![]()

It has come to my attention – a most unsettling attention, mind you, like discovering a misplaced samovar in a field of turnips – that certain investors are presently captivated by the fortunes of Micron Technology. A curious spectacle, indeed. The company, purveyor of those ethereal slivers of silicon we call memory, has experienced a…shall we say, vigorous ascent. A rise so precipitous, one might suspect the assistance of unseen gears and mischievous sprites. Over the past year, it has bloomed like a particularly stubborn weed, exceeding 300% in value. A most unsettling bloom, as it threatens to obscure the more sensible rose bushes of value investing.

This surge, it seems, is fueled by a shortage – a modern plague, if you will – of memory chips. A shortage born of this… artificial intelligence. A most peculiar creation, this intelligence. It demands these chips – these high-bandwidth memory, or HBM, as the technicians call them – as a glutton demands pastries. The demand, of course, has driven revenue and profits skyward, like a poorly constructed balloon released into a tempest. Analysts now whisper of revenues doubling to $75.4 billion by 2026, and earnings quadrupling to $33.38 per share. A forward P/E of a mere 12? A pittance! A trifle! Though one suspects such figures are merely phantoms, conjured by the optimistic imagination of accountants.

We are witnessing, it appears, a “supercycle.” A grandiose term for the predictable oscillation between glut and scarcity that afflicts all commodities. Memory chips, unlike, say, a well-aged cheese, do not improve with age. They are prone to booms and busts, a chaotic dance dictated by the whims of demand and the relentless accumulation of inventory. These semiconductor manufacturers, these captains of industry, operate under a peculiar logic. They will run their factories – their fabs, as they call them – until the very last kopek is squeezed from the operation, even if it means incurring losses on the books. A most peculiar accounting, if you ask me. Like pretending a leaky roof is merely “enhanced ventilation.”

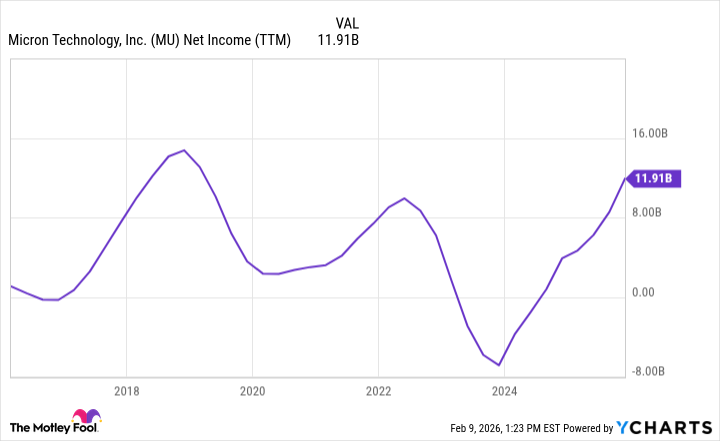

Observe, if you will, the chart below. It chronicles Micron’s past cycles. A landscape of peaks and valleys, of triumphs and near-ruins. A particularly dismal trough saw net losses plummeting to nearly $8 billion. A truly alarming figure. One imagines the executives pacing their offices, haunted by the ghosts of failed investments. But now, it seems, they are on the verge of record profits. Analysts predict around $35 billion for the current fiscal year. A sum so vast, it could fund a small principality. Though I suspect much of it will be consumed by the insatiable appetite of expansion and the whims of the board.

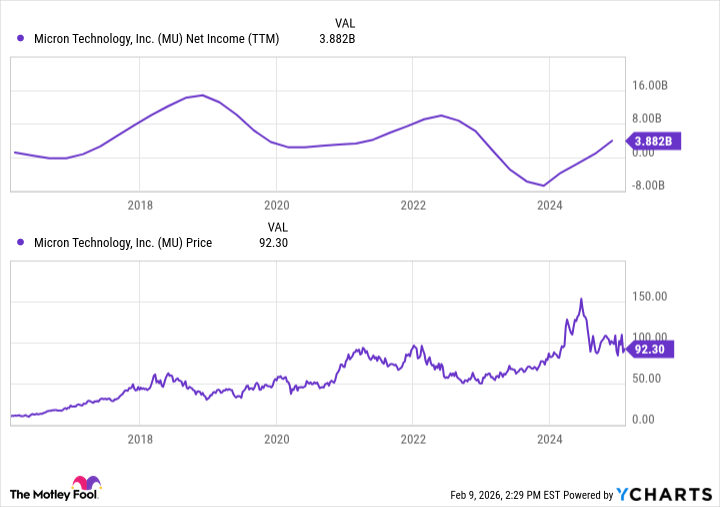

History, as they say, repeats itself. And the memory cycle is no exception. Past cycles have been remarkably short, lasting only a couple of years from trough to peak. The highest peak, at nearly $16 billion in net income, was a testament to the power of cloud computing. Though it was followed, inevitably, by a precipitous decline. The stock price, naturally, runs ahead of the profit cycle. It is a restless spirit, always anticipating the future. The chart below, ending a year ago, demonstrates this perfectly. The share price begins its ascent long before the profits follow. A most curious phenomenon. Like a dog chasing its own tail.

Historically, Micron’s stock has gained around 600% from trough to peak. A most impressive return, to be sure. But one must remember that past performance is no guarantee of future results. The table below chronicles these gains. A neat and tidy display of numbers, concealing the chaos and uncertainty that lie beneath.

| Trough date | Peak date | Trough price | Peak Price | % Gain |

|---|---|---|---|---|

| 11/2008 | 4/2011 | $1.59 | $11.95 | 651% |

| 5/2012 | 12/2014 | $5.00 | $36.50 | 630% |

| 5/2016 | 5/2018 | $9.35 | $64.66 | 591% |

| 12/2018 | 1/2022 | $29.00 | $98.45 | 239% |

| 12/2022 | ??? | $48.43 | $455.50 (so far) | 840% (so far) |

Micron has already exceeded its typical trough-to-peak gain. A most remarkable achievement. But one must tread carefully. The current boom has some unique elements. The unprecedented capital expenditures of hyperscalers like Amazon, Microsoft, Alphabet, and Meta Platforms are fueling demand. They are planning to spend over $600 billion on capex this year, much of it devoted to AI infrastructure. This suggests continued strong demand for memory. Several big tech companies, including Apple and Alphabet, have commented on the shortage. It is expected to impact the smartphone industry significantly this year.

New capacity takes time to come online. The shortage on the supply side will not be easily addressed. The race in AI seems likely to feed demand for the foreseeable future. The memory cycle will eventually peak, as it always does. But that could still be years away. In the meantime, Micron looks like a smart way to play the AI boom. Its profits should soar through at least the next year. If AI sentiment remains strong, the stock could still double before the peak is in, bringing it close to $800 a share.

However, investors should be aware of the cyclical history in memory. Given the recent stock surge and the more-than-300% gain in a year, the sell-off could be brutal when the cycle eventually turns. It will be a spectacle, I assure you. A chaotic dance of panic and regret. A most unsettling sight. One best observed from a safe distance, with a glass of something strong and a healthy dose of skepticism.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-11 06:32