As a crypto investor with experience in following MicroStrategy’s moves closely, I view this 10-for-1 stock split announcement positively. MicroStrategy’s association with Bitcoin and its aggressive buying strategy have made it a significant player in the digital asset space. The company’s share price appreciation has been remarkable, which might have made it less accessible for some retail investors due to high entry prices.

As a researcher studying publicly traded companies in the technology sector, I came across an intriguing announcement from MicroStrategy Incorporated on July 11, 2023. This software firm, known for its significant Bitcoin holdings and being listed on Nasdaq, declared a substantial 10-for-1 stock split. With this strategic decision, the company aims to make its shares more attainable to a wider audience of potential investors and employees.

In the company’s press announcement, the board has endorsed a 1-for-10 stock division for both classes A and B common shares. This adjustment will take effect through a stock dividend, payable to shareholders holding records as of August 1, 2024, at market close. In essence, each shareholder will acquire nine extra shares for every owned share. The new shares are expected to be distributed post-market on August 7, 2024, with trading commencing on an adjusted basis from August 8, 2024. Crucially, this stock split does not affect the voting or other entitlements of the shareholders.

After experiencing exceptional growth in the past year, MicroStrategy’s stock price nearly tripled, reaching an unprecedented peak of $1,919 per share on March 27. This milestone occurred just after Bitcoin achieved its new record high of $73,737.

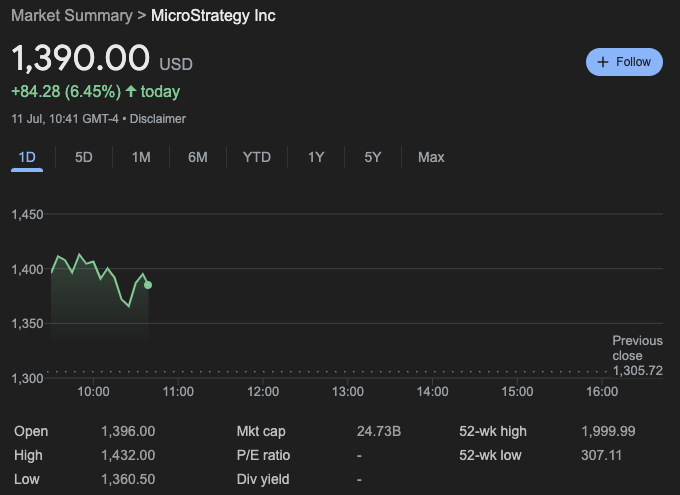

As a financial analyst, I’d like to note that at the point of composing this text, MicroStrategy’s stocks were being exchanged for around $1,390 each, representing a 6.48% increase in value compared to the previous trading session.

Under Michael Saylor’s tenure as executive chairman, MicroStrategy has gained a reputation for investing in Bitcoin. The company often obtains funds through corporate borrowing to acquire more Bitcoin, resulting in a substantial increase in its Bitcoin holdings. As of the most recent purchase, MicroStrategy owns 226,331 BTC, which is valued above $13 billion.

Companies with significantly increased share values frequently implement stock splits. Despite not altering the company’s total worth, this action lowers the individual share price, making it more affordable for average investors psychologically. For instance, MicroStrategy has considered a stock split due to its high share price becoming a barrier for certain investors. This strategy is consistent with other well-known companies like NVIDIA Corporation, which carried out a 10-for-1 split in June following notable price growth.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- USD ILS PREDICTION

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All 6 ‘Final Destination’ Movies in Order

2024-07-11 17:50