Microsoft, a name now almost synonymous with the very architecture of our digital age, has, over the past five years, demonstrated a resilience that few can match. While the more flamboyant successes of a Nvidia may capture the immediate eye, Microsoft’s steady ascent, though perhaps less spectacular, speaks to a deeper, more enduring strength. A recent, rather sharp correction following the release of its fiscal second-quarter earnings – a period ending December 31st – has presented a peculiar opportunity, one that, after some consideration, appears decidedly favorable.

The market, it seems, is a creature of fleeting passions, easily swayed by expectations, and prone to fits of disproportionate reaction. Before the recent decline, the stock had more than doubled in value over the preceding five years. The correction, however, has brought that return down to approximately 85.5%, a mere shadow behind the S&P 500’s 87%. It is a curious thing, this tendency of the collective to punish a company for not exceeding already ambitious forecasts. One might almost suspect a perverse delight in disappointment.

I find this sell-off, frankly, a touch absurd. A momentary lapse in euphoric expectation should not necessarily dictate a fundamental reassessment of value. Indeed, it presents a rather elegant entry point for those of us who favor a more measured approach. I submit three reasons why Microsoft, at its current price, is a compelling proposition, and why it is likely to resume its position as a market leader in the months to come.

The Azure Current: A Rising Tide

Microsoft is, of course, no longer merely a purveyor of operating systems. It is a cloud services provider, and within that realm, Azure stands as its most significant engine of growth. The health of this division is, quite rightly, the primary concern of any serious investor. Azure is not simply a business; it is a foundational layer upon which much of the future will be built.

The current fascination with artificial intelligence only serves to accelerate this trend. Clients require immense computational power to train and deploy these models, and Azure provides precisely that. The recent quarterly report revealed a 39% year-over-year increase in Azure revenue – a figure that surpassed even the most optimistic projections. Management had cautiously forecast 37% growth, but the reality proved more generous. It is a testament to the underlying strength of the platform and the growing demand for its services.

Two of Microsoft’s three major divisions exceeded expectations, yet the market responded with a sell-off. It is as if the collective intelligence demands constant, unsustainable growth. Such behavior is rarely rational, and often creates opportunities for those willing to exercise a little patience.

OpenAI: A Shadowed Partnership

The Price of Prudence

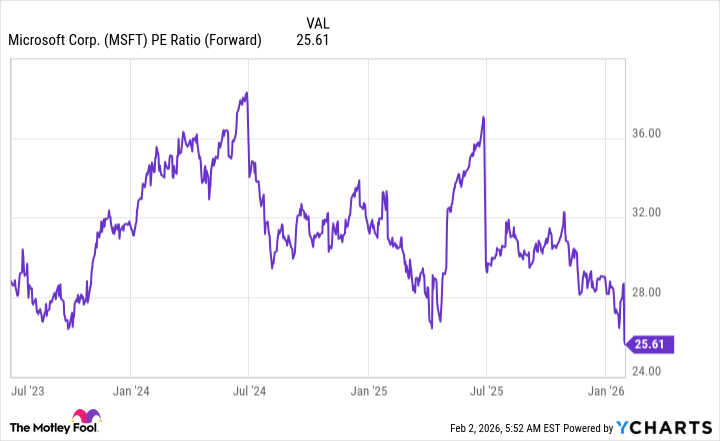

Following the recent correction, Microsoft’s valuation appears, dare I say, reasonable. The stock now trades for less than 26 times forward earnings – a level rarely seen in recent years. It is a welcome respite from the inflated valuations that have plagued the market for so long.

Microsoft has earned its premium valuation through consistent execution and a strong growth trajectory. None of that has fundamentally changed, yet the stock has fallen by 10%. This presents a compelling opportunity to acquire shares at a significant discount. It is not often that Microsoft’s stock goes “on sale,” and those who recognize the value will be well-rewarded. The company currently boasts $625 billion in remaining performance obligations within its Azure business, a figure that suggests substantial growth in the years to come. The AI race is far from over, and Microsoft is well-positioned to remain a dominant player.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2026-02-04 03:23