MSFT”>

During the earnings call, Microsoft’s CFO, Amy Hood, rather delicately pointed out that investors seem to be drawing a “direct correlation” between capital expenditure and Azure’s revenue. A diplomatic way of saying they’re questioning the return on investment in all this AI infrastructure. One can hardly blame them. Throwing money at a problem rarely solves it, though it does provide employment for accountants.

A Buying Opportunity, Perhaps?

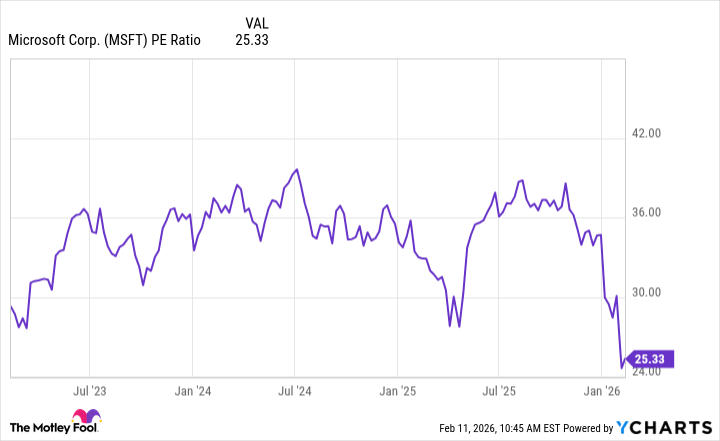

From a purely valuation perspective, Microsoft hasn’t looked this… accessible since the dawn of this AI mania. A price-to-earnings multiple of 25 is hovering near a three-year low. One might even call it a bargain. Though, naturally, one wouldn’t want to appear too enthusiastic.

And the consensus price target amongst the sell-side analysts is $596, implying a rather substantial 48% upside. Wall Street, it seems, remains bullish on Microsoft’s AI ambitions. One trusts they have done their due diligence, of course. Though one does harbor certain reservations regarding the collective wisdom of the financial community.

Given the attractive valuation and potential upside, buying Microsoft stock hand over fist might seem tempting. However, there’s always a degree of execution risk. This infrastructure build-out requires careful management, and there’s no guarantee it will translate into tangible benefits for Azure, or indeed, other parts of the Microsoft ecosystem. One prefers to maintain a degree of skepticism.

Therefore, one would cautiously buy the dip, but wouldn’t mortgage the manor. The sell-off seems rather overblown, and taking advantage of the depressed price action could prove to be a savvy move in the long run. Though, naturally, one wouldn’t want to be caught with one’s trousers down. A little prudence never goes amiss.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 15:32