MicroStrategy has recently acquired approximately 2,530 Bitcoins for roughly $243 million, marking its second purchase of 2025 thus far. Yet, these recent acquisitions represent a notable decrease compared to the firm’s Bitcoin accumulations in Q4 2024.

Despite representing a significant shift from its past course, this purchase doesn’t offer much proof yet of a complete transformation or revitalization.

Or,

Though it signifies a notable departure from the company’s previous direction, it does not provide substantial evidence of a comprehensive turnaround thus far.

Saylor’s New Bitcoin Energy

Ever since Michael Saylor initiated his substantial Bitcoin buying spree, MicroStrategy has grown to be among the globe’s top Bitcoin owners. In a recent social media update, he affirmed that this investment approach remains active, as evidenced by a significant new purchase.

MicroStrategy recently purchased 2,530 Bitcoins for approximately $243 million, which equates to around $95,972 per Bitcoin. This acquisition has resulted in a Year-to-Date (YTD) Bitcoin Yield of 0.32% for the year 2025. As of January 12, 2025, they now hold a total of 450,000 Bitcoins, which were acquired for approximately $28.2 billion, with each Bitcoin costing around $62,691. This is what Saylor stated.

Yet, among the latest acquisitions, this specific one is distinct due to a single conspicuous factor: The price of Bitcoin has been sliding since the conclusion of its November bull run, and MicroStrategy’s buying pattern has also decreased accordingly.

In December alone, MicroStrategy spent over $6 billion on Bitcoin, and their November investments were even larger. However, in the beginning of January, they’ve only invested $344 million in BTC. Although this is still a considerable amount compared to most public companies, Saylor has demonstrated a pattern of making more aggressive Bitcoin acquisitions.

Over the past month, there’s been a gradual decrease in Bitcoin purchases, and speculation suggests that Saylor might temporarily halt these purchases. Yet, for the first time in several weeks, the purchase volume has slightly increased. This intriguing tidbit of information has added fuel to the growing curiosity.

Back in early January, Saylor asserted that MicroStrategy planned to procure $2 billion through a stock offering for purchasing Bitcoin. However, as per SEC records, this offering hasn’t been executed yet. Yet, the amount intended for Bitcoin purchases appears to be growing. It seems that speculations suggesting MicroStrategy could no longer afford such costly acquisitions might have been exaggerated.

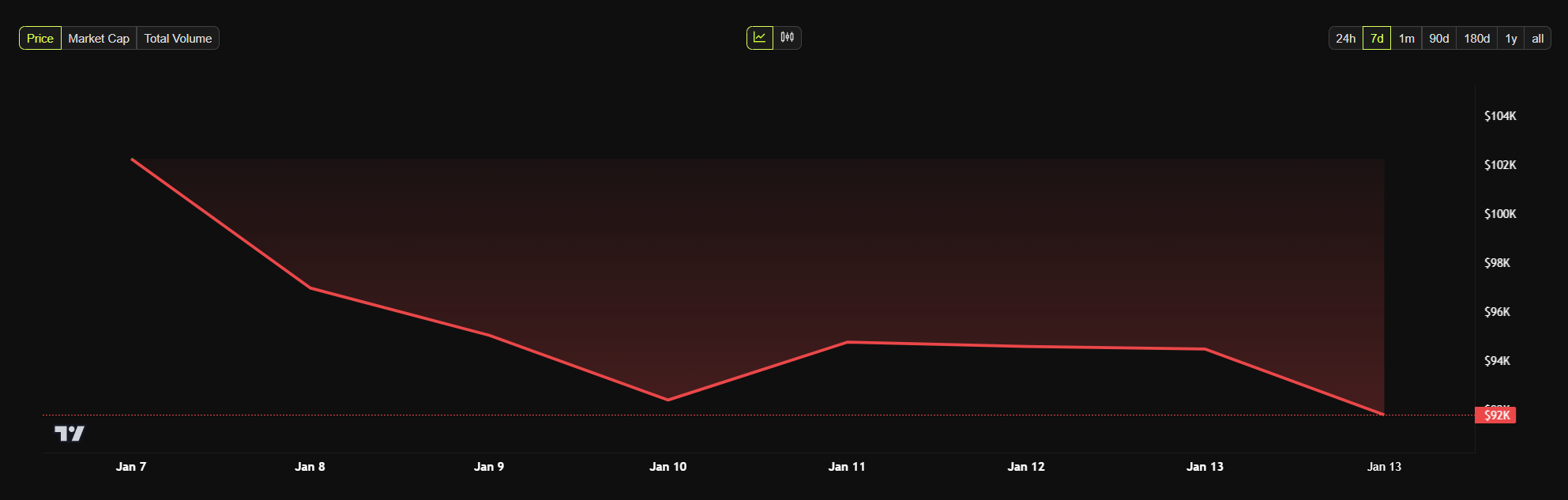

Alternatively, it’s possible that other large-scale economic aspects are influencing these modest transactions by MicroStrategy. They might be examining the present stability of Bitcoin, as its value has shown considerable fluctuations in January, dropping more than 10% just in the last week.

Despite a strong 550% growth in 2024, Microsoft Corporation’s (MSTR) shares have dropped by almost 20% this month, indicating lingering uncertainty about the company.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-13 21:25