Microsoft (MSFT 2.28%) has had quite the rollercoaster ride through 2025, ascending from a humble perch of around $420 per share at the dawn of the year to a rather sprightly $490 by December, which is approximately a 17% return – not exactly grounds for a victory parade in the realm of stock picking, but commendable nonetheless, especially when the S&P 500 (^GSPC +0.19%) decided to don its party hat and frolic with an 18% increase. Alas, our dear Microsoft found itself outshone, much like a starlet at a gala overshadowed by a more dazzling co-star.

But as we peer into the crystal ball to speculate on what 2026 holds, one must ponder: will Microsoft dazzle us in the upcoming year, or will it be yet another chapter of matching the market or, dare I say, losing ground? Let’s unfurl the scroll of possibilities regarding Microsoft’s stock price by the end of 2026 and see if it can manage to outshine the ever-fickle market.

The Neutrality of Azure: A Cloudy Conundrum

In the bustling bazaar of artificial intelligence, where companies jostle for position like merchants at a fair, Microsoft has opted for the role of facilitator rather than the mad inventor. This could be a double-edged sword as we tumble headlong into an AI-centric universe, where one’s fate often hinges on who wields the most potent algorithm.

Cloaked within their vast empire lies the oft-overlooked Azure cloud computing division. Azure, currently basking in the glow of being the second-largest cloud service (just behind the behemoth known as Amazon Web Services, or AWS for those in the know), shows no signs of slowing down. In the first quarter of fiscal year 2026 (which concluded on the last day of September 2025, in case anyone was counting), Azure’s revenue boasted a staggering 40% growth year-on-year, which is akin to a magical spell doubling the yield of a particularly thirsty crop, while AWS merely managed a modest 20%. This remarkable performance may well stem from Azure’s charming neutrality regarding the generative AI models it provides users, offering a veritable buffet rather than a fixed menu.

Ah, but here’s the kicker: despite holding a 27% stake in OpenAI, Microsoft is no monopolist in this realm. Developers can choose from a plethora of competitors like xAI’s Grok or Anthropic’s Claude, or perhaps even opt for a more economical model from DeepSeek. By sidestepping the trap of allegiance to a single model, Microsoft stands to gain from the rising tide of AI adoption, much like a ship benefiting from a favorable wind.

One delightful niche that has flourished under the auspices of increased AI usage is none other than Microsoft’s Office products. Enter stage left: the Copilot add-on, granting users the sort of generative AI capabilities typically reserved for the wizardly elite, which has become remarkably popular. This little gem has contributed to a 17% growth in Microsoft 365 commercial ventures and an astounding 26% in consumer growth. It seems even bureaucrats are enchanted by a little automated assistance.

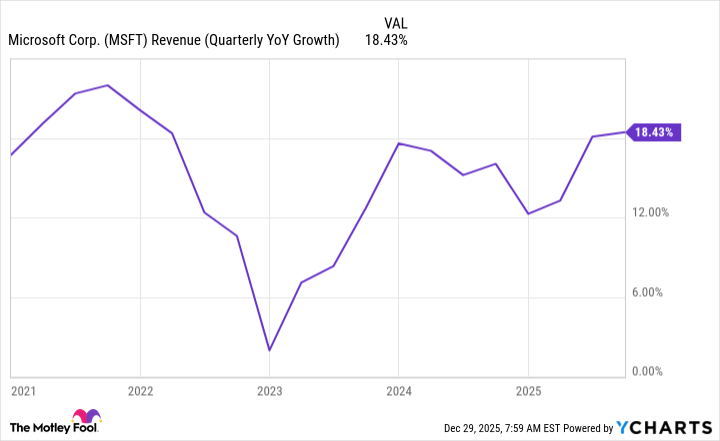

The trends that graced 2025 are unlikely to vanish into the ether as we stride boldly into 2026, a sentiment echoed by Wall Street seers who prophesy a 16% sales growth for FY 2026 (ending June 30, 2026). Moreover, for FY 2027, estimates suggest a 15% growth. One might say these figures have settled comfortably into the predictable realm of Microsoft’s recent history, much like a well-worn chair in a cozy study.

Microsoft is, without a doubt, a success story wrapped in a predictable narrative. This predictability serves as a fine foundation upon which we can construct our stock price estimate, much like building a sturdy tower from well-milled logs.

The Perilous Path of Valuation

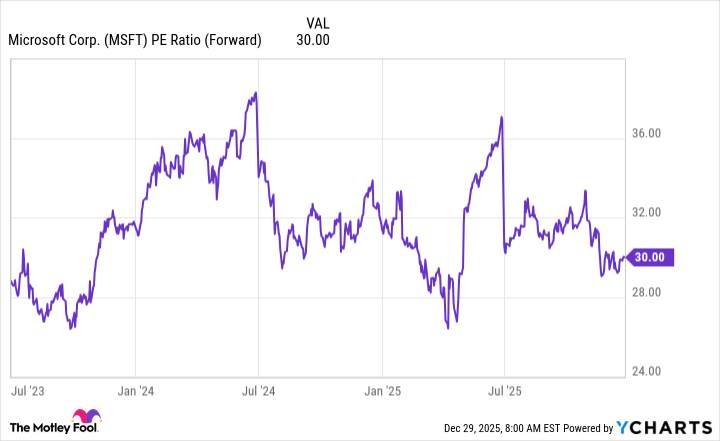

Now, dear investor, as we embark on this perilous journey towards predicting stock prices, we must consider the arcane art of valuation. The current norm dictates that a thirty-times forward earnings multiplier has become the standard fare for tech giants like Microsoft. Thus, assigning a year-end valuation of thirty times forward earnings seems a reasonable and fair assumption, much like expecting a wizard to wear a pointy hat at all times.

If Microsoft manages to deliver a 15% growth rate in both revenue and earnings during the latter half of FY 2026 and the early months of FY 2027 while maintaining its thirty-times forward earnings valuation, we can anticipate the stock soaring in accordance with the same growth rate. Picture it: with shares currently hovering at about $485 each, my prediction for year-end pricing would be nearly $560. While that growth might not suffice to outpace the market in 2025, I firmly believe that should Microsoft sustain its double-digit growth trajectory, it will solidify its status as a long-term champion in the stock market arena, making it an enticing prospect for those looking to invest now and hold for the future.

After all, the financial landscape is like a raucous tavern filled with tales of triumph and woe, and those who navigate it wisely may find fortunes awaiting them amidst the chaos. 🍀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- HSR Fate/stay night — best team comps and bond synergies

2026-01-05 14:13