Microsoft, a company whose fortunes are so widely observed as to be almost a public trust, has lately presented a study in contrasts. Its most recent accounting reveals a performance of considerable strength, yet the market’s response, a decline of nearly ten percent in a single day, suggests a degree of unease not entirely accounted for by mere figures. One might venture to suggest that expectations, like the demands of a particularly discerning assembly, are ever difficult to satisfy.

Let us, therefore, examine the particulars with a dispassionate eye, and discern what lessons this quarter’s report might offer to those engaged in the prudent management of estates—or, in this case, portfolios.

A Most Comfortable Income

It is a truth universally acknowledged that a company possessed of ample means is a company in a favourable position. Microsoft, in this regard, is remarkably well-endowed. Revenue for the quarter reached $81.3 billion, a sum exceeding expectations by a respectable margin, and a testament to the enduring demand for its offerings. Earnings per share likewise demonstrated a healthy increase, reaching $4.14, while net income experienced a most gratifying expansion. Though increased expenditure does temper the margins somewhat, the flow of capital remains, undeniably, robust. A slight diminution in the performance of Xbox Content and Services is a matter of minor concern, easily offset by the strength exhibited elsewhere.

The OpenAI Connection: A Delicate Arrangement

A considerable portion of Microsoft’s future commitments—some $281 billion, to be precise—is tied to its association with OpenAI. While such a substantial backlog might, under ordinary circumstances, be cause for celebration, it introduces a degree of dependency that warrants careful consideration. One cannot but observe a parallel with the intricacies of a marriage settlement; a promising alliance, certainly, but one reliant upon the continued good faith and competence of another party. Should OpenAI prove unable to fulfill its obligations, Microsoft would find itself diminished, though, one trusts, not irreparably harmed.

Azure’s Advancement: A Question of Capacity

The expansion of Azure, Microsoft’s cloud service, has been, of late, most impressive. However, even the most successful enterprises encounter limitations. Demand for Azure’s capabilities presently exceeds the available capacity, a circumstance which, while flattering, threatens to impede further growth. It is a situation not unlike a crowded ballroom; one may admire the elegance of the dancers, but their movements are constrained by the limitations of the space. The revenue growth of 39% remains commendable, but a slowing pace is, perhaps, inevitable.

Expenditure and Advancement: A Necessary Investment

Microsoft’s capital expenditure for the quarter reached $37.5 billion, a sum devoted largely to the development of its artificial intelligence infrastructure. Such investment, while substantial, is, one might argue, a necessity in the present climate. The rapid obsolescence of hardware—particularly GPUs and CPUs—presents a challenge, demanding constant renewal and adaptation. To remain competitive, Microsoft must maintain a leading position in the realm of AI, and that requires a commitment to the latest technology, however fleeting its advantage may prove.

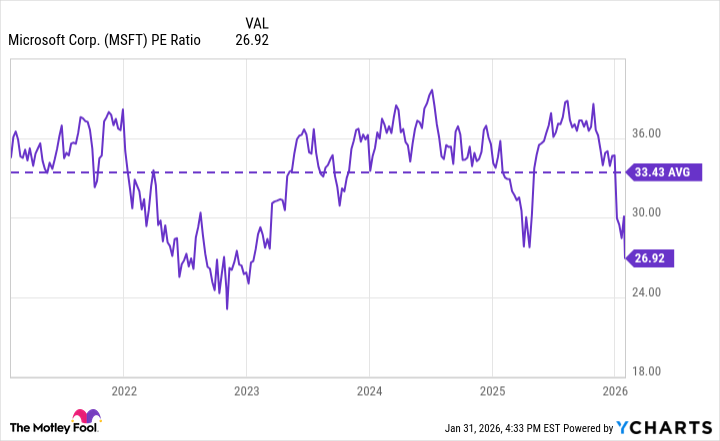

A More Reasonable Valuation

As of the close of the market on January 31st, Microsoft’s stock traded at approximately 27 times its earnings—the lowest among its peers. This represents a considerable shift from the valuations of recent years and presents a more attractive entry point for discerning investors. While one cannot predict the future with certainty, it is reasonable to suggest that the recent decline has created an opportunity. The stock is, at present, priced with a degree of prudence that was absent before the correction, and offers a more favourable balance between risk and potential reward.

In conclusion, while Microsoft’s recent performance has been accompanied by a degree of market volatility, a careful examination of the facts reveals a company of considerable strength and enduring potential. Prudence, as ever, remains the watchword, but a judicious allocation of capital to this estate may, in time, yield a most satisfactory return.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

2026-02-04 16:53