Right. Artificial intelligence. It’s everywhere, isn’t it? Suddenly, everything needs to be ‘powered by AI’. Honestly, it’s exhausting. But, and this is where it gets tricky, it is making some people very, very rich. And, let’s be real, that’s always interesting. Over the last three years, a few tech stocks have gone properly bonkers, and it all boils down to this insatiable hunger for…well, for everything AI. Which means, someone has to build the stuff that makes it all happen. And that, my friends, is where Micron Technology comes in.

Micron (MU +2.18%). They make memory chips. Sounds dull? Trust me, it’s not. Think of them as the pick-and-shovel merchants of the AI gold rush. Everyone’s obsessed with the shiny new AI tools, but someone needs to supply the basic building blocks. Micron provides the memory chips that let those fancy AI accelerators actually, you know, do something. It’s not glamorous, but it’s essential. And, as it happens, the stock has already jumped nearly 28% this year. I’m not saying it’s a sure thing – nothing ever is – but it feels…promising. Let’s unpack why, shall we?

Unprecedented Memory Demand: Or, Why Everyone’s Panicking

I was reading an interview with Micron’s Manish Bhatia recently – Bloomberg, naturally – and he casually dropped the bombshell that there’s a serious shortage of memory chips. Not a little shortage. A proper, teeth-gnashing, ‘we’re-all-doomed’ shortage. Apparently, the demand for high-bandwidth memory (HBM) – the stuff that powers those AI GPUs and custom processors – has gone absolutely through the roof. It’s like everyone suddenly realized they needed more memory, and now they’re all scrambling. Which, honestly, is always a good sign for the company making the memory.

And it’s not just data centers. Smartphone and PC manufacturers are also desperate to secure their supply. Apparently, data centers are set to hoover up a whopping 70% of all memory chips manufactured this year. Seventy percent! That leaves scraps for everyone else. Automotive, consumer electronics, television…they’re all fighting over the leftovers. It’s a bit like Black Friday in the semiconductor industry, only with potentially more significant consequences. The clever bit is that AI is driving up memory content across everything. Nvidia and Broadcom are packing more HBM into their chips, and even AI-powered smartphones need more memory. It’s a virtuous cycle, as they say. Though, honestly, I’m starting to suspect ‘virtuous’ is rarely a word you can apply to the tech industry.

Micron’s management is bracing for this crunch to last a while, and frankly, I believe them. Counterpoint Research says memory manufacturers are already selling out their 2028 capacity. 2028! That’s a long way off. This is pushing up prices, and market research firm Omdia predicts the memory industry’s revenue will jump by over 80% this year, to just over $400 billion. It’s all a bit dizzying, isn’t it? Makes you wonder if we’re heading for another bubble. But let’s not dwell on that just yet.

The Company is on Track to Clock Stunning Growth in 2026

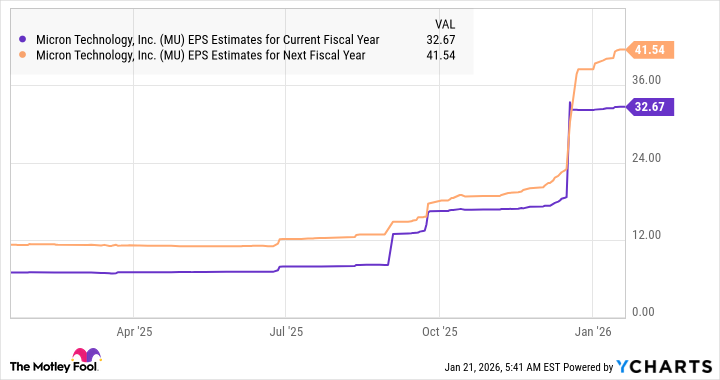

Micron is already benefiting from these favorable market dynamics. Consensus estimates project a 294% spike in earnings this year, to $32.67 per share. That’s…substantial. And another healthy increase is expected next year. But here’s the thing: Micron could easily outperform those expectations, given the supply constraints. They’re consistently exceeding Wall Street’s projections, and that should translate to further upside, both this year and beyond. Especially considering they’re trading at just 11.5 times forward earnings. A bargain, some might say. Though I tend to be suspicious of anything described as a ‘bargain’ in the stock market.

The tech-laden Nasdaq-100 index is trading at 25.6 times forward earnings. If Micron can achieve the anticipated growth and trade in line with the index, its stock price could skyrocket. It’s a big ‘if’, of course. But, let’s be honest, isn’t that always the case with investing? All this makes Micron one of the best ways to capitalize on the AI boom this year. It’s not a guaranteed win, mind you. Nothing ever is. But it’s a pretty compelling story, and frankly, I’m starting to feel a little bit irresponsible not considering it.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-23 15:04