The market, that fickle beast, has spoken. Or rather, it has belched. Microsoft, a titan accustomed to reverence, experienced a rather undignified stumble after its quarterly pronouncements. Meta, meanwhile, ascended, a phoenix from the ashes of skepticism. One might be forgiven for suspecting a mischievous imp at the controls of the exchanges. But let us dispense with the theatrics, however tempting, and attempt a sober assessment. Which of these digital behemoths offers the more prudent path for the discerning investor? A question, I assure you, fraught with more peril than a stroll through a Moscow cemetery on a moonless night.

Microsoft’s Azure: A Glimmering Illusion?

Microsoft, that purveyor of operating systems and office suites, now presents itself as a cloud computing pioneer. Azure, its cloud division, is the object of particular fascination, a sort of digital oracle consulted by those seeking the secrets of artificial intelligence. The logic is simple, or so it seems: abundant cloud capacity equals abundant AI spending. Clients, eager to dabble in the wonders of machine learning, flock to Azure, eschewing the messy business of maintaining their own data centers. A convenient arrangement, to be sure, but one cannot help but wonder if this entire enterprise is not merely a grand illusion, a shimmering mirage in the desert of technological progress.

Management, with a disarming candor that bordered on recklessness, predicted 37% growth for Azure. They delivered 39%. A triumph, one might say. Yet, they confessed that this figure could have been higher, had they not diverted some of their newfound capacity to internal machinations. A curious admission. It suggests a certain… indecisiveness, a reluctance to fully commit to the demands of the market. One pictures a bureaucrat, shuffling papers, lamenting the inconvenience of progress. Despite this minor transgression, the market reacted with a petulant outburst, punishing the stock with a double-digit decline. The whims of the crowd are rarely governed by logic, of course. It’s as if they expected a miracle.

Meta’s Capital Expenditure: A Descent into Madness?

Meta, formerly known as Facebook, has undergone a metamorphosis, shedding its social media skin to reveal a creature obsessed with the metaverse and artificial intelligence. The company’s recent earnings announcement was met with a predictable wave of hysteria. The numbers themselves were… acceptable. But it was Meta’s capital expenditure plans that truly ignited the market’s anxieties. A staggering sum, to be sure. A veritable mountain of money earmarked for data centers. A sum that would make even a Tsarist finance minister blush.

The projected expenditure for 2026 is nothing short of astronomical: $115 to $135 billion. A sum that dwarfs the national debt of several small nations. The market, understandably, recoiled in horror. Was Meta embarking on a fool’s errand? Throwing good money after bad? Building a digital palace on a foundation of sand? The specter of overleverage loomed large. It reminded me of a certain master, building a tower of Babel, oblivious to the inevitable collapse. Yet, management, with a touch of audacity, announced that despite this massive investment, operating income would exceed that of the previous year. A bold claim, to be sure. A lifeline thrown to a drowning investor. It eased some of the panic, but the stock remains bruised, lagging behind its former glory.

The Verdict: A Matter of Taste, or Perhaps, Desperation?

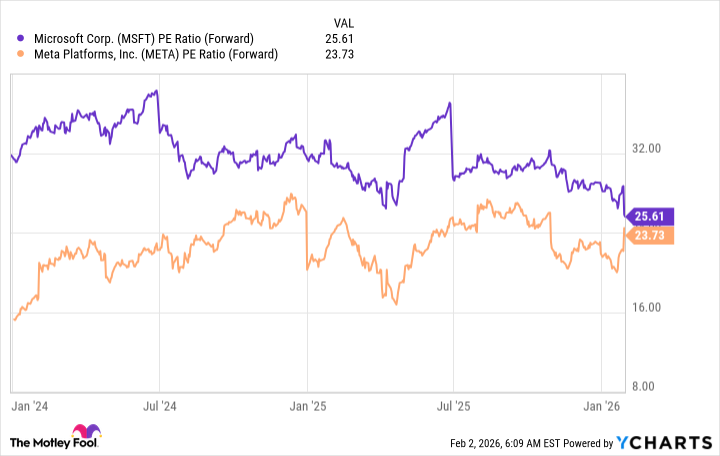

Comparing the two, Meta currently exhibits a slightly more vigorous rate of growth. Its revenue increased by 22% in the last quarter, a testament to the effectiveness of its generative AI initiatives. Microsoft, a venerable institution, managed a respectable 17%. But the difference is marginal. Both companies are, shall we say, doing quite well. The price-to-earnings ratios are similarly aligned: 26 times forward earnings for Microsoft, 24 times for Meta. A negligible distinction.

One might argue that Meta is the more attractive option, given its faster growth and slightly lower valuation. But Microsoft possesses a certain… stability. A steadier revenue stream. A less precarious foundation. Azure, despite its occasional missteps, represents a long-term growth opportunity. It’s a bit like choosing between a spirited young stallion and a reliable workhorse. Both have their merits. Ultimately, the decision comes down to temperament. Or perhaps, desperation. I, for one, am inclined toward Microsoft. It’s a safer bet. A less likely candidate for a spectacular, and irreversible, fall. But then again, I’ve always been a pessimist. It’s a habit, you see. A rather inconvenient one, but a habit nonetheless.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-05 05:02