Microsoft (MSFT +0.47%) has, after a period of sustained growth, entered a phase of correction. The stock is down approximately fifteen percent year-to-date, a decline punctuated by a ten percent fall following the recent earnings report. The market, it seems, is now appraising the company with a stricter eye.

There are, predictably, two prevailing interpretations. One casts this decline as a harbinger of deeper troubles. The other views it as a temporary aberration, a chance to acquire shares at a reduced price. For the rational investor, the latter holds more weight, though not without a degree of caution.

The Source of the Disquiet

The earnings themselves were, on the surface, satisfactory. Revenue and earnings per share exceeded analyst expectations. The present difficulty stems not from a failure to perform, but from the company’s stated intention to invest heavily in artificial intelligence and the necessary data center infrastructure. This expenditure, while potentially fruitful in the long term, does not yield immediate returns.

Such investment will, inevitably, impact free cash flow and short-term profitability – a fact that appears to have unsettled a segment of the investor community. Coupled with anxieties regarding a possible deceleration in the growth of Azure, Microsoft’s cloud platform, and the extent of its financial commitment to OpenAI, a predictable wave of selling ensued. The market dislikes uncertainty, and it particularly dislikes spending without immediate gratification.

A Core Holding, Nonetheless

It is important to remember that Microsoft remains a uniquely entrenched entity within the global corporate landscape. To remove it from the equation would inflict considerable disruption, and arguably, damage. This is not to suggest invulnerability, but rather to acknowledge a degree of indispensability. The company’s influence extends far beyond mere technological innovation.

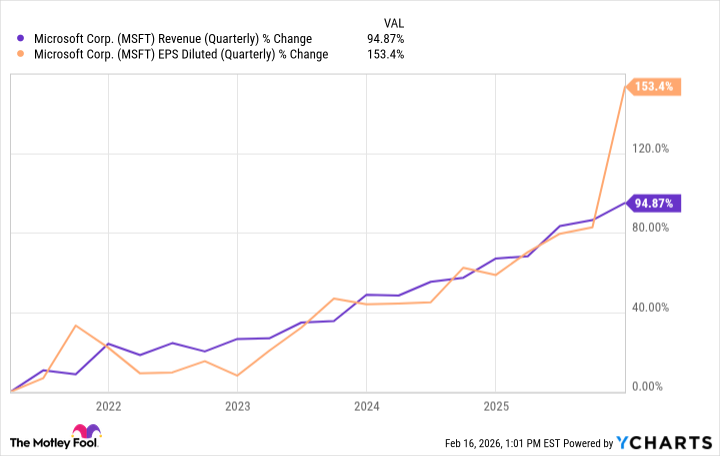

Its core businesses continue to flourish. Recent figures indicate a sixteen percent increase in Productivity and Business Processes revenue, a twenty-nine percent rise in Intelligent Cloud revenue, and an overall revenue increase of seventeen percent, totaling $81.3 billion. These are not the figures of a company in decline.

The current sell-off, therefore, appears to be driven not by fundamental weakness, but by an excess of expectation and a disproportionate reaction to short-term uncertainty. The market, in its eagerness to anticipate the future, often overreacts to present conditions.

The Long View

Predicting the future performance of any stock is, of course, an exercise in speculation. Purchasing shares at this juncture should not be predicated on the belief that the price will immediately rebound. The justification lies in the acquisition of a fundamentally sound company at a more reasonable valuation.

Given the recent underperformance of the so-called “Magnificent Seven” stocks and the growing anxieties surrounding a potential artificial intelligence bubble, a strategy of dollar-cost averaging – gradually increasing one’s stake over time – appears prudent. Microsoft remains a comparatively safe option within the volatile technology sector, a bulwark against the prevailing winds.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Brent Oil Forecast

- Where to Change Hair Color in Where Winds Meet

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-02-19 19:02