Microsoft, a leviathan of the digital age, has recently reported earnings that have unsettled the markets. The figures, superficially positive, have been met with a distinct lack of enthusiasm. Profits were up, yes, but the cost of achieving them has become a matter of some concern – a concern, it seems, that many are choosing to ignore.

The company’s continued investment in artificial intelligence infrastructure is being treated as a reckless gamble. Analysts fixate on capital expenditure, on the immediate outflow of funds. They demand a return on investment now. But to focus solely on the present cost is to miss the larger, more troubling implications.

The Price of Progress

For the recent fiscal quarter, Microsoft reported revenues of $81.3 billion – a respectable increase of 17%. More encouraging still is the growth of Azure, the cloud computing division, which saw a 29% rise in sales. Azure services specifically increased by 39%. The ability to generate revenue is not, apparently, the issue. The issue is what must be spent to sustain it.

The company’s capital expenditure reached $37.5 billion – a 66% increase year over year. A simple equation, one might think: increased spending to maintain growth. Yet, the operating cash flow of $35.8 billion fell short of that expenditure. Free cash flow declined as a consequence. The arithmetic is straightforward, and deeply unsettling.

The question, then, is not whether Microsoft can maintain this level of spending, but whether it must. The answer, it seems, lies in a figure largely overlooked: the remaining performance obligations (RPO), which grew by an astonishing 110% to $625 billion. Furthermore, 45% of this backlog is tied to OpenAI.

The OpenAI Factor

The concentration of risk in a single entity – OpenAI – is, naturally, a cause for concern. A prudent investor would acknowledge the possibility that commitments from a company that is not yet consistently profitable may not materialize as quickly as anticipated. This is a reasonable observation, but it misses the crucial point.

The growing RPO suggests something far more significant. It is not simply a matter of cloud spending, cyclical and transient. It suggests that artificial intelligence is becoming embedded in the very fabric of enterprise workflows. OpenAI’s usage is not a temporary surge, but a structural shift – a cornerstone upon which a multiyear infrastructure supercycle will be built. To view it as merely a risk is to misunderstand the nature of the game.

A Moment of Opportunity?

Following the earnings report, Microsoft stock experienced a sharp decline – a drop of over 10%. Some analysts have even invoked the ominous term “death cross,” a technical indicator suggesting further selling. The markets, it seems, are prone to panic, and to overreaction.

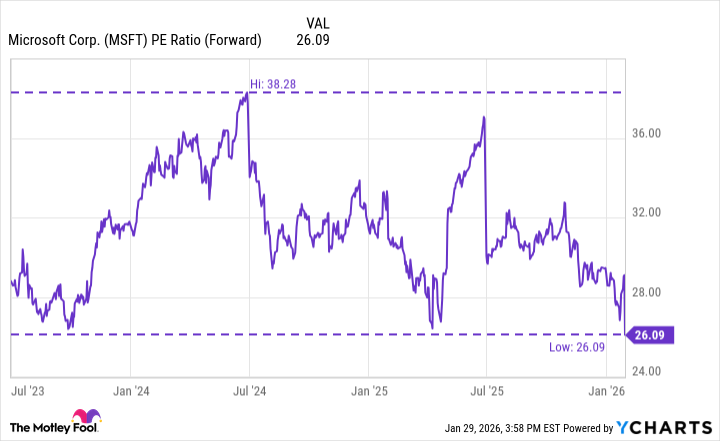

This decline has resulted in a forward price-to-earnings ratio of 26 – the lowest valuation Microsoft has seen throughout this period of AI-driven revolution. The price, in other words, has become… interesting.

As a long-term observer, I find few companies with over half a trillion dollars in future revenue already secured. While investors may continue to shy away from those who spend freely, this, perhaps, presents an opportunity. A moment to acquire a stake in a company that, despite its current expenditures, appears to be building not merely for the present, but for a future that is rapidly unfolding.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 20:02