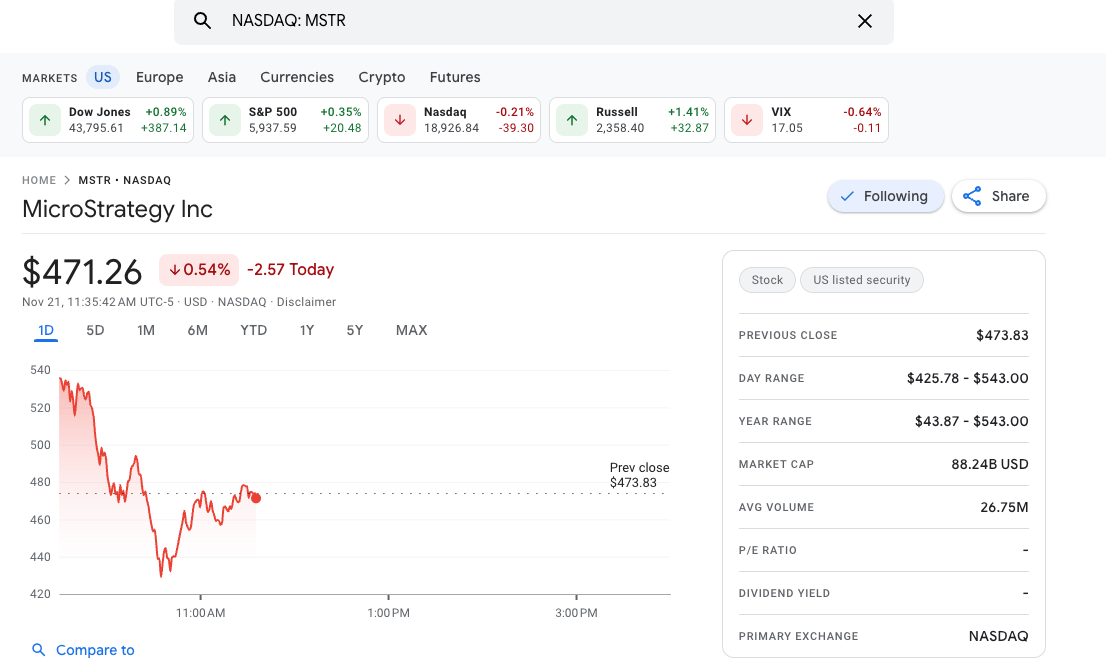

On Thursday morning, MicroStrategy’s shares exhibited significant fluctuations, dropping to $467.53 by 11:36 AM EST, representing a decrease of more than $6 from the previous closing price of $473.83. A closer look at the day’s trading chart reveals a very active and unstable early session. The stock initially opened close to $520, then plummeted significantly to around $440. However, it managed to partially recover from this decline.

In this fluctuating market scenario, the Dow Jones and S&P 500 are seeing slight increases (up by 0.83% and 0.27% respectively), but the Nasdaq is moving downward (-0.20%).

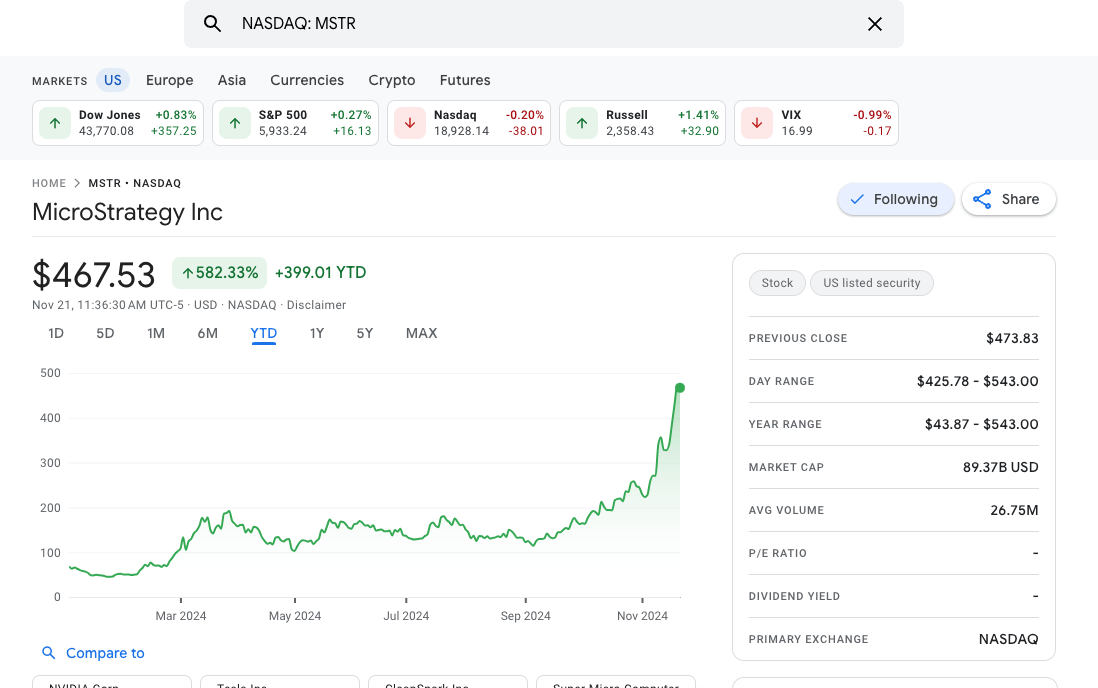

This year so far, MicroStrategy’s performance paints an incredible tale. Shares of the company have experienced an astounding increase of 582%, resulting in a significant gain of approximately $399.01 per share since January. The graph reveals a remarkably swift ascent, with the stock price spiking dramatically from around $200 to over $540 within mere weeks, starting in October 2024.

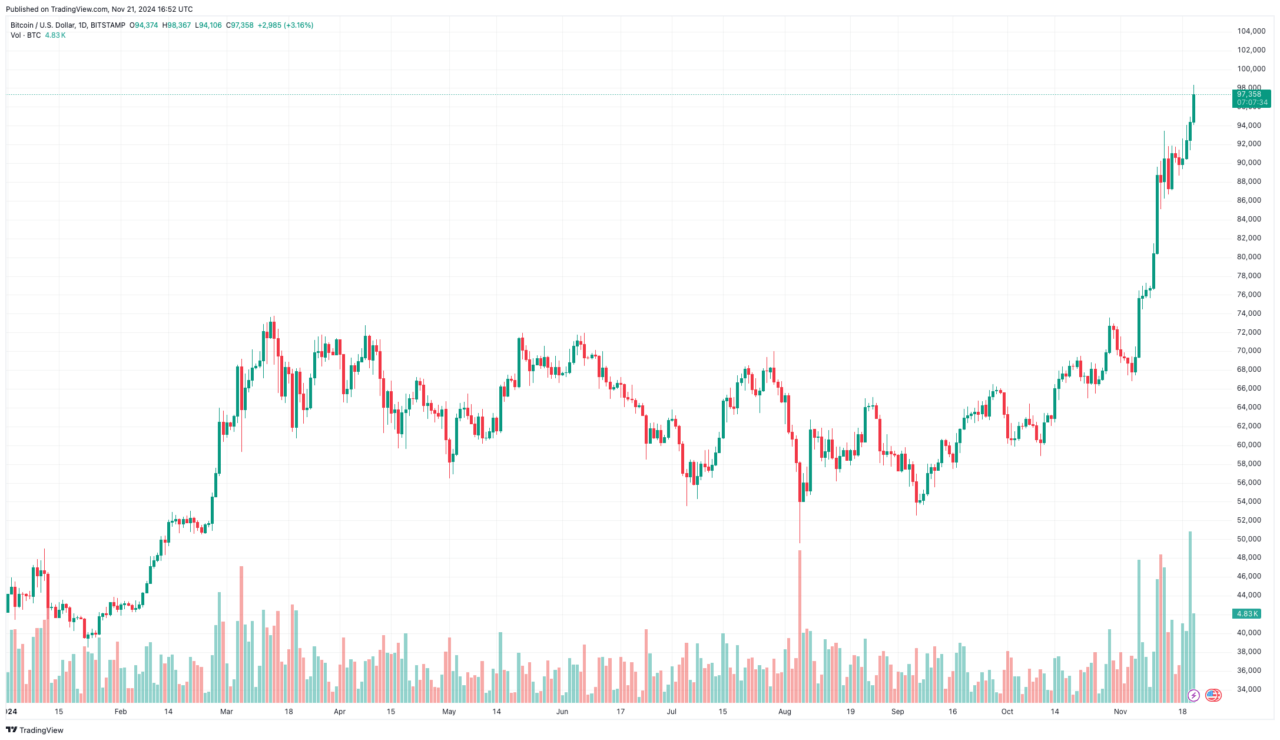

In this turbulent trading period, well-known short seller Citron Research revealed a fresh negative stance on the company’s shares. Notably, MicroStrategy has been increasing its Bitcoin investments, buying 51,780 Bitcoins for around $4.6 billion in cash and an average price of $88,627 per Bitcoin. The corporation now owns a total of 331,200 Bitcoins, which were purchased for $16.5 billion at an average rate of $49,874 per Bitcoin.

After Donald Trump’s election win in early November, the stock’s rapid growth significantly increased, soaring by 110%. Meanwhile, Bitcoin experienced a 44% rise and hit an all-time high of $98,000.

Boasting a market value of $94.36 billion and an average daily share trading volume of approximately 26.75 million, MicroStrategy has emerged as a prominent figure in the crypto-related equity sector. Remarkably, as reported by Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, MSTR was America’s busiest stock on the trading floor yesterday.

At the time of writing, MSTR is the US stock with the second-highest daily trading volume:

Citron Research’s current viewpoint represents a significant shift compared to their late 2020 advice, where they endorsed MicroStrategy with a projected price of $700. Despite recognizing Michael Saylor’s forward-thinking approach to Bitcoin, they now contend that the increased accessibility of Bitcoin investment opportunities through spot ETFs, platforms like Coinbase and Robinhood, has decoupled MicroStrategy’s trading activity from the underlying value of Bitcoin.

Even though they continue to be optimistic about Bitcoin, Citron has decided to take a cautious approach by shorting MicroStrategy’s shares. This action implies that they believe the current Bitcoin rally may have reached an excessive level.

4 years ago, Citron predicted that MicroStrategy would be an excellent investment opportunity for Bitcoin. At the time, they set a target price of $700. Today, the value of MicroStrategy (MSTR) has soared far beyond that, reaching over $5,000 when adjusted. Well done to Michael Saylor and his team for making this prediction come true!

— Citron Research (@CitronResearch) November 21, 2024

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-21 20:15