![]()

Okay, let’s talk chips. For the last few years, if you said “AI” and “hardware” in the same sentence, everyone automatically pictured Nvidia. It was like saying “peanut butter” and expecting “jelly” to finish your thought. Nvidia’s been the reigning monarch of graphics processing, the queen bee of the AI hive. But, newsflash: there’s a new chip in town, and it’s not trying to be Nvidia. It’s just… different. And frankly, a little less expensive. We’re looking at Micron.

Now, before you start picturing me in a tinfoil hat, let’s be clear. I’m not saying Micron is going to become Nvidia. That’s like saying your sourdough starter is going to become a Michelin-star bakery. But the market is realizing that AI isn’t just about the flashy GPUs. It’s about…well, everything else. It’s a whole ecosystem, and someone has to supply the memory. That’s where Micron comes in. Think of them as the unsung heroes, the supporting cast that makes the whole show possible. And, in this market, supporting casts get paid.

What Does Micron Actually Do?

Look, the AI chip world is layered. Nvidia and AMD are building the brains. Broadcom’s doing the bespoke silicon for the hyperscalers – Alphabet, Meta, the usual suspects. They’re basically building custom engines for specific tasks. It’s all very impressive, very expensive, and very…niche.

But everyone needs memory. Lots of it. And that’s where Micron shines. They’re the masters of HBM, DRAM, NAND – all the things that actually store the data. Bloomberg Intelligence says the AI accelerator market is going to hit $604 billion by 2033. That’s a lot of zeros. And every one of those zeros needs a place to live. Micron provides the real estate.

Right now, Micron’s total addressable market is around $35 billion. They’re forecasting $100 billion by 2028. That’s a growth rate that even a venture capitalist would get excited about. The takeaway? Memory demand is accelerating faster than GPU demand. It’s basic supply and demand, people. And right now, supply is…challenging.

Why Is Memory Suddenly So Expensive? (Spoiler: It’s Not Just Inflation)

The hyperscalers are throwing money at AI infrastructure like it’s going out of style. We’re talking over $500 billion this year. It’s like a tech company version of “Hoarders.” And all that spending is creating a massive shortage of HBM solutions. TrendForce is predicting DRAM and NAND prices could jump 60% and 38% respectively in the first quarter. That’s not a typo. It’s a price increase that would make even the most seasoned trader raise an eyebrow.

Is Micron Stock a Buy? (Asking for a Friend)

Micron’s stock has gone parabolic, rising 348% in the last year. Which, let’s be honest, always makes you a little nervous. It’s like dating someone who’s too enthusiastic. But looking at the stock price in isolation is a rookie mistake. You have to look at the valuation.

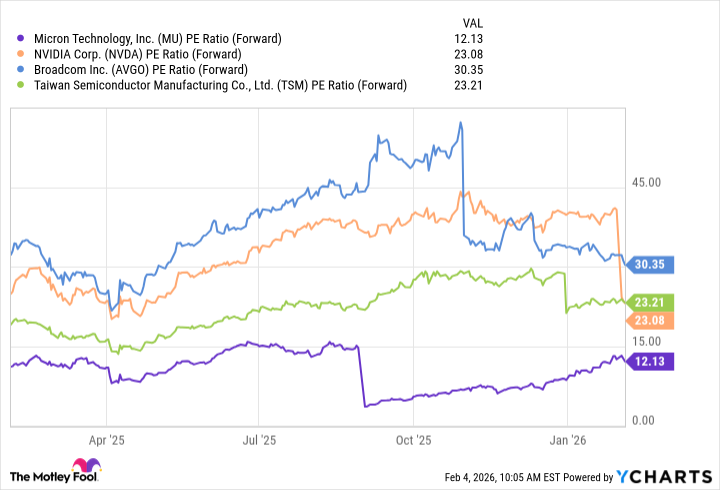

Currently, Micron trades at a forward P/E multiple of 12. Compared to other AI chip leaders, that’s a steal. It’s like finding a designer handbag at a thrift store. Seriously. Given the strong tailwinds and attractive valuation, I think Micron is a no-brainer. It might not experience the same explosive growth as Nvidia, but its critical role in the memory market is undeniable.

So, is Micron the new Nvidia? Maybe not. But it’s a solid play in a rapidly growing market. And in this business, that’s about as close to a sure thing as you’re going to get. Now, if you’ll excuse me, I have some charts to analyze and a portfolio to rebalance. And possibly a strong drink.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 02:32