The matter of Microsoft (MSFT 0.16%) has become, as these things invariably do, a chronicle of diminishing returns. For a period, approximately six months prior to the current reckoning, the shares exhibited a trajectory that might have been termed…acceptable. Now, however, a descent of twenty-two percent over the last half-year suggests a more fundamental misalignment. One begins to suspect the figures themselves are not merely reflecting performance, but actively participating in its erosion.

The question, then, is not whether to participate in this decline, but to what degree one is already irrevocably entangled within its bureaucratic embrace. Let us attempt, with the understanding that such attempts are often merely elaborate exercises in self-deception, to discern the underlying logic.

The Dip, Explained (or Not)

The reported financials, upon initial inspection, are not overtly catastrophic. Revenue for the second fiscal quarter of 2026 reached $81.3 billion, a seventeen percent increase. The cloud division, predictably, remains the locus of attention, with Azure revenue climbing thirty-nine percent. Earnings per share, adjusted, rose to $4.14. These numbers, presented in isolation, suggest a continuation of the expected order. Yet, the order itself is suspect.

The company’s expenditures, however, are…substantial. Capital expenditures reached $37.5 billion, a sixty-six percent increase year over year. This suggests an ambition that, while perhaps not ill-founded, is consuming resources at an alarming rate. Azure’s growth, while still positive, appears to be…stabilizing. The projected increase of thirty-seven to thirty-eight percent for the third quarter (in constant currency) is, to put it mildly, a deceleration. It is as if the engine, having reached a certain velocity, is now subtly, inexorably, slowing.

The problem, it seems, is not that Microsoft is failing, but that its performance is no longer exceeding expectations. The market, having become accustomed to exponential growth fueled by Azure and its attendant capital expenditures, now demands…more. Anything less is deemed insufficient. The stock, therefore, is not merely reflecting performance; it is punishing the failure to maintain an unsustainable trajectory. It is a judgment rendered by an entity that operates according to rules that are, at best, opaque.

A Momentary Respite?

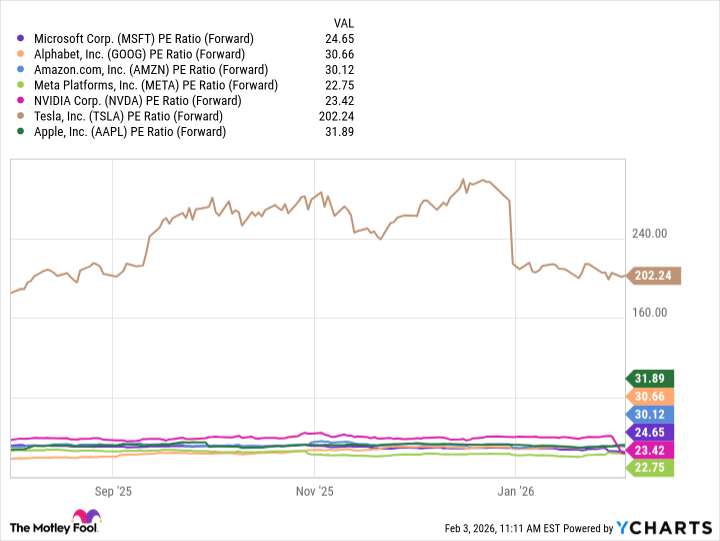

The recent decline has, predictably, resulted in a more…reasonable valuation. The company is currently trading at 24.7 times forward earnings, which, in the context of its peers in the so-called “Magnificent Seven” – a designation that feels increasingly arbitrary – and the industry average of 24.5, is…acceptable. It is a temporary reprieve, perhaps, before the next round of scrutiny begins.

Even with decelerating growth, Microsoft remains a leader in cloud computing and artificial intelligence, thanks to its entrenched relationships with large enterprises and its partnership with OpenAI, a market leader. It also benefits from the inertia of switching costs, a phenomenon that ensures a degree of captive clientele. These advantages, however, feel increasingly…fragile.

And even if the stock is due for a further correction, given the stabilization of growth in its Azure division, Microsoft appears…tolerable to long-term investors at current levels. It is not a promising prospect, but a calculated risk, a surrender to the inevitability of incremental decline. The company, like a vast, bureaucratic machine, will continue to operate, even as its momentum wanes.

Can capital expenditures ultimately prove problematic? Potentially. But the company has demonstrated a capacity for adaptation, a willingness to implement austerity measures when necessary, as it did a few years ago with job cuts and other…adjustments. So, Microsoft is, at best, a temporary holding, a refuge for those seeking a degree of stability in an increasingly unstable world. It is a buy, perhaps, for those resigned to a future of diminished returns.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-15 00:55