The market, that capricious beast, has seen fit to castigate Microsoft (MSFT 0.31%). A decline of over twenty-five percent from recent heights… a rather dramatic fall for a titan, wouldn’t you agree? And for no readily apparent sin? It smacks of a collective, irrational panic, a momentary lapse into the abyss of fear that so often plagues these exchanges. One begins to suspect a deeper malaise, a spiritual emptiness reflected in the fluctuating lines of stock prices.

This, then, presents an opportunity. Not a joyous occasion, mind you, but a somber reckoning. A chance to acquire a stake in a company that, despite this temporary affliction, remains… substantial. To suggest this investment will “set you up for life” feels… vulgar. Let us instead say it may offer a measure of solace in a world perpetually teetering on the brink of chaos, a potential for returns that, while not guaranteeing salvation, might alleviate some of the anxieties of a finite existence.

The Illusion of Percentage Points

The S&P 500… a benchmark, yes, but a rather hollow one. To merely match its performance is to accept a life of quiet desperation. The pursuit of wealth, after all, is not simply about accumulating numbers; it is about securing a degree of freedom, a respite from the relentless pressures of this mortal coil. Historically, ten percent annually… a respectable, if unremarkable, figure. Invest five hundred a month for twenty-nine years, and you arrive at a million. A tidy sum, certainly, but hardly a bulwark against the inevitable decay of all things.

But what if we could nudge that return, by a mere three percentage points? The difference, though seemingly insignificant, is… profound. Twenty-five years instead of twenty-nine. And should we extend that horizon, the divergence widens into a chasm. At twenty-nine years, ten percent yields a little over a million. Thirteen percent… nearly double. It is a cruel irony, isn’t it? That such a small advantage can yield such a disproportionate reward. The pursuit of these extra points… it borders on obsession. A desperate attempt to outrun the inevitable.

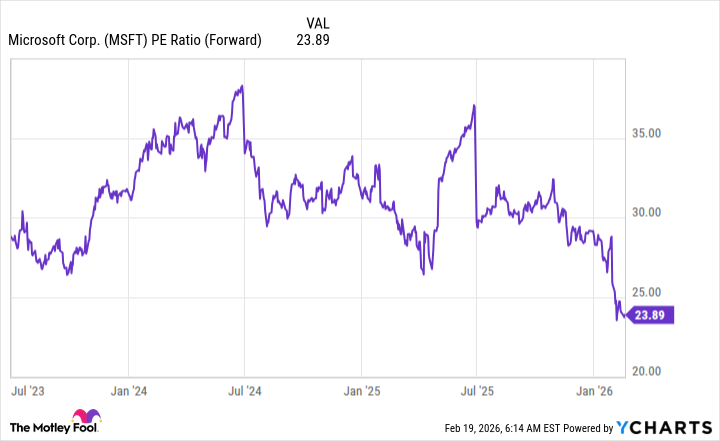

And Microsoft, currently… undervalued. A rare sight, like a moment of genuine honesty in a world saturated with deception. A stock trading at a discount, for reasons that seem… illogical. It is a tempting proposition, though one must approach it with a degree of skepticism. The market is rarely kind to those who seek easy answers.

Its core software business, while not glamorous, remains remarkably resilient. And its foray into artificial intelligence… intriguing. Not a reckless pursuit of novelty, but a pragmatic attempt to facilitate the technology, to offer it as a service. Azure, its cloud platform, continues to grow, burdened by a backlog of demands. A healthy sign, perhaps, but also a source of potential strain. It is a delicate balance, this dance between ambition and sustainability.

In the second quarter of fiscal year 2026, Microsoft reported a seventeen percent increase in revenue. A respectable figure, certainly, but hardly a cause for unrestrained jubilation. Yet, the stock continues to languish, weighed down by the collective anxieties of the market. It is a paradox, isn’t it? That a company performing so admirably should be subjected to such unwarranted punishment.

Currently, Microsoft trades at twenty-four times forward earnings. The cheapest it has been in nearly three years. A modest valuation, considering its size and stability. It is not far off the S&P 500, which trades at twenty-one point nine times forward earnings. A small difference, perhaps, but a significant one. A glimmer of hope in a world shrouded in darkness.

Opportunities like this are rare. Fleeting moments of clarity in a sea of confusion. To acquire a stake in Microsoft at this price… it is not a guarantee of riches, but a calculated risk. A somber investment, perhaps, but one that might offer a measure of solace in a world perpetually teetering on the brink of chaos. A chance to accelerate your timeline to financial security, and perhaps… to find a small measure of peace in a world desperately in need of it.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 17:54